One Week Health Insurance Coverage

One Week Health Insurance Coverage – What You Need to Know

What Is One Week Health Insurance Coverage?

One Week Health Insurance Coverage is a type of short-term health insurance plan that provides coverage for up to seven days. This type of plan is designed to provide coverage for people who are traveling, visiting family, attending a short-term job or internship, or who need temporary coverage due to a gap in other health insurance plans. It is also an ideal option for those who have recently lost their job, are between jobs, or who are switching jobs and need coverage while they wait for their new health insurance to kick in.

What Does One Week Health Insurance Cover?

One Week Health Insurance Coverage typically covers doctor visits, emergency room visits, prescriptions, and other medical expenses. The exact coverage and limits vary by plan. Some plans may also offer additional coverage for preventive care, such as routine physicals, immunizations, and lab tests. The coverage is typically limited to the seven-day period, so any care received after the seven-day period is not covered.

Who Is Eligible for One Week Health Insurance Coverage?

One Week Health Insurance Coverage is generally available to people of all ages and can be purchased without any medical underwriting. This means that you do not need to answer any medical questions or have a medical exam in order to qualify for coverage. However, some plans may have age restrictions or other eligibility requirements. It is important to check with your insurance provider to make sure you meet the eligibility requirements.

How Much Does One Week Health Insurance Cost?

The cost of One Week Health Insurance Coverage varies by plan and provider. Generally, the cost is based on the type of coverage you choose and the amount of coverage you need. Plans typically range from $50 to $200, depending on the coverage and the number of people being covered. It is important to compare plans to find the one that best fits your needs and budget.

How Do I Get One Week Health Insurance Coverage?

Most insurance providers offer One Week Health Insurance Coverage. You can purchase a plan directly from the insurance provider or through a health insurance marketplace. It is important to compare different plans and providers to find the one that best fits your needs and budget. Additionally, some employers may offer this type of coverage as part of their health insurance benefits.

Conclusion

One Week Health Insurance Coverage is a short-term health insurance plan that can provide coverage for up to seven days. It is an ideal option for those who are between jobs, need temporary coverage due to a gap in other health insurance plans, or are traveling. The cost of coverage varies by plan and provider, and can be purchased directly from the insurance provider or through a health insurance marketplace. It is important to compare different plans and providers to find the one that best fits your needs and budget.

