Barclays Graduate Additions Rac Breakdown Cover

Barclays Graduate Additions Rac Breakdown Cover

What is the Barclays Graduate Additions Rac Breakdown Cover?

Barclays Graduate Additions Rac Breakdown Cover is an insurance policy designed to provide a range of benefits to graduates of universities and other higher education institutions throughout the UK. It is designed to provide cover for a variety of eventualities, including mechanical breakdown, liability, legal expenses and more. The policy is provided through the Royal Automobile Club (RAC), one of the leading providers of breakdown cover in the UK. The policy is available to anyone aged over 18 and is valid for up to two years. It is competitively priced and is designed to offer peace of mind to graduates who may not be able to afford more comprehensive cover.

What Benefits Does the Cover Provide?

The Barclays Graduate Additions Rac Breakdown Cover provides a range of benefits to the policyholder. Firstly, it provides cover for mechanical breakdown, meaning that should the policyholder’s vehicle suffer a breakdown, such as a flat battery, a flat tyre or an engine failure, the policyholder can rely on the cover to get them back on the road again. Secondly, the cover provides liability cover, which will cover the policyholder should they be found liable for causing damage to someone else’s property or injury to another person.

The cover also provides legal expenses cover, meaning that the policyholder can take legal action against another party should they be found liable for causing damage or injury. Additionally, the cover provides a range of additional benefits, such as cover for lost or stolen keys, cover for towing and recovery, and cover for medical expenses incurred as a result of an accident. The cover also provides a range of discounts and offers, including discounts on travel and accommodation, as well as discounts at selected retailers.

How Can I Make a Claim?

Making a claim with the Barclays Graduate Additions Rac Breakdown Cover is easy and straightforward. The policyholder will need to contact the Royal Automobile Club (RAC) either by phone or online, providing details of the incident and the cover being claimed. The RAC team will then conduct a thorough investigation into the claim and make a decision on whether the cover is valid and a settlement will be paid.

Are There Any Exclusions?

Like any insurance policy, the Barclays Graduate Additions Rac Breakdown Cover does have a number of exclusions. These include cover for damage caused by misfuelling, wear and tear, and any damage caused by an act of nature, such as a flood or an earthquake. It is important to read the policy carefully and make sure that you understand what is and is not covered by the policy before making a claim.

How Can I Get the Best Deal?

Getting the best deal on the Barclays Graduate Additions Rac Breakdown Cover involves shopping around and comparing prices. You can do this online, either through the RAC website or through comparison websites such as GoCompare or Compare the Market. Additionally, it is worth considering bundling the cover with other insurance policies, such as car insurance, to get a better deal. Finally, it is always worth asking whether the provider offers any discounts or offers, as these can help reduce the cost of the cover.

Barclays offer graduates £550 to tackle interview costs | Executive

50% off RAC Breakdown Cover, £4.50 | LatestDeals.co.uk

RAC Breakdown Cover - UK Contact Numbers

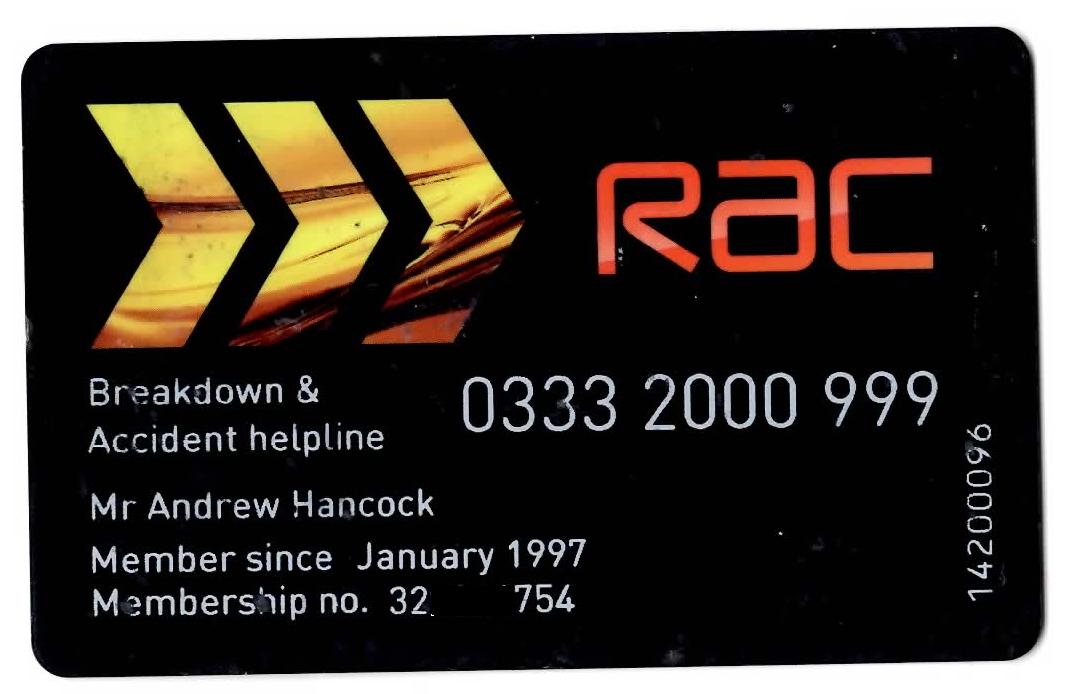

Breakdown Cover « andysworld!