Tata Aia Term Insurance Customer Care

Tata AIA Term Insurance: Ensuring Customer Care in All Circumstances

Understanding Tata AIA Term Insurance

Tata AIA Term Insurance is a comprehensive life insurance policy that offers protection to you and your family against life’s uncertainties. It is a type of life insurance policy that provides life cover for a specified period of time. The term insurance policy pays out a lump sum amount to the nominee if the policyholder dies within the policy tenure. Tata AIA Term Insurance provides coverage for a fixed period of time and allows policyholders to avail of the insurance cover at an affordable premium rate. Moreover, the policy also provides an option to customize the sum insured, tenure, and rider benefits, according to the needs of the policyholder.

Benefits of Tata AIA Term Insurance

Tata AIA Term Insurance offers a host of benefits that make it a preferred choice for many people. The policy offers a free look period of 15 days, wherein the policyholder can cancel the policy and get a complete refund if he/she is not satisfied with the policy’s features and benefits. The policy also provides comprehensive coverage for a wide range of death-related events, such as accidental death, terminal illness, and natural death. Furthermore, the policy also offers riders such as Critical Illness Cover, Accidental Death Benefit, and Waiver of Premium, which can be bought for an additional premium. Additionally, the policy offers flexible payment options, such as monthly, quarterly, half-yearly, and yearly.

Why is Customer Care Important with Tata AIA Term Insurance?

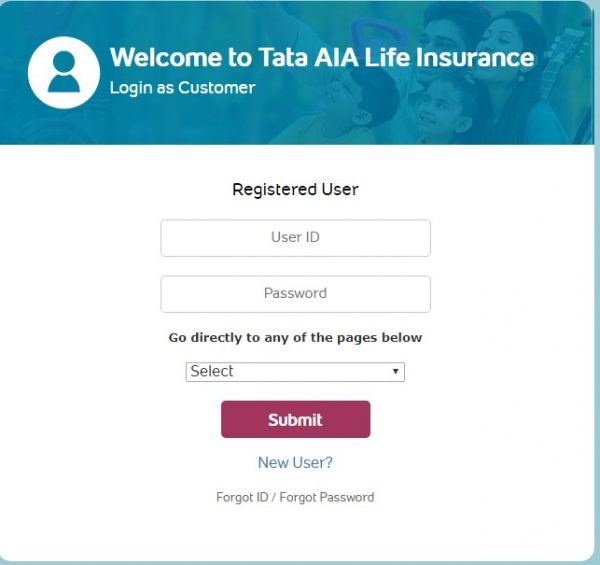

Customer care is one of the most important aspects of any insurance policy. Tata AIA Term Insurance ensures that its customers get the best possible customer care. The customer care team of Tata AIA Term Insurance is well-trained to provide accurate and prompt assistance to customers. They are available 24x7 to answer any queries or provide assistance with policy-related matters. The customer care team can be contacted through the customer service numbers, email, or the Tata AIA website. Customers can also visit the nearest Tata AIA branch to get assistance with policy-related matters.

Additional Benefits of Tata AIA Term Insurance Customer Care

Apart from providing assistance with policy-related queries, Tata AIA Term Insurance also offers additional benefits for customers. Customers can avail of a free medical check-up, which is provided by the company. The company also offers a special discount to existing customers on the purchase of additional term insurance policies. Furthermore, customers can also avail of loyalty rewards and special offers from time to time.

Conclusion

Tata AIA Term Insurance is a comprehensive life insurance policy that offers protection against life’s uncertainties. It provides a wide range of benefits that make it a preferred choice for many. Moreover, the company also ensures that its customers get the best possible customer care. The customer care team is available 24x7 to help and assist with policy-related matters. Furthermore, the company also offers additional benefits such as free medical check-ups, special discounts, and loyalty rewards.

