When Does Car Insurance Go Down For Women

Sunday, October 12, 2025

Edit

When Does Car Insurance Go Down For Women?

Why Do Women Pay Lower Car Insurance Rates?

Women often pay lower car insurance rates than men. The reason is that women are less likely to get into an auto accident than men. Women are also less likely to drive recklessly, which can lead to expensive claims. According to a study by the Insurance Information Institute, women are involved in fewer accidents than men. This means that insurance companies can offer lower rates to women and still make a profit.

When Can Women Get Lower Car Insurance Rates?

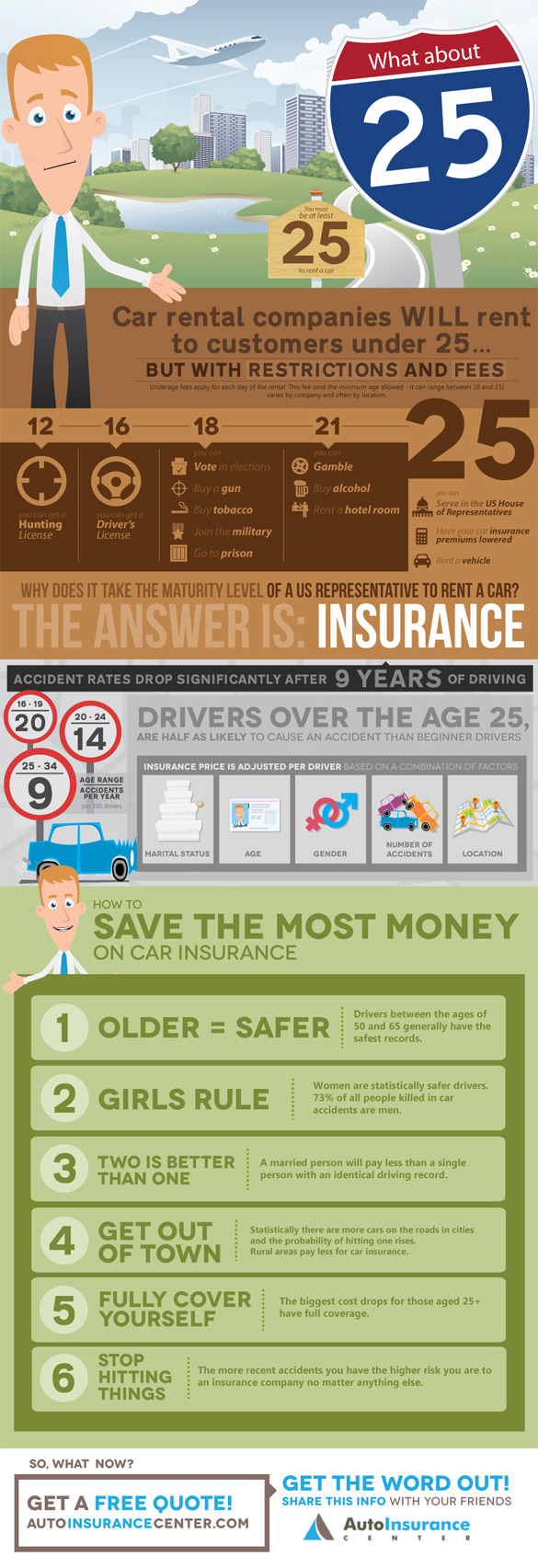

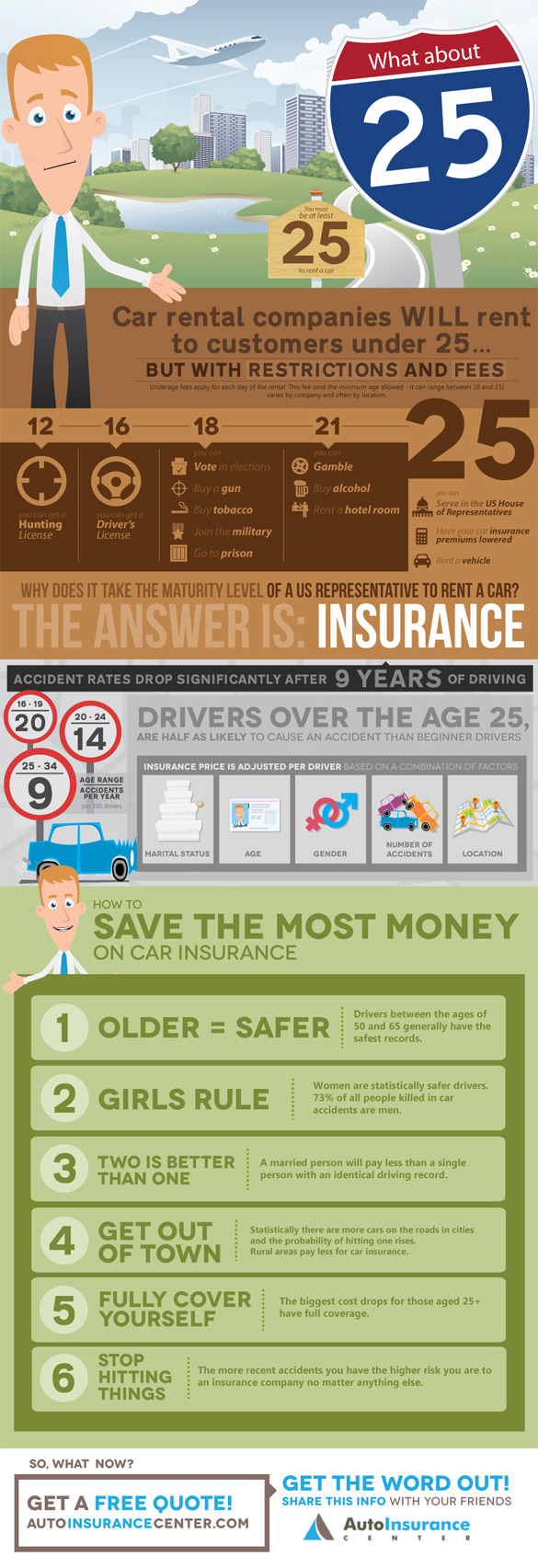

Women can start to see lower car insurance rates around the age of 25. This is when insurance companies start to consider them to be more mature and less likely to be involved in an accident. Women can also expect to see lower rates if they have a good driving record. Insurance companies will reward drivers who have a clean record and who have not had any accidents or traffic violations in the past.

Are There Other Factors That Affect Car Insurance Rates for Women?

In addition to age and driving record, there are other factors that can affect car insurance rates for women. Insurance companies may take into account the type of car a woman drives. Sports cars and luxury cars may cost more to insure than sedans or minivans. The location a woman drives in can also affect her insurance rate. Insurance companies may charge higher rates in areas where there is a higher rate of accidents, or a higher rate of auto theft.

What Can Women Do To Get Lower Car Insurance Rates?

