Reliance Car Insurance Policy Details

Monday, October 20, 2025

Edit

Reliance Car Insurance Policy Details

Overview of Reliance Car Insurance

Reliance Car Insurance is a comprehensive car insurance policy offered by Reliance General Insurance, one of the leading insurance companies in India. The policy provides coverage for the insured’s car against accidental and natural damage. It also provides coverage for third party liabilities, personal accidental cover, and medical expenses. Reliance Car Insurance offers various benefits such as cashless repair facility, on-road assistance, round the clock customer service, and more. It also offers various add-on covers that can be opted for additional protection.

Features of Reliance Car Insurance

Reliance Car Insurance offers a comprehensive coverage for the insured’s car against any accidental and natural damage. It also provides coverage for third party liabilities and personal accident covers. The policy also offers personal accident covers for the passengers travelling in the insured’s car. It also provides coverage for the medical expenses incurred due to any accident.

The policy also offers some additional benefits such as cashless repair facility, on-road assistance, and round the clock customer service. The cashless repair facility is available at more than 3000 network garages across India. The policy also offers cashless claim settlement facility. The on-road assistance facility is available 24 hours a day and seven days a week.

Types of Coverage Offered by Reliance Car Insurance

The Reliance Car Insurance policy offers two types of coverage, namely, third party liability cover and comprehensive cover. The third party liability cover provides coverage for the legal liabilities arising out of any damage caused to the third party due to the insured's car. The comprehensive cover provides coverage for the insured’s car against any accidental and natural damage. It also provides coverage for the personal accident cover and medical expenses.

The policy also offers some additional add-on covers such as zero depreciation cover, engine protector cover, and roadside assistance cover. The zero depreciation cover provides coverage for the full value of the car without any deduction for depreciation. The engine protector cover provides coverage for the engine of the car against any damage due to water leakage or oil leakage. The roadside assistance cover provides coverage for the towing charges and other expenses incurred due to the breakdown of the car.

Eligibility Criteria for Reliance Car Insurance

The eligibility criteria for Reliance Car Insurance policy varies depending on the type of coverage. For the third party liability cover, the eligibility criteria are as follows:

The applicant must be aged between 18 and 70 years.

The applicant must have a valid driving license.

The applicant must have a valid car registration certificate.

For the comprehensive cover, the eligibility criteria are as follows:

The applicant must be aged between 18 and 70 years.

The applicant must have a valid driving license.

The applicant must have a valid car registration certificate.

The car must be no more than 7 years old.

The car must be fitted with an ARAI approved anti-theft device.

Premium Rates for Reliance Car Insurance

The premium rates for Reliance Car Insurance vary depending on the type of coverage and the sum assured. The premium rates for the third party liability cover are as follows:

The premium rate for the third party liability cover is Rs. 600 for a sum assured of Rs. 15 lakh.

The premium rate for the third party liability cover is Rs. 1200 for a sum assured of Rs. 25 lakh.

The premium rate for the third party liability cover is Rs. 1800 for a sum assured of Rs. 50 lakh.

The premium rates for the comprehensive cover are as follows:

The premium rate for the comprehensive cover is Rs. 1000 for a sum assured of Rs. 15 lakh.

The premium rate for the comprehensive cover is Rs. 2000 for a sum assured of Rs. 25 lakh.

The premium rate for the comprehensive cover is Rs. 3000 for a sum assured of Rs. 50 lakh.

Conclusion

Reliance Car Insurance is a comprehensive car insurance policy offered by Reliance General Insurance. The policy provides coverage for the insured’s car against accidental and natural damage. It also provides coverage for third party liabilities, personal accidental cover, and medical expenses. Reliance Car Insurance also offers various add-on covers that can be opted for additional protection. The policy also offers various benefits such as cashless repair facility, on-road assistance, and round the clock customer service.

Reliance General Insurance — Insurance not paid.

