How Much Is A General Liability Insurance Policy

What Is General Liability Insurance?

Business owners are always looking for ways to protect their investments, and one of those ways is to get general liability insurance. General liability insurance is a type of insurance policy that provides protection from a variety of claims and lawsuits that may arise from a business’s activities. It covers a range of events, from physical injury to property damage and from advertising errors to libel and slander. This type of insurance protects businesses from claims of negligence and covers legal costs if the business is taken to court for any type of claim. It also helps to protect the business’s assets if it is found liable for any damages.

Understanding the Cost of General Liability Insurance

The cost of a general liability insurance policy depends on the size and type of business, the number of employees, the type of activities conducted by the business, and the amount of coverage needed. Generally, a small business will pay more for general liability insurance than a larger company. This is because smaller companies have less financial resources to cover potential liabilities. Additionally, businesses with more employees tend to pay higher premiums since each employee increases the risk of a claim being filed against the business.

Factors That Affect the Cost of General Liability Insurance

The cost of general liability insurance is also affected by the type of business, its location, and the amount of coverage needed. For example, businesses that operate in high-risk industries such as construction or manufacturing tend to pay higher premiums than businesses that operate in lower-risk industries such as retail or hospitality. Similarly, businesses located in high-crime areas may also pay higher premiums than those located in low-crime areas. The amount of coverage needed also affects the cost of a general liability insurance policy, as higher coverage limits tend to cost more than lower limits.

How to Get the Best Value for Your General Liability Insurance

When shopping for general liability insurance, it’s important to compare quotes from different insurers and make sure you’re getting the best value for your money. Be sure to read the policy to make sure it meets your needs, and always ask questions if you’re not sure about something. Additionally, it’s a good idea to review your policy regularly to make sure it’s still meeting your needs and to make sure the premiums haven’t increased significantly.

The Benefits of Having General Liability Insurance

Having general liability insurance provides a number of benefits for businesses. It helps to protect the business’s assets in the event of a claim or lawsuit, and it helps to cover the legal costs associated with such events. Additionally, it can help to protect the business’s reputation if it is sued for any type of claim. Finally, having general liability insurance can help to attract customers, as customers are more likely to do business with companies that are insured against potential liabilities.

Conclusion

General liability insurance is an essential form of insurance for businesses of all sizes. It helps to protect businesses from a variety of claims and lawsuits, and it covers legal costs if the business is taken to court for any type of claim. The cost of a general liability insurance policy varies depending on the size and type of business, the number of employees, the type of activities conducted by the business, and the amount of coverage needed. By shopping around and comparing quotes, businesses can get the best value for their money. Additionally, having general liability insurance can help to protect the business’s assets, reputation, and customers.

What Is General Liability Insurance and How Much Does It Cost?

How much does general liability insurance cost - insurance

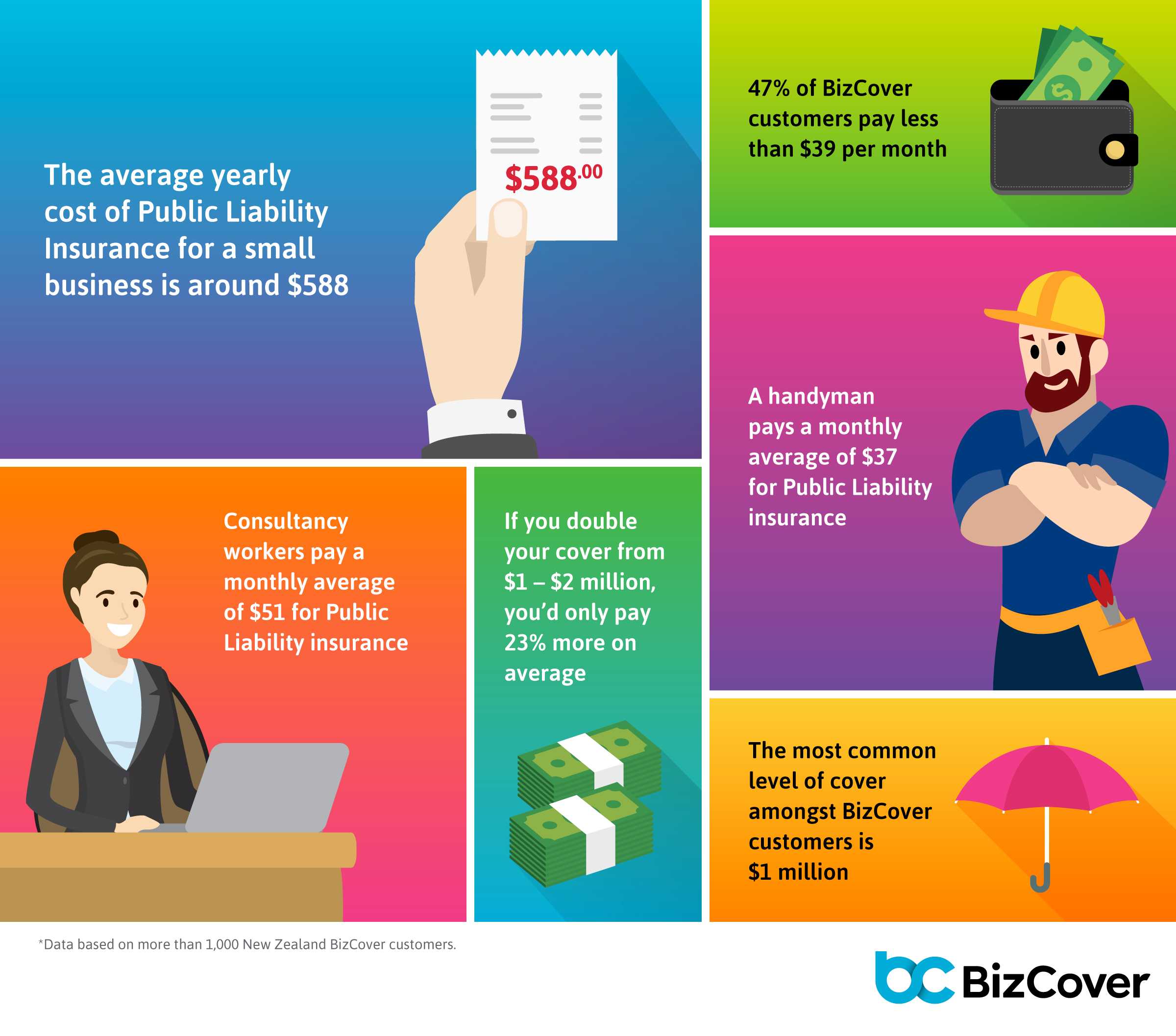

What does Public Liability Insurance Cost? | BizCover NZ

Business Insurance 101

How Much Does Liability Insurance Cost For A Small Business ~ wow