Tata AIA Life Insurance Customer Care: Toll Free Number, Email ID

Tata AIA Insurance asked to pay compensation of Rs 60,000 to customer

[Resolved] Tata AIA Life — misled by tata aia agent

![Tata Aia Term Insurance Customer Care [Resolved] Tata AIA Life — misled by tata aia agent](https://www.consumercomplaints.in/thumb.php?complaints=2382962&src=822809501.jpg&wmax=900&hmax=900&quality=85&nocrop=1)

Aia insurance review information | World Event

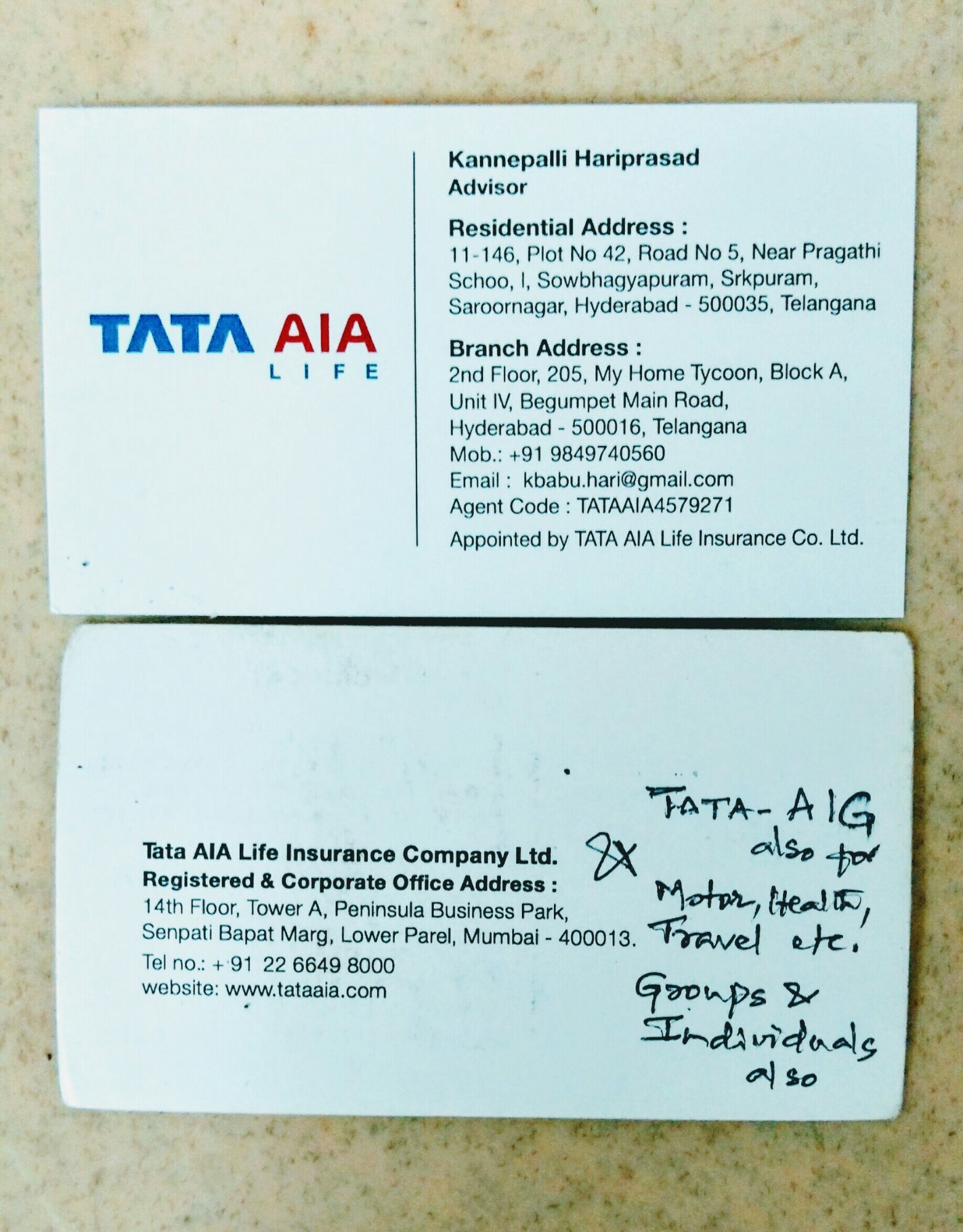

K. Hari Prasad - Insurance Agent - TATA AIA AIG in Manikonda, Hyderabad