Cheapest Car Insurance For Teens In South Carolina

Saturday, November 1, 2025

Edit

Cheapest Car Insurance for Teens in South Carolina

Why South Carolina Teen Drivers Need Auto Insurance?

As a teenager in South Carolina, getting your driver’s license is an exciting event. It marks a milestone in your life, and a step towards freedom. However, with that freedom comes great responsibility. If a teen driver gets into an accident, they’ll be held liable for any damages or injuries. That’s why it’s important for South Carolina teen drivers to get car insurance. In this article, we’ll discuss why teens need auto insurance, and some tips on how to find the cheapest car insurance for teens in South Carolina.

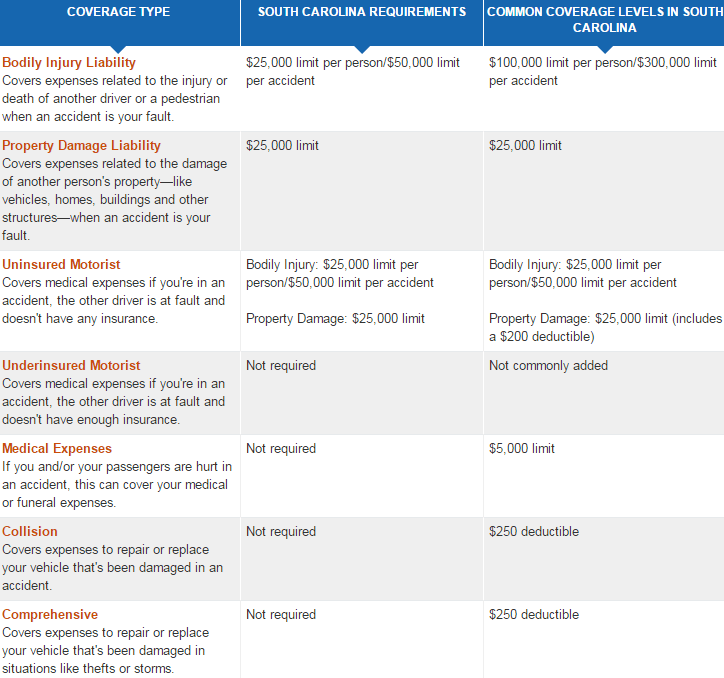

Requirements for Car Insurance in South Carolina

In South Carolina, all drivers must have the minimum amount of auto insurance. This includes liability coverage, which pays for damages and injuries caused to other people if you are at fault in an accident. Liability coverage must include at least $25,000 for bodily injury for one person, $50,000 for bodily injury for two or more people, and $25,000 for property damage. This coverage is known as 25/50/25 coverage.

In addition to liability coverage, South Carolina drivers may choose to purchase other types of coverage, such as collision, comprehensive, and uninsured motorist coverage. Collision coverage pays for damages to your own car if you are at fault in an accident. Comprehensive coverage pays for damages to your car caused by events other than an accident, such as theft or vandalism. Uninsured motorist coverage pays for damages and injuries caused by a driver who does not have insurance.

Tips on Finding Cheap Car Insurance for South Carolina Teens

Finding the cheapest car insurance for teens in South Carolina can be a challenge. However, there are some tips that can help make the process easier.

First, shop around. Don’t just settle for the first policy you find. Compare rates from different insurance companies to make sure you’re getting the best deal.

Second, take advantage of discounts. Many insurance companies offer discounts for teens who maintain good grades, take a driver’s education class, or are part of a safe driving program.

Third, consider a multi-car policy. If you and your family have multiple cars, consider getting a multi-car policy. This can help reduce the cost of insurance for everyone.

Finally, consider raising your deductible. A higher deductible means a lower premium, so you may be able to save money by raising your deductible.

What to Look for in a South Carolina Car Insurance Policy

Once you’ve shopped around and compared rates, it’s important to make sure you’re getting the coverage you need. Make sure the policy you choose includes the minimum amount of liability coverage required by South Carolina law. Also, make sure you understand the other types of coverage available and choose the ones that are best for you.

In addition, make sure you understand the terms and conditions of the policy. Read the fine print carefully, and make sure there are no hidden fees or costs. Also, make sure you understand the claims process and what you need to do if you have to file a claim.

Conclusion

Finding the cheapest car insurance for teens in South Carolina can be a challenge. However, by shopping around and taking advantage of discounts, you can find a policy that fits your needs and budget. Make sure you understand the terms and conditions of the policy, and read the fine print to make sure there are no hidden fees or costs. With a little bit of research, you can find the best policy for you.

Cheap Car Insurance in South Carolina 2019

Cheapest Car Insurance In South Carolina - Great Price And Coverage

car insurance - cheap car insurance in sc - Top 10 best insurance list

Cheapest Car Insurance – Youth Driving Safe

Cheapest Car Insurance For Students