Sri Lanka Insurance 3rd Party Price

Wednesday, October 22, 2025

Edit

Insurance in Sri Lanka: The Third Party Price

The Third Party Price in Sri Lanka

Insurance in Sri Lanka is a rapidly growing industry, and with that growth comes a growing need for third party prices for motor insurance policies. Third party prices are the cost incurred by the insurer to pay for third party damages or losses caused by an insured party. It is a necessary expense for any insurer in order to maintain its financial stability. In Sri Lanka, third party pricing is determined by the Motor Insurance Board (MIB) and the Insurance Regulatory Commission (IRC).

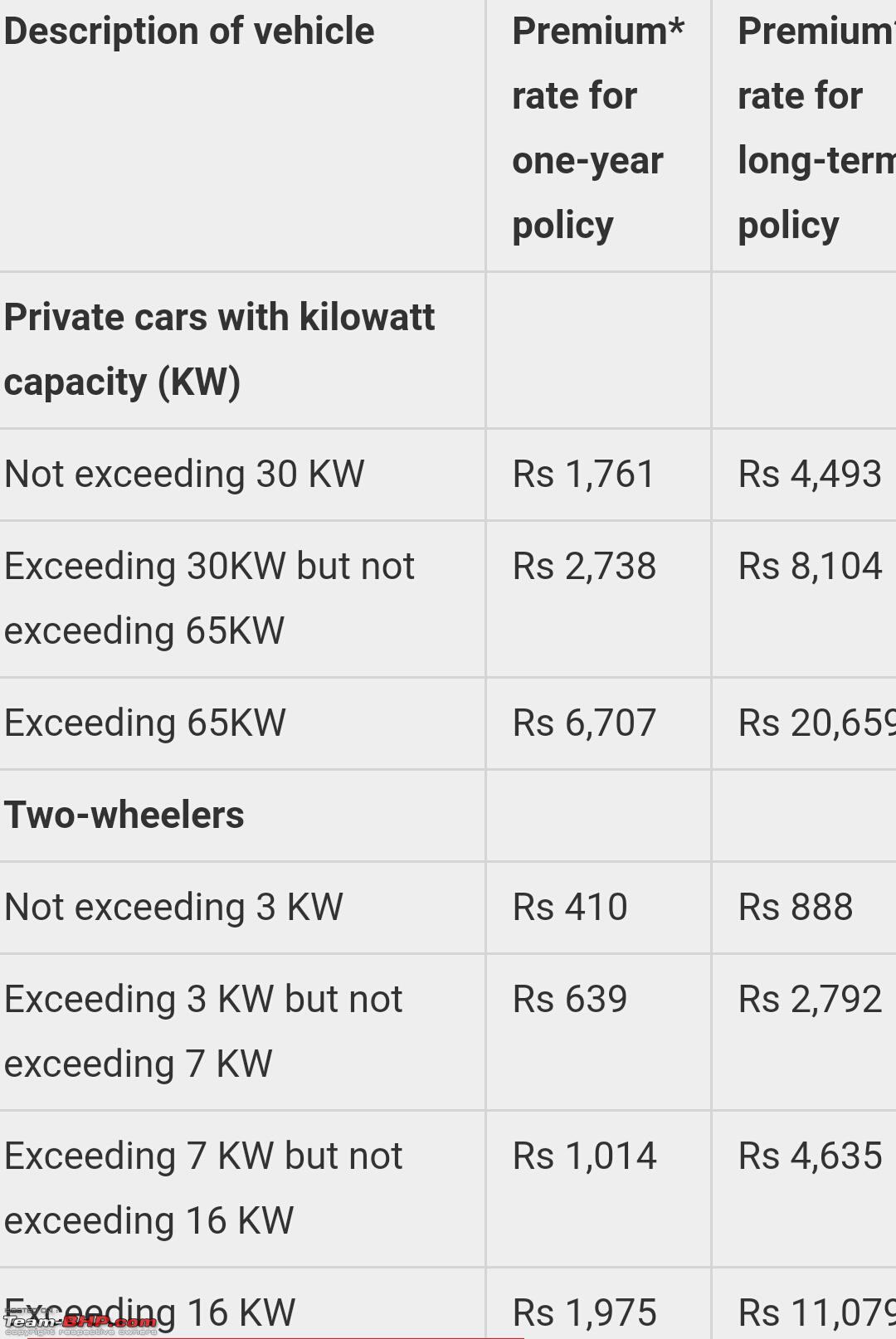

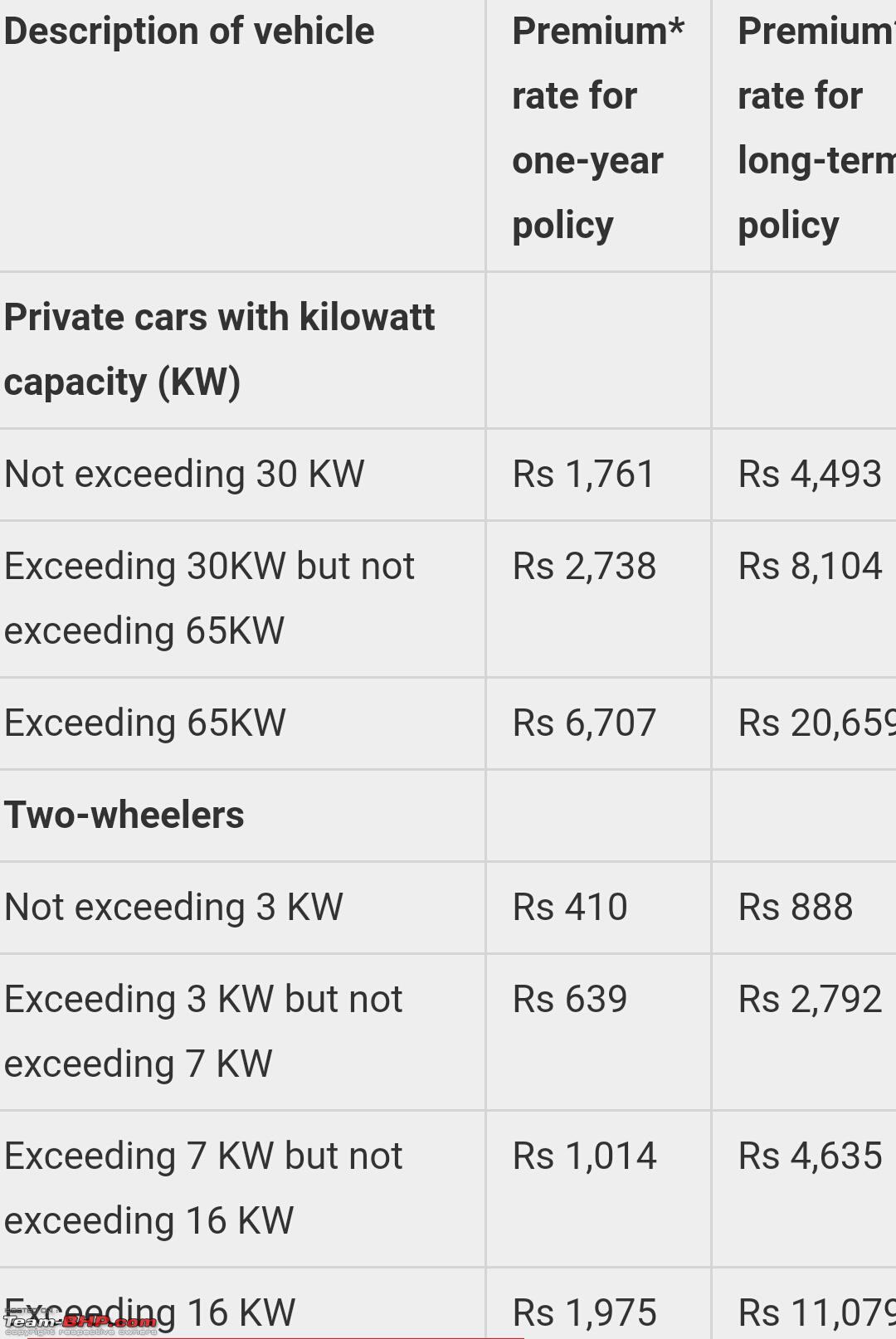

The third party price in Sri Lanka is based on certain factors such as the type of vehicle, its age, the number of years it has been in operation and the overall risk associated with it. The price is also determined by the type of coverage and the amount of coverage purchased. The cost of third party coverage also varies according to the type of policy and the insurer offering it.

The Impact of Third Party Prices on Insurance in Sri Lanka

The third party price has a direct impact on the cost of motor insurance policies in Sri Lanka. The higher the third party price, the higher the cost of coverage. This is because the insurer needs to pay for any third party damages or losses caused by an insured party.

Third party pricing also affects the availability of motor insurance policies in Sri Lanka. If the prices are too high, insurers may be reluctant to offer coverage, resulting in fewer available policies. This can lead to higher premiums and less choice for consumers.

The Role of the Motor Insurance Board and the Insurance Regulatory Commission

The Motor Insurance Board and the Insurance Regulatory Commission are the two government bodies that regulate and set the third party pricing in Sri Lanka. The MIB is responsible for approving and setting the third party pricing for motor insurance policies. The IRC, on the other hand, is responsible for monitoring and regulating the insurance industry in Sri Lanka.