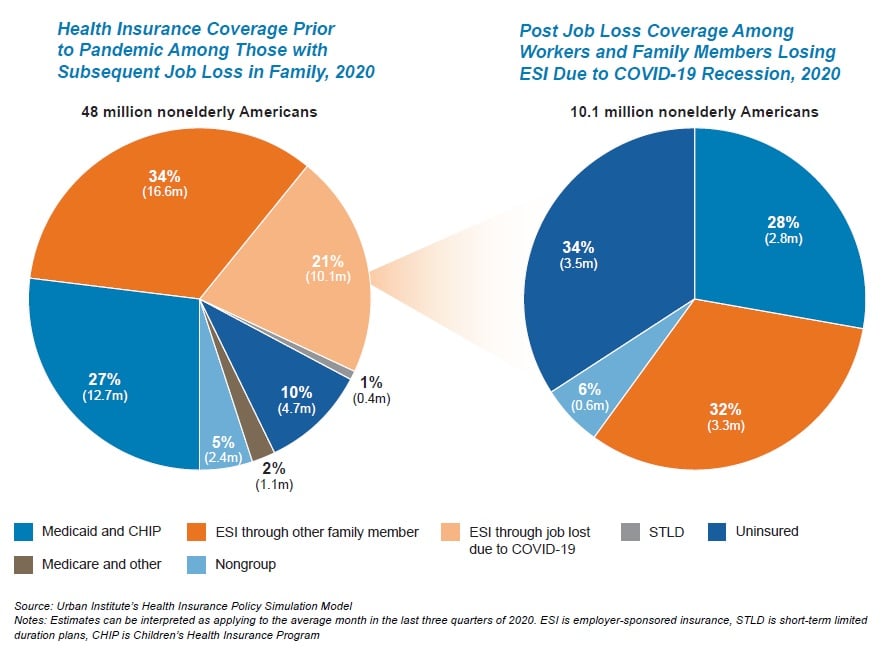

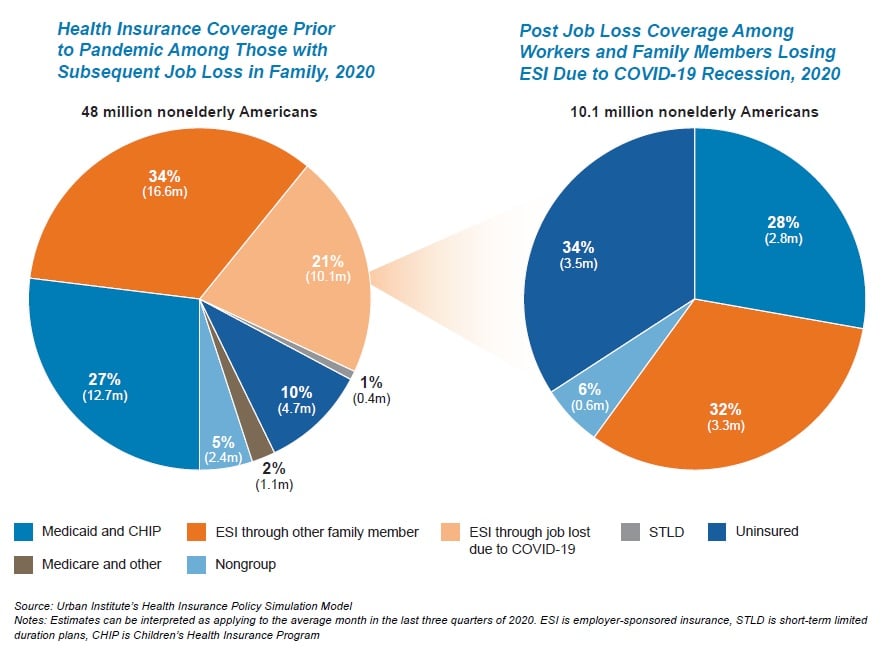

10 million Americans expected to lose employer-sponsored