Car Insurance Covers All Drivers

Car Insurance Covers All Drivers

What is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection for cars, trucks, and other vehicles against physical damage and/or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Car insurance is required in almost every state in the United States, and it is important to have the proper coverage for your vehicle. Car insurance can provide protection from a variety of risks such as, liability for bodily injury and property damage, medical payments for you and your passengers, and protection from uninsured and underinsured motorists.

Does Car Insurance Cover All Drivers?

Yes, car insurance covers all drivers. Most states require that all drivers must have a minimum amount of liability coverage, which includes bodily injury and property damage. This coverage is designed to protect you and other drivers in the event of an accident. Liability coverage also includes uninsured and underinsured motorist coverage, which can provide additional protection if you are in an accident with a driver who does not have adequate insurance coverage.

In addition to liability coverage, most states require drivers to have personal injury protection coverage, which provides medical coverage for you and your passengers in the event of an accident. This type of coverage can be invaluable in the event of an accident, as medical bills can quickly add up. It is important to make sure you have enough coverage to meet your needs and that you are adequately protected.

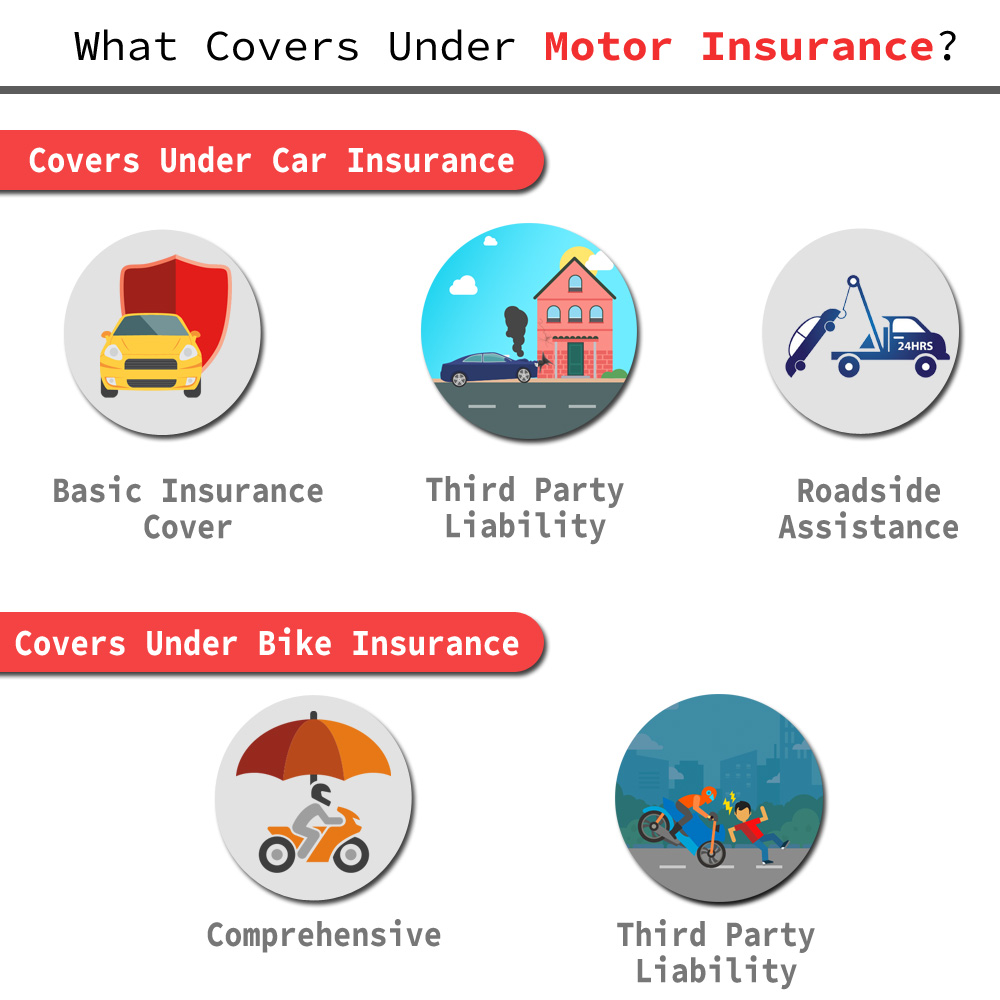

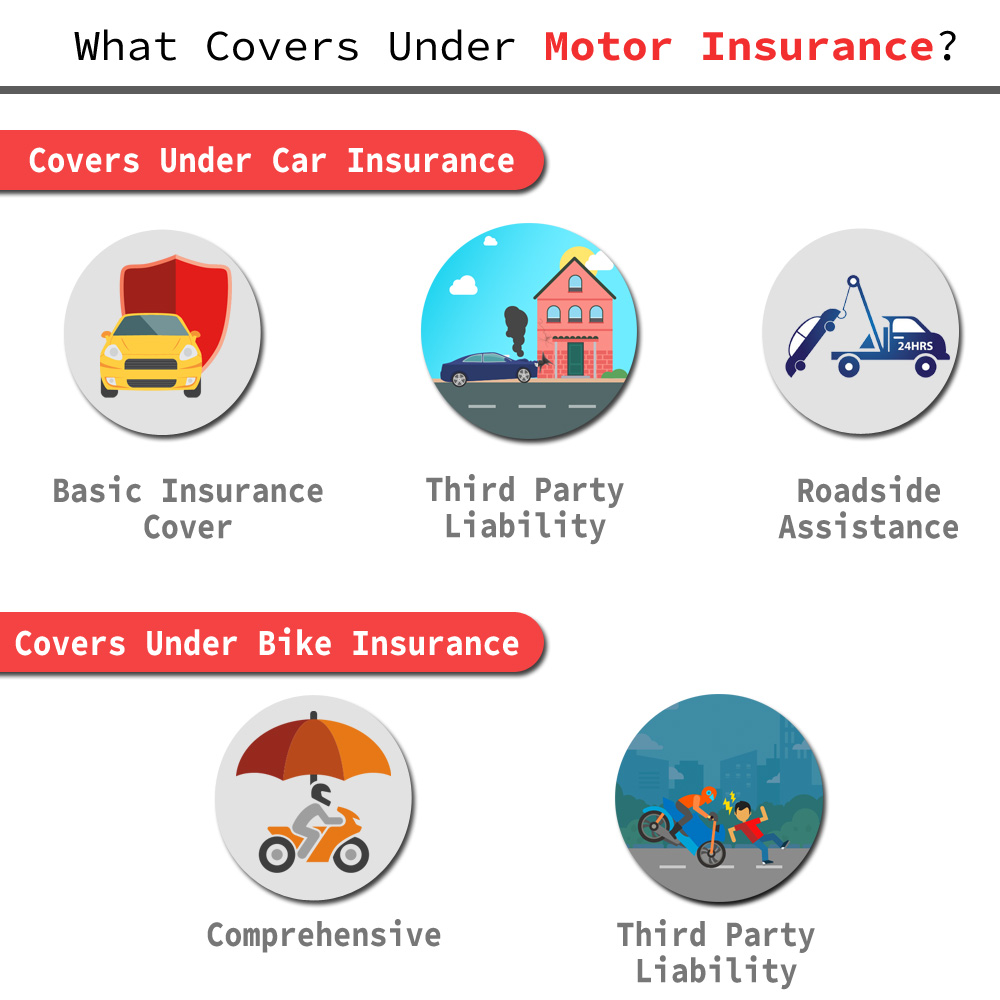

What Are The Different Types of Car Insurance Coverage?

In addition to liability coverage, there are several other types of car insurance coverage available. Collision coverage provides protection for your car if you are in an accident with another vehicle or object. Comprehensive coverage provides protection for your car in the event of theft, vandalism, fire, or other non-accident related damage. Other types of coverage include rental car coverage, gap insurance, and roadside assistance.

It is important to understand the different types of coverage available and how they can help protect you and your vehicle. It is also important to make sure that you are adequately covered and that you are getting the best possible rate for your car insurance coverage.

How Can I Find the Best Car Insurance Rates?

The best way to find the best car insurance rates is to shop around and compare quotes from different providers. By comparing rates, you can save money on your car insurance coverage. Additionally, by shopping around, you can make sure that you are getting the most comprehensive coverage for the best possible price.

In addition to comparing rates, you should also consider the customer service and claims process of the insurance company. You want to make sure that you are dealing with a reputable company that will be able to help you if you ever need to make a claim. It is also important to make sure that the company you choose is willing to work with you if you have any questions or concerns.

Conclusion

Car insurance covers all drivers, regardless of their driving record or experience. It is important to make sure that you are adequately covered and that you are getting the best possible rate for your car insurance coverage. By shopping around and comparing quotes from different providers, you can make sure that you are getting the most comprehensive coverage for the best possible price.

Motor Insurance | Car Insurance | Two Wheeler Insurance Plans

Find out which types of car insurance you should be looking into for

Learn the Different Types of Car Insurance Policies

Five types of car insurance covers explained by the best lawyers in s…