The MIB and IRC work together to ensure that the third party pricing is fair and balanced. The MIB sets the prices based on the factors mentioned earlier, such as the type of vehicle, its age and the amount of coverage purchased. The IRC then monitors the industry to ensure that the prices are not too high or too low and that the insurers are meeting the needs of their customers.

The Advantages of Third Party Prices in Sri Lanka

Third party prices in Sri Lanka provide many advantages for consumers. For example, it helps to keep insurance premiums affordable for consumers. It also helps to maintain the stability of the insurance industry by ensuring that the prices are fair and balanced.

In addition, third party prices help to protect consumers from potential losses or damages caused by an insured party. This is because the insurer is responsible for paying for these damages or losses. Finally, third party prices also help to ensure that insurers are offering the best policies to their customers.

Conclusion

Third party prices are an essential part of insurance in Sri Lanka. They are set and regulated by the Motor Insurance Board and the Insurance Regulatory Commission to ensure that insurance premiums remain affordable and that insurers are providing the best policies to their customers. Third party prices also help to protect consumers from potential losses or damages caused by an insured party.

Overall, third party prices are an important factor to consider when purchasing motor insurance in Sri Lanka. They help to keep premiums affordable and to ensure that consumers are protected from potential losses or damages caused by an insured party.

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Srilanka Insurance - Get Images One

Review of the performance of Sri Lankan insurance market in 2019 | Daily FT

Srilanka Insurance - Get Images One

Driver - Insurance Board of Sri Lanka - Job Vacancies - Gazette.lk