Third Party Loss Insurance Definition

Sunday, October 19, 2025

Edit

Third Party Loss Insurance Definition

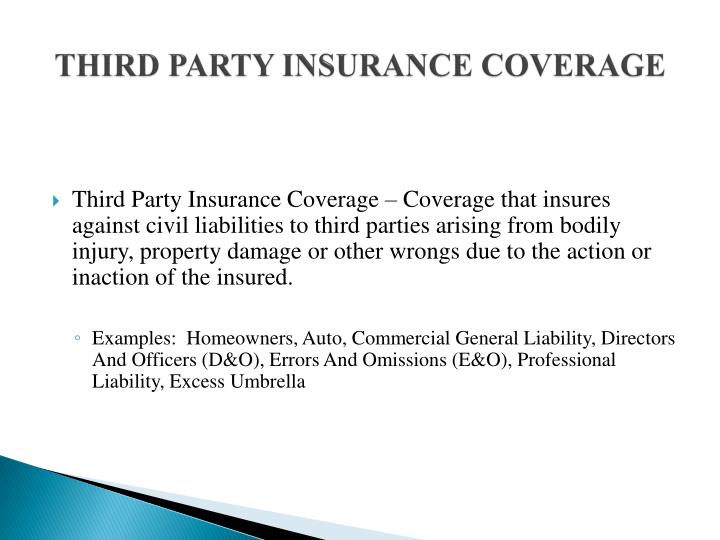

What is Third Party Loss Insurance?

Third Party Loss Insurance is a type of insurance that is meant to protect businesses from losses caused by another person or entity. This type of insurance helps to protect businesses in the event that another party causes damage to property, finances, or reputation. This type of coverage is particularly helpful for businesses that are in the business of providing services or products to customers or clients. For example, a business that provides services such as construction, computer repair, or IT services might want to purchase this type of insurance to protect themselves from any losses that may occur as a result of their services.

What does Third Party Loss Insurance Cover?

Third Party Loss Insurance is designed to provide protection for businesses against losses due to another person or entity. This type of insurance can provide coverage for a variety of losses, including property damage, personal injuries, financial losses, and reputational losses. Additionally, this type of insurance can also provide coverage for any legal fees that may be associated with the claim. This type of insurance is typically purchased by businesses who are in the business of providing services or products to customers or clients.

When is Third Party Loss Insurance Necessary?

Third Party Loss Insurance is necessary when a business is at risk of suffering losses due to another person or entity. For example, a business that provides services such as construction, computer repair, or IT services might want to purchase this type of insurance to protect themselves from any losses that may occur as a result of their services. Additionally, this type of insurance is also necessary for businesses that are in the business of providing products or services to customers or clients. This type of insurance can help to protect the business from any claims that might arise due to the actions of another person or entity.

How Much Does Third Party Loss Insurance Cost?

The cost of Third Party Loss Insurance will depend on a variety of factors, including the type of coverage that is purchased, the size of the business, and the type of services or products that the business provides. Generally, larger businesses may be required to purchase higher levels of coverage in order to adequately protect themselves from losses. Additionally, the cost of this type of insurance may also vary depending on the amount of coverage that is purchased.

How to Find the Right Third Party Loss Insurance Provider?

When looking for the right Third Party Loss Insurance provider, it is important to research different providers to ensure that you are getting the best coverage for the best price. Additionally, you should also consider the provider's reputation and customer service record. Additionally, it is important to read the policy language carefully to ensure that you are getting the coverage that you need. Additionally, it is also important to consider any discounts or promotions that the provider may be offering.

Conclusion

Third Party Loss Insurance is an important type of insurance that can help to protect businesses from losses due to another person or entity. This type of insurance can provide coverage for a variety of losses, including property damage, personal injuries, financial losses, and reputational losses. Additionally, this type of insurance can also provide coverage for any legal fees that may be associated with the claim. When looking for the right Third Party Loss Insurance provider, it is important to research different providers to ensure that you are getting the best coverage for the best price.

What Is Third-party Insurance?

PPT - INSURANCE LAW : What Every Practitioner Should Know PowerPoint

What is third party insurance | Online insurance, Compare insurance

Third Party Liability Insurance Definition

Reasons why you should buy third party insurance online in 2020