insurance this

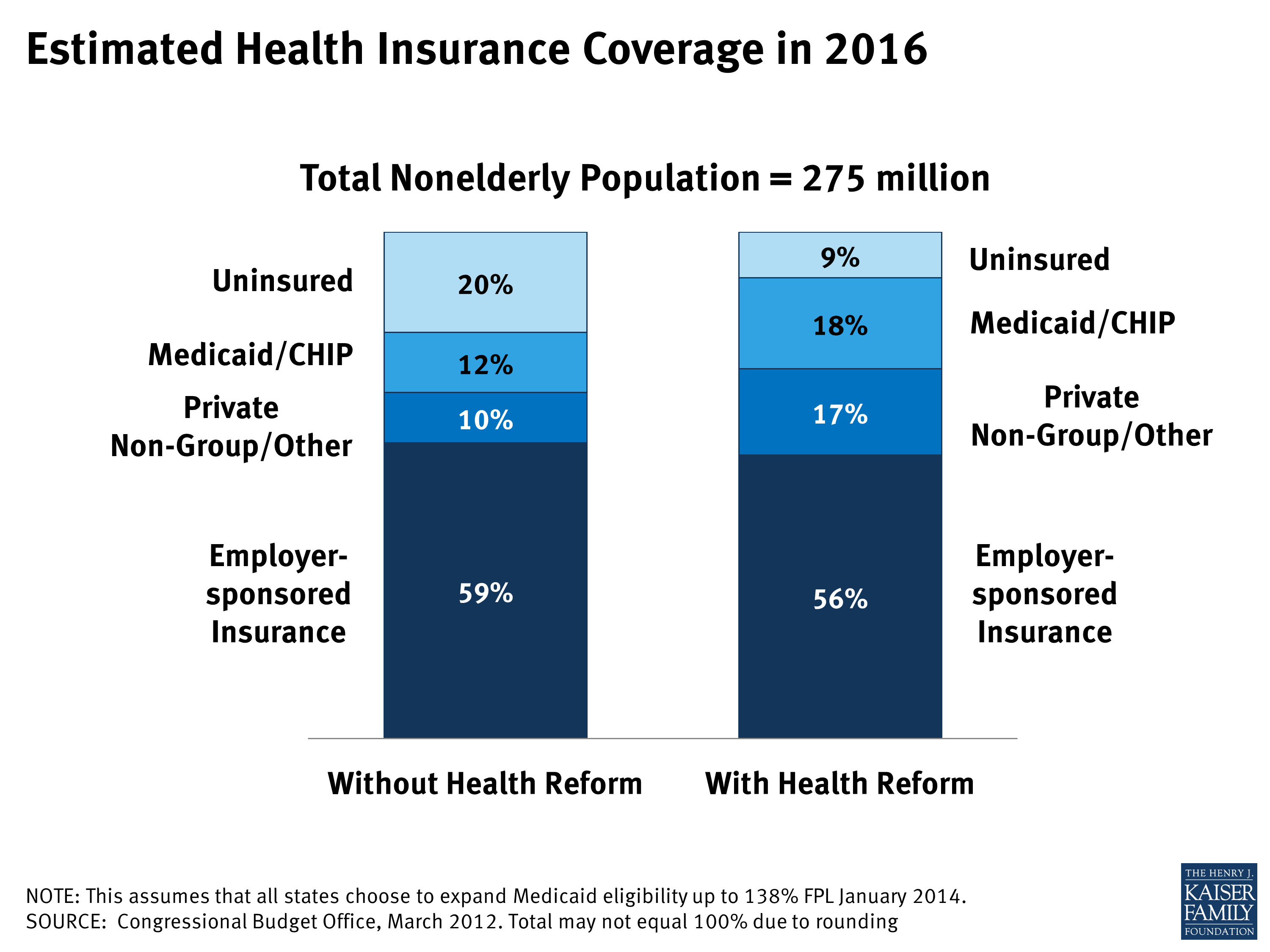

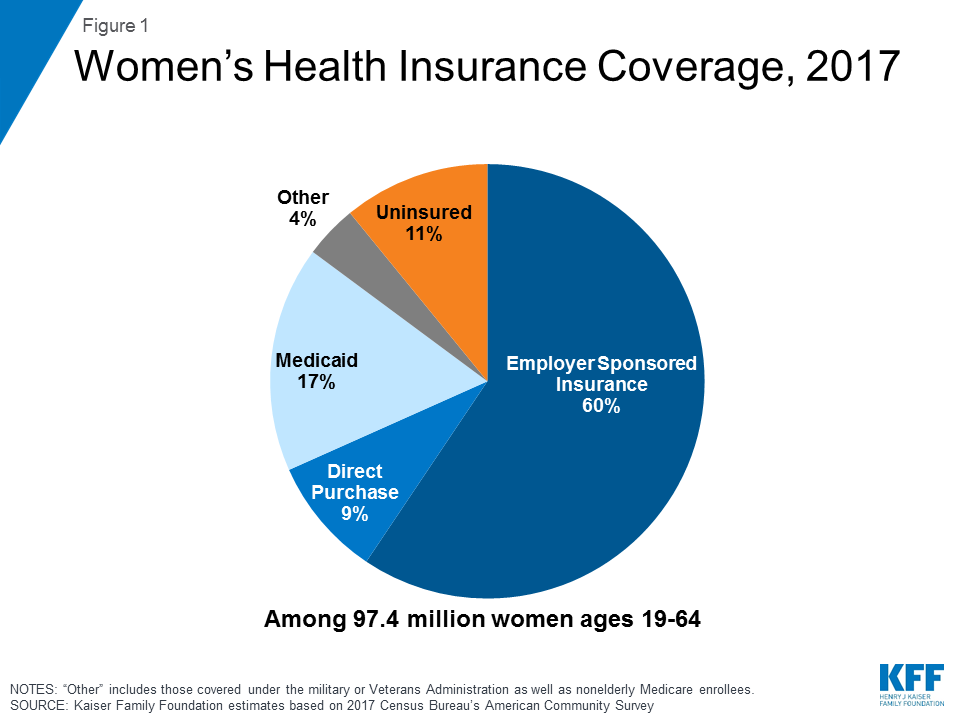

Estimated Health Insurance Coverage in 2016 | KFF