Women can take steps to ensure they get the lowest rates possible on their car insurance. They can shop around for different insurance companies and compare rates. Additionally, they can take steps to improve their driving record. This can include taking a defensive driving course or installing a device in their car that tracks their driving habits. Women can also bundle their car insurance with other types of insurance, such as homeowner’s or renter’s insurance, to get a better rate.

Are There Any Other Tips For Women Looking To Save On Car Insurance?

There are several other tips that women can use to save money on car insurance. One is to increase their deductible. Increasing the deductible will lower the premium, but it also means that the driver will have to pay more out of pocket if they do get into an accident. Women can also consider dropping certain types of coverage, such as collision or comprehensive. These are optional types of coverage and may not be necessary if a woman drives an older car. Finally, women can pay their car insurance premiums in full to avoid paying costly monthly fees.

Conclusion

Women can save money on car insurance by shopping around, improving their driving record, increasing their deductible, and bundling their insurance policies. They can also save money by dropping certain types of coverage, such as collision or comprehensive, and by paying their premiums in full. Women can expect to see lower rates around the age of 25, and if they have a clean driving record.

What Age Does Insurance Drop - Business insolvencies drop to lowest

Does Car Insurance Go Down After 6 Months? (Insurance Rates)

When Does Car Insurance Go Down for Females? (Top Secrets Revealed!)

What Age Will My Car Insurance Decrease? | Tippla

How does insurance work when you rent a car? - Rentalcars.com