Is Costco Auto Insurance Good

Is Costco Auto Insurance Good?

Why Should You Consider Costco Auto Insurance?

If you’re looking for a reliable and trustworthy auto insurance company, it’s hard to go wrong with Costco Auto Insurance. Costco has been providing car insurance for over 20 years and is one of the most respected and well-known providers in the industry. They offer a wide range of coverage options, from basic liability to comprehensive coverage, so you can find the perfect plan for your needs. They also have competitive rates and excellent customer service. In addition, Costco has a well-established and secure online platform, so you can easily purchase and manage your policy online.

What Does Costco Auto Insurance Cover?

Costco Auto Insurance offers a variety of coverage options, depending on your needs. The most common types of coverage include liability, collision, and comprehensive. Liability coverage protects you from financial responsibility in the event of an accident that you are found to be at fault. Collision coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault. Comprehensive coverage pays for damages to your vehicle caused by events such as theft, vandalism, or natural disasters.

What Benefits Does Costco Auto Insurance Offer?

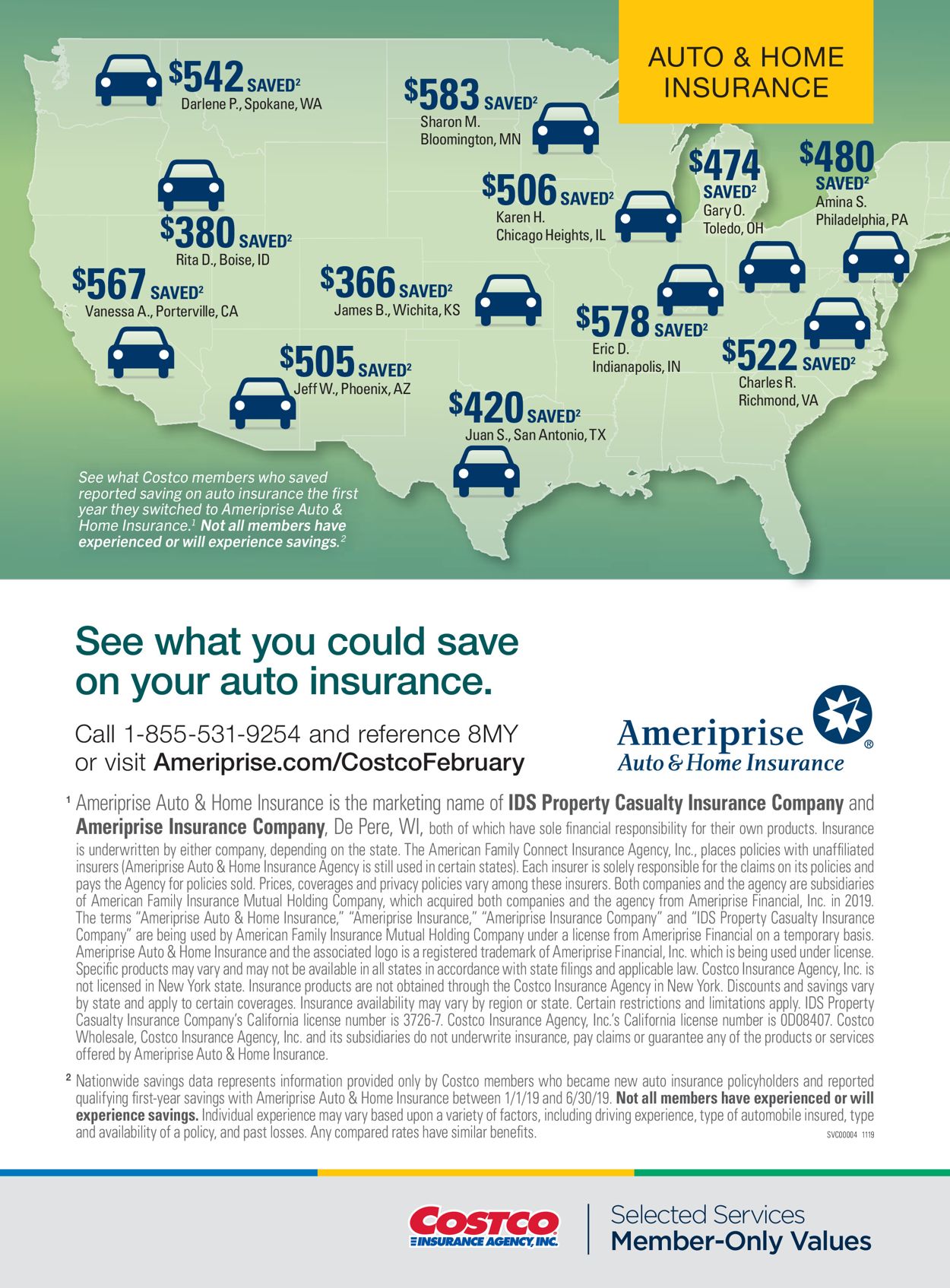

Costco Auto Insurance offers several benefits that make it an attractive option for drivers. They offer a variety of discounts, including those for safe drivers, multiple vehicle policies, and good students. Additionally, Costco offers a range of payment options, so you can pay for your policy in a way that works best for you. They also have a number of convenient features, such as their online portal, which makes it easy to manage your policy. Finally, Costco is known for providing excellent customer service, with knowledgeable and friendly agents available to answer any questions you might have.

What Are the Drawbacks of Costco Auto Insurance?

The biggest drawback of Costco Auto Insurance is that they do not offer full coverage in all states. Additionally, they do not offer coverage for high-risk drivers or those with a poor driving record. Furthermore, they require that all drivers carry liability insurance, which can be expensive for drivers with high-value vehicles. Finally, Costco’s online platform is not as user-friendly as some of their competitors, which can make it difficult to get the answers you need.

What Are the Alternatives to Costco Auto Insurance?

If you’re looking for an alternative to Costco Auto Insurance, there are plenty of other options available. State Farm, Allstate, and Geico are all reputable providers that offer a range of coverage options and competitive rates. Additionally, many local insurers offer personalized service and the ability to customize your policy, which can be a great option for drivers who want to tailor their coverage to their specific needs. Finally, some online providers, such as Progressive and Esurance, offer low rates and convenient features that make it easy to manage your policy online.

Conclusion

Costco Auto Insurance is a great option for drivers who are looking for a reliable and reputable provider. They offer competitive rates, a wide range of coverage options, and excellent customer service. However, they do have some drawbacks, such as limited coverage options and a less user-friendly online platform. If you’re looking for an alternative, there are plenty of other providers that offer similar coverage options and competitive rates. Ultimately, it’s up to you to decide which provider is the best fit for your needs.

Costco Auto & Home Insurance Review, Types, Features, Discounts

Which Kind of Insurance Is Cheap on Costco? Price Comparison Charts

Costco Car Insurance Company - Should you buy insurance at Costco

Costco Auto Insurance Connect - Insurance Reference

Costco Auto Insurance - About Costco Auto & Home Insurance - TrendEbook