What Does The Motor Insurance Bureau Do

What Does The Motor Insurance Bureau Do?

The Motor Insurance Bureau (MIB) is an organization that helps protect drivers, passengers and pedestrians from the financial consequences of an accident caused by uninsured or untraced drivers. The organization works with the government and the insurance industry to help people who have been injured or suffered property damage as a result of a motor accident. It also works to reduce the number of uninsured drivers on the roads and to make sure that those who do cause accidents are held accountable.

What Does The Motor Insurance Bureau Do?

The MIB helps to protect people by providing compensation for losses caused by uninsured or untraced drivers. The organization works with the government and the insurance industry to ensure that people who have been injured or suffered property damage as a result of a motor accident are compensated. The MIB also works to reduce the number of uninsured drivers on the roads and to make sure that those who do cause accidents are held accountable.

What Are The Benefits Of The Motor Insurance Bureau?

The MIB helps to protect drivers and pedestrians from the financial consequences of an accident caused by an uninsured or untraced driver. It also works to reduce the number of uninsured drivers on the roads. By having uninsured drivers pay for the damage they cause, the MIB helps to reduce the cost of insurance premiums for all drivers. This helps to make sure that everyone is paying their fair share for their motor insurance.

How Does The Motor Insurance Bureau Work?

The MIB works to ensure that people who have been injured or suffered property damage as a result of a motor accident are compensated. The organization works with the government and the insurance industry to make sure that those who do cause accidents are held accountable. The MIB also works to reduce the number of uninsured drivers on the roads. It works to make sure that those who are uninsured are identified, and that they are held liable for the damage they cause.

What Are The Limitations Of The Motor Insurance Bureau?

The MIB does not cover all losses caused by uninsured or untraced drivers. It does not cover the cost of repairs or medical expenses for those who are injured in an accident caused by an uninsured or untraced driver. The organization also does not cover damage to property that is owned by the uninsured driver. The MIB also does not cover any damage caused by a driver who is under the influence of drugs or alcohol.

Conclusion

The Motor Insurance Bureau helps to protect drivers, passengers and pedestrians from the financial consequences of an accident caused by an uninsured or untraced driver. The organization works with the government and the insurance industry to ensure that people who have been injured or suffered property damage as a result of a motor accident are compensated. The MIB also works to reduce the number of uninsured drivers on the roads and to make sure that those who do cause accidents are held accountable. The organization does not cover all losses caused by uninsured or untraced drivers, and it does not cover the cost of repairs or medical expenses for those who are injured in an accident caused by an uninsured or untraced driver.

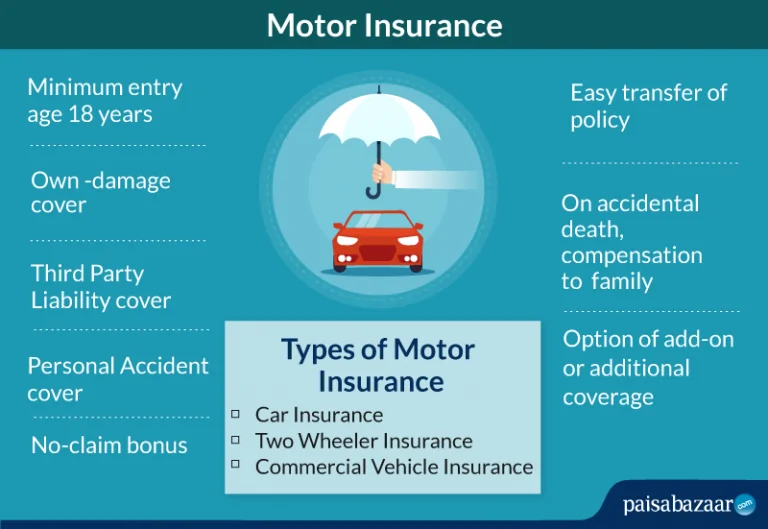

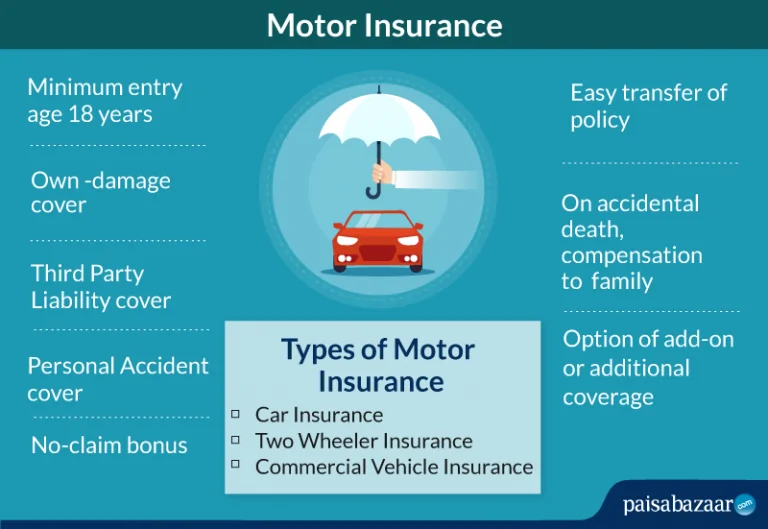

Motor Insurance in India: Types, Coverage, Claim & Renewal

motor insurance companies

PPT - MOTOR INSURANCE BY R.R.JOSHI PowerPoint Presentation, free

Complete Guide to Vehicle Insurance - Finance Buddha Blog | Enlighten

Detariffication of Motor Insurance in Malaysia 1 July 2017 - YouTube