Adding A Non Driver To Car Insurance Woolworths

Adding A Non Driver To Car Insurance Woolworths

Understanding Non Driver Insurance

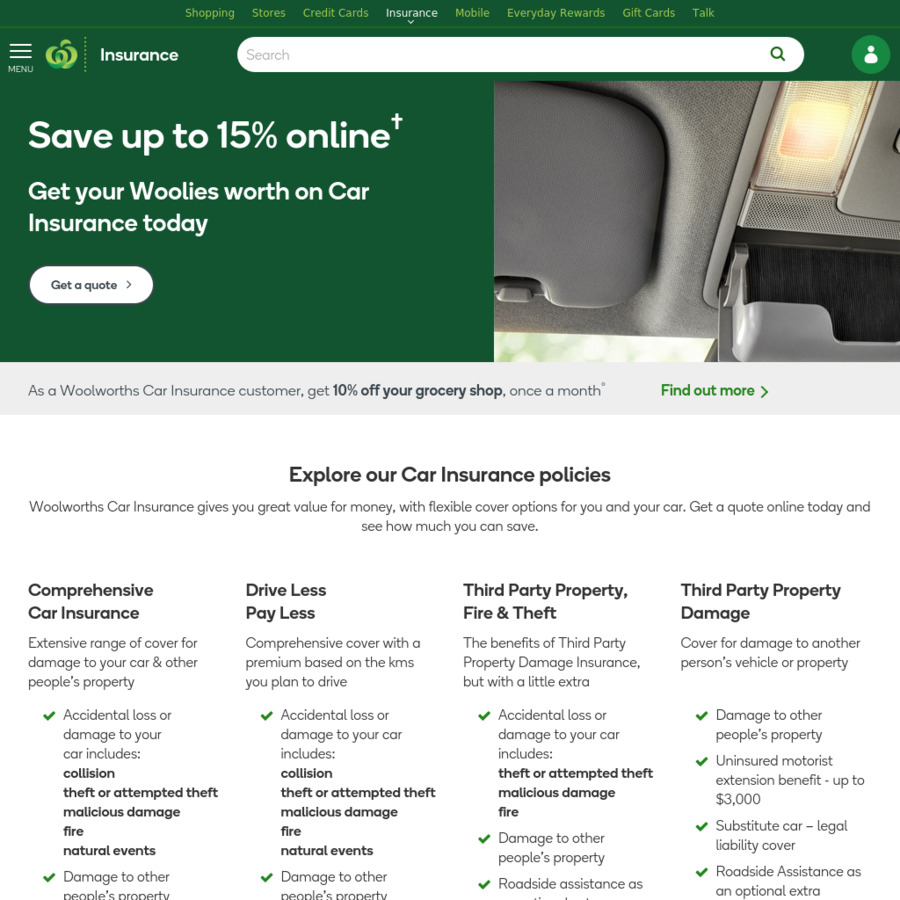

The concept of adding a non-driver to a car insurance policy may seem confusing at first, but it’s actually quite simple. A non-driver is someone who does not own or drive the car that is being insured, but lives in the same household as the primary driver. Adding a non-driver to your policy can provide additional coverage and protection in the event of an accident. It can also help you save money on your premiums. Woolworths provides a range of car insurance options that allow you to add a non-driver to your policy.

Benefits of Adding a Non Driver

There are several benefits to adding a non-driver to your car insurance policy. First, it can provide additional coverage and protection in the event of an accident. A non-driver can also provide an extra layer of liability protection, which can help to protect the primary driver from financial responsibility in the event of an accident. Lastly, adding a non-driver to your policy can help to lower your premiums, as insurers often offer discounts for adding non-drivers.

How To Add A Non Driver To Your Policy With Woolworths

Adding a non-driver to your car insurance policy with Woolworths is easy. The first step is to contact the insurer and provide them with the name, date of birth, and address of the non-driver you wish to add. You may also be asked to provide proof of residency for the non-driver. The insurer may also require you to provide a copy of their driver’s license or other proof of identity. Once this information has been provided, the insurer will review your request and make a decision as to whether or not to add the non-driver to your policy.

Cost Of Adding A Non Driver

The cost of adding a non-driver to your car insurance policy will vary depending on the insurer and the age and driving history of the non-driver. Generally, younger non-drivers and those with poor driving records will be more expensive to add, while older non-drivers and those with good driving records will be less expensive. Additionally, the amount of coverage you choose for the non-driver will also affect the cost of the policy.

Is Adding A Non Driver Worth It?

Adding a non-driver to your car insurance policy with Woolworths can be a great way to provide additional coverage and protection, while potentially saving you money on your premiums. It is important to consider the age and driving history of the non-driver, as this will affect the cost of the policy. Additionally, be sure to compare the cost of adding a non-driver to your policy with the cost of increasing your coverage, as this may be a more cost-effective option.

Woolworths Comprehensive Car Insurance | ProductReview.com.au

Woolworths Car Insurance - Drive Less Pay Less 15" - YouTube

10000 Rewards Points (Worth $50) with New Comprehensive Car Insurance

Woolworths Insurance Coupon and Promo Codes May 2022

Woolworths Car Insurance Contact Details