Florida Auto Insurance Carriers Non Standard

Florida Non-Standard Auto Insurance Carriers

Understanding Non-Standard Auto Insurance

Non-standard auto insurance is designed for higher risk drivers who may have difficulty finding traditional coverage. This type of auto insurance is typically more expensive and offers fewer options than a standard policy. There are a variety of factors that can make a driver a higher risk, such as a poor driving record, multiple speeding tickets, a DUI or DWI conviction, or even simply being a young driver. Non-standard auto insurance can be a great way for higher risk drivers to get the coverage they need.

Non-Standard Carriers in Florida

There are a number of non-standard auto insurance carriers that operate in the state of Florida. These companies specialize in providing coverage to those who may have difficulty finding it elsewhere. Some of the most popular non-standard carriers in Florida include Progressive, Allstate, and AIG. These companies offer a variety of coverage options including liability, comprehensive, and collision coverage. They also offer a range of discounts for those who qualify.

How to Find the Best Non-Standard Carrier

