Minimum Car Insurance Washington State

Sunday, October 26, 2025

Edit

Minimum Car Insurance Requirements in Washington State

Overview of Car Insurance Requirements in Washington State

When it comes to car insurance, most states have similar requirements for drivers. Washington State is no different. All drivers in the state must have car insurance that meets certain guidelines. This article will explain the minimum car insurance requirements in Washington State, so you can make sure you have the coverage you need.

What is the Minimum Car Insurance Required in Washington State?

The minimum car insurance requirements in Washington State are as follows: $25,000 in bodily injury liability per person, $50,000 in bodily injury liability per accident, and $10,000 in property damage liability. In addition to this, drivers must also have $10,000 in personal injury protection (PIP) coverage. This coverage pays for medical expenses related to an accident, regardless of who is at fault.

What Else Should I Know About Car Insurance in Washington State?

In addition to the minimum requirements, there are other types of car insurance coverage that you may want to consider. These can include collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Collision coverage pays for repairs to your car if you are involved in an accident. Comprehensive coverage pays for repairs to your car if it is damaged by something other than an accident, such as a flood or fire. Uninsured/underinsured motorist coverage pays for damages if you are hit by a driver who does not have enough insurance or any insurance at all.

Are There Any Other Laws I Should Know About?

In addition to the minimum car insurance requirements, Washington State also has other laws related to car insurance. For example, it is illegal to drive without insurance in Washington State. If you are found to be driving without insurance, you could face fines and other penalties. In addition, you may be required to file an SR-22 form with the state, which verifies that you have car insurance.

Do I Need an Insurance Agent?

An insurance agent can help you find the right car insurance policy for your needs. An agent can explain the different types of coverage and help you find the best policy for your situation. They can also answer any questions you may have about car insurance in Washington State.

Conclusion

Having the right car insurance is important for every driver in Washington State. Make sure you understand the minimum car insurance requirements and consider other types of coverage that may be beneficial. An insurance agent can help you find the right policy for your needs. With the right coverage in place, you can have peace of mind knowing you are protected.

Washington Minimum Car Insurance Requirements - Sunnyside WA - YouTube

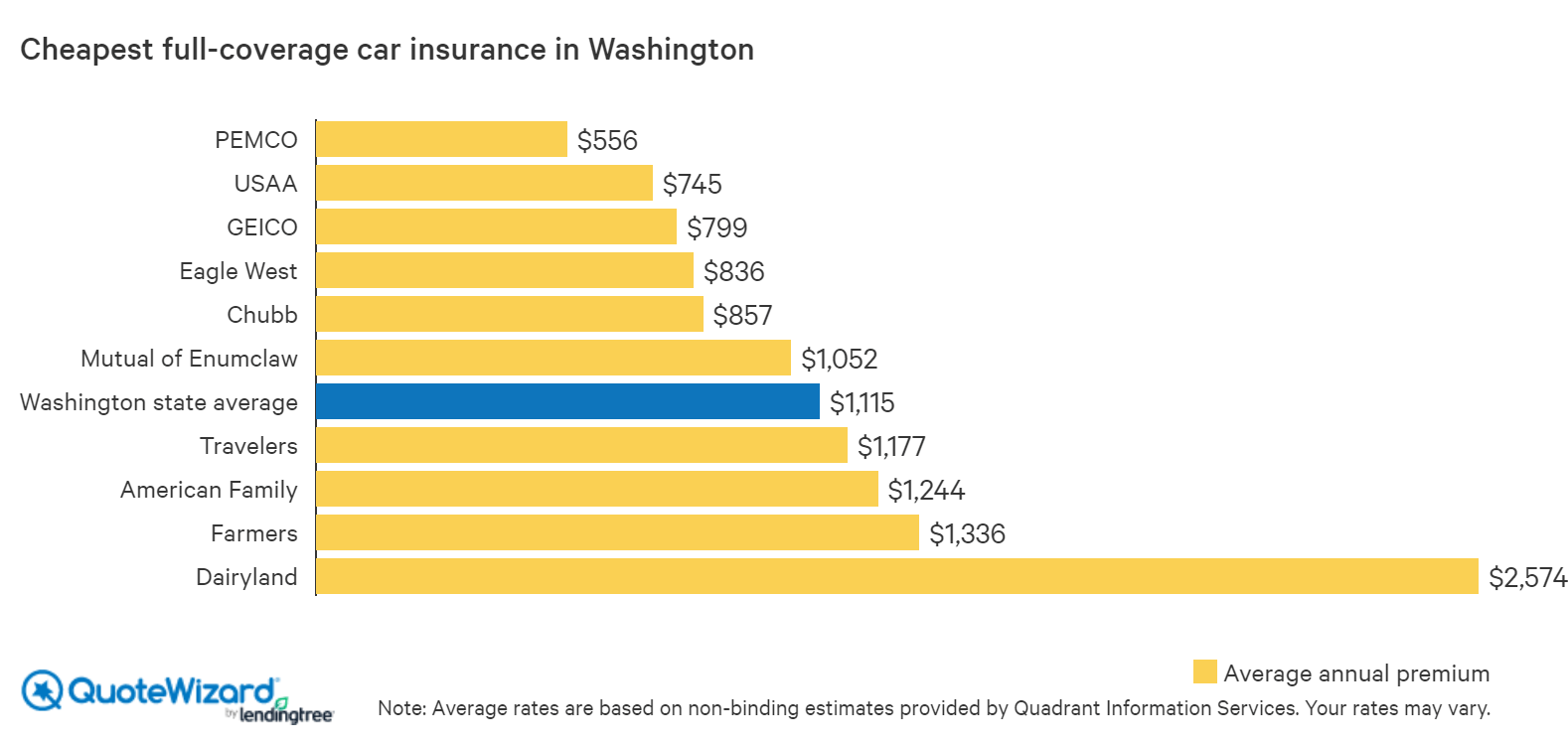

Find Cheap Car Insurance in Washington | QuoteWizard

jasonlorddesign: Washington State Car Insurance Requirements

Car insurance costs soar 44% after one claim | HuffPost

Why State Minimum Liability Auto Insurance Coverage Sucks! - YouTube