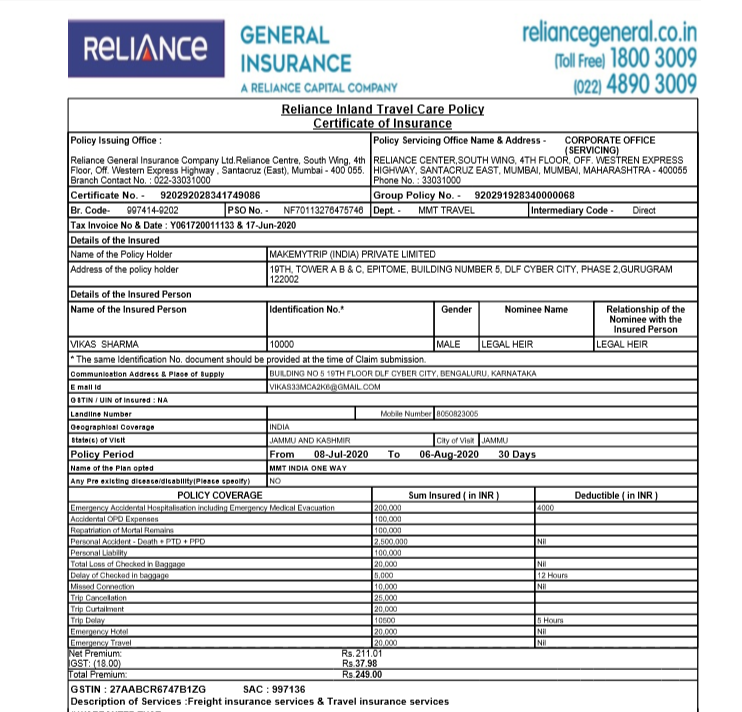

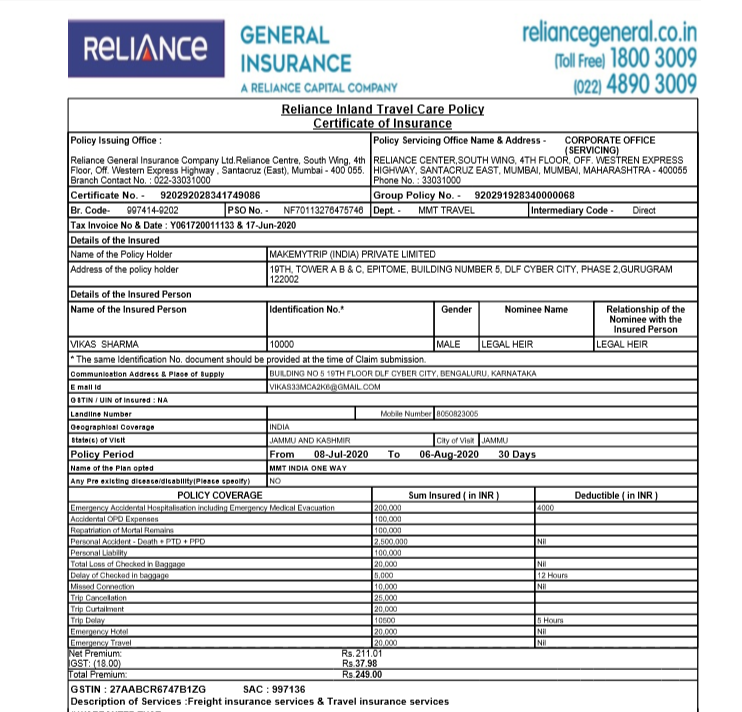

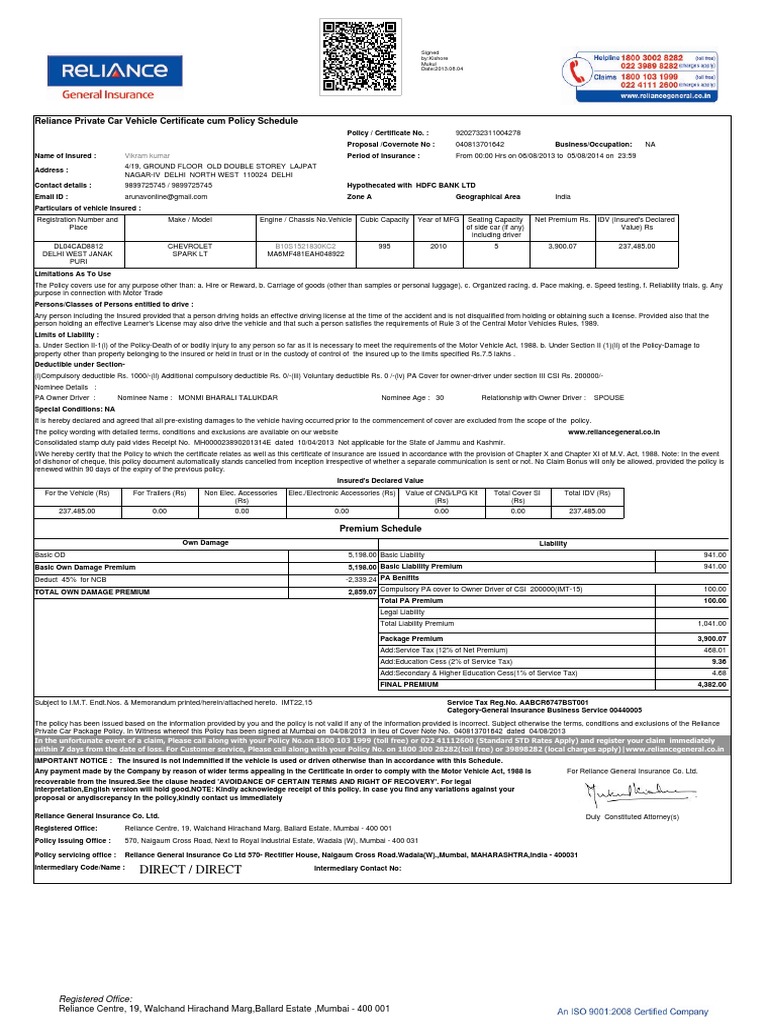

Direct / Direct: Reliance Private Car Vehicle Certificate cum Policy

Reliance General Insurance Form - INSURANCE DAY

Reliance Insurance Online Payment, Pay Premium, Buy & Renew Online

Motor Claim Form reliance general insurance | Traffic Collision | Insurance