Women’s Health Insurance Coverage | The Henry J. Kaiser Family Foundation

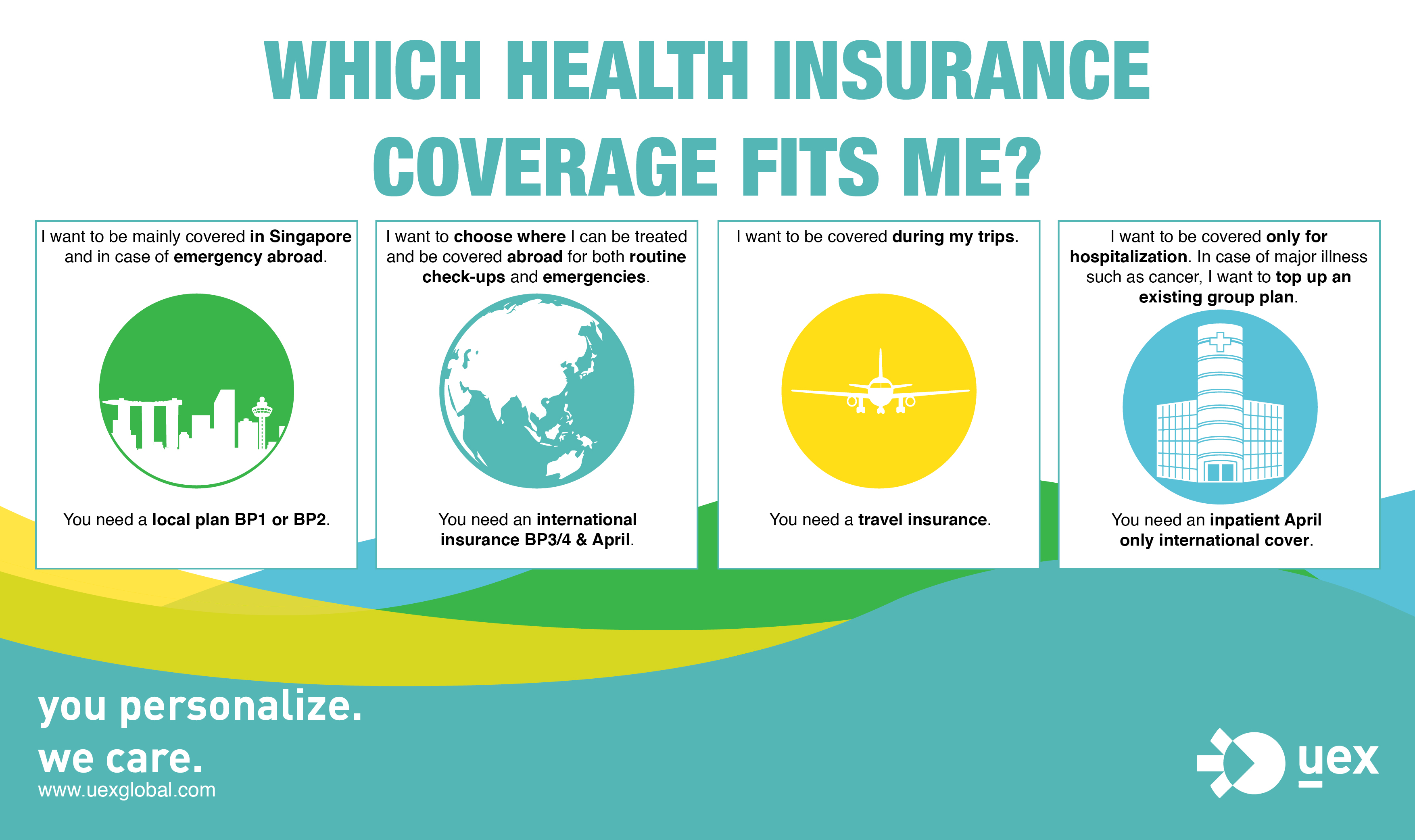

