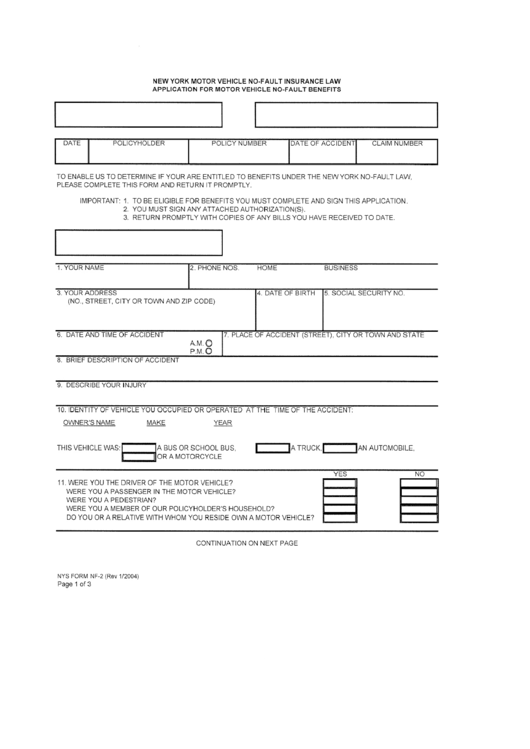

New York Motor Vehicle No Fault Insurance Law Application

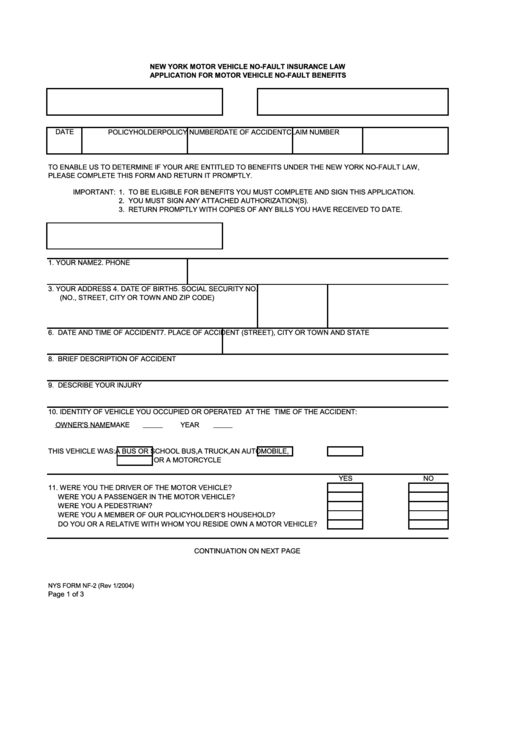

New York Motor Vehicle No Fault Insurance Law Application

What is No-Fault Insurance?

No-fault insurance is an auto insurance system that requires drivers to be insured by their own insurance company regardless of who is to blame for an accident. In other words, with no-fault insurance, your insurance company will pay for your losses or injuries regardless of who is at fault for the accident. In New York, this type of insurance is referred to as “No-Fault Insurance Law” and is required for all drivers in the state.

Why is No-Fault Insurance Necessary?

No-fault insurance is a necessary part of driving in New York because it helps to ensure that all drivers are held accountable for their own mistakes, regardless of who is at fault for the accident. No-fault laws are designed to reduce the number of lawsuits that are associated with auto accidents, as well as to reduce the costs associated with automobile insurance.

What Does No-Fault Insurance Cover?

No-fault insurance covers a wide range of expenses associated with an auto accident, including medical bills, lost wages, and property damage. In addition, it can also provide coverage for any passengers in the vehicle at the time of the accident. This type of insurance is designed to provide financial protection for both the driver and passengers in the event of an accident.

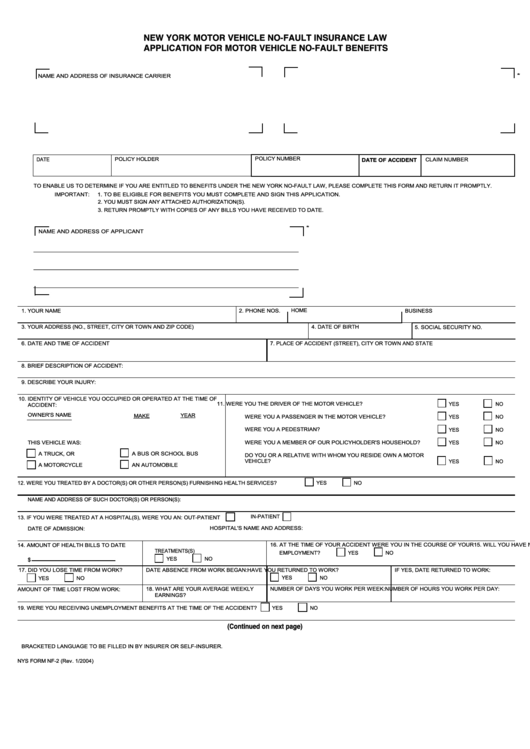

What is the Application Process for No-Fault Insurance?

In order to apply for no-fault insurance in New York, you must provide proof of insurance to the Department of Motor Vehicles. This proof of insurance must be in the form of a valid insurance certificate from an approved insurance company. Once you have provided this proof of insurance, the DMV will process your application and issue you a no-fault insurance policy.

What Are the Benefits of No-Fault Insurance?

No-fault insurance provides a variety of benefits for drivers in New York. It helps to reduce the cost of auto insurance, as well as to reduce the number of lawsuits associated with auto accidents. It also provides financial protection for both the driver and passengers in the event of an accident. Furthermore, no-fault insurance can provide coverage for medical bills, lost wages, and property damage.

How Can I Get More Information About No-Fault Insurance in New York?

If you would like to learn more about no-fault insurance in New York, you can contact the Department of Motor Vehicles or your insurance company. They will be able to answer any questions you may have about no-fault insurance and provide you with the necessary information to apply for coverage.

Top Nf2 Form Templates free to download in PDF format

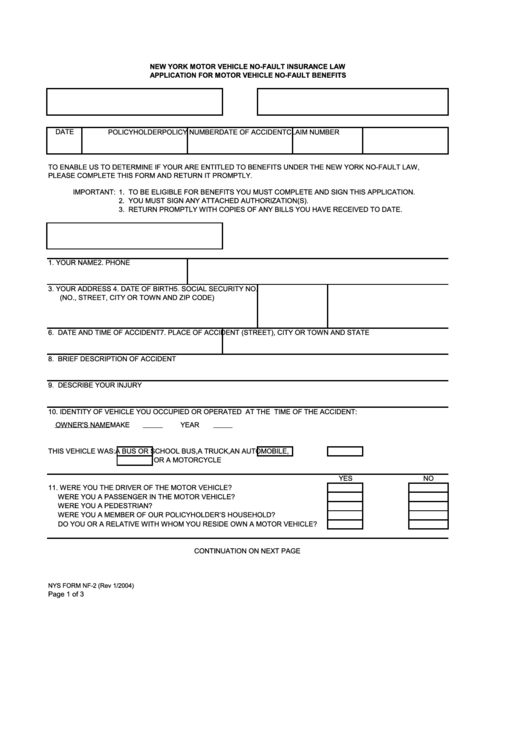

EXHIBIT(S) - C New York Motor Vehicle No-Fault Insurance Law

Fillable Form Nf-2 - Application For Motor Vehicle No-Fault Benefits

2004 Form NY NYS NF-1A Fill Online, Printable, Fillable, Blank - pdfFiller

Nys Form Nf-2 - Application For Motor Vehicle No-Fault Benefits