Which health insurance coverage fits me best

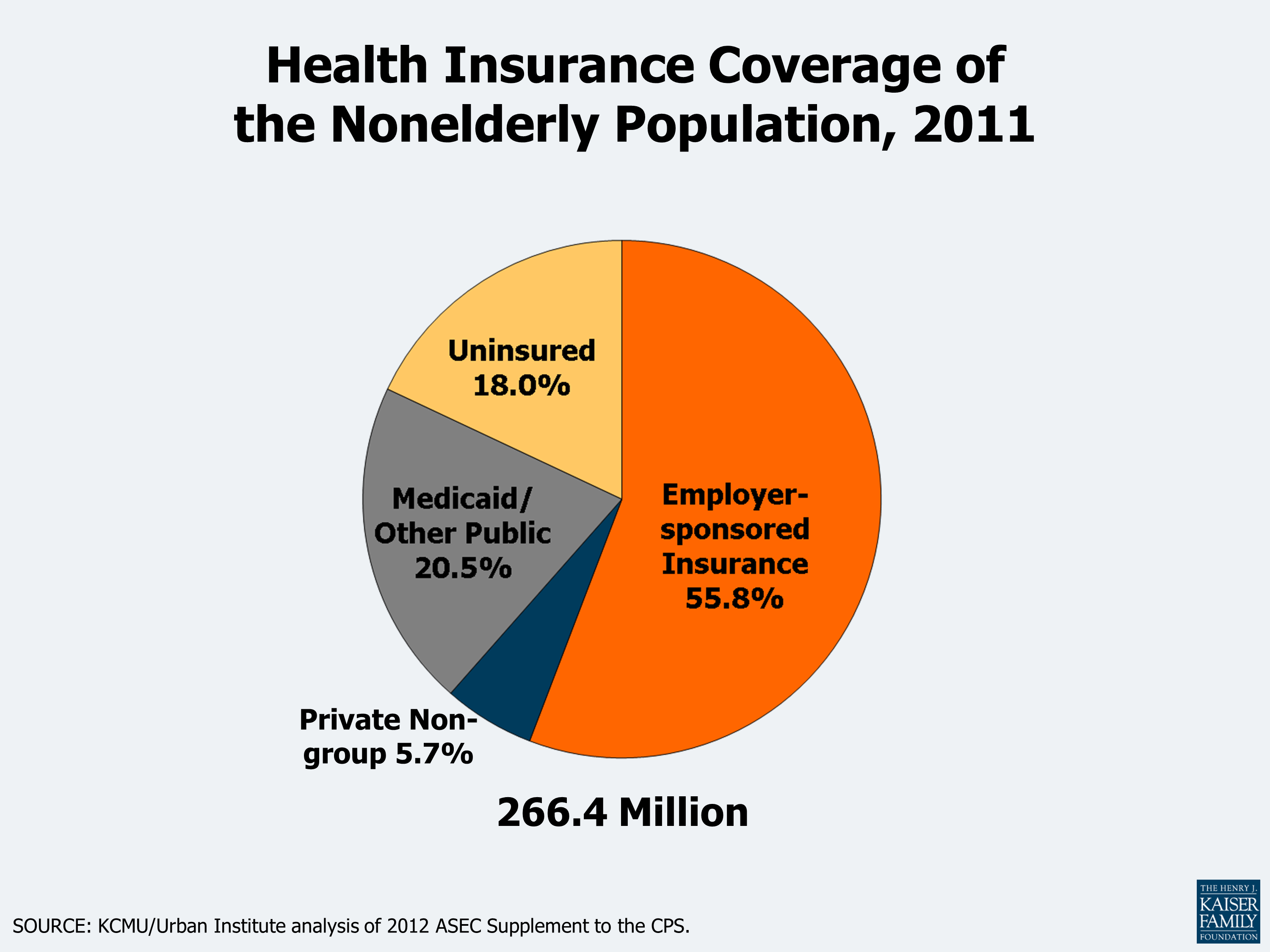

Health Insurance Coverage in America, 2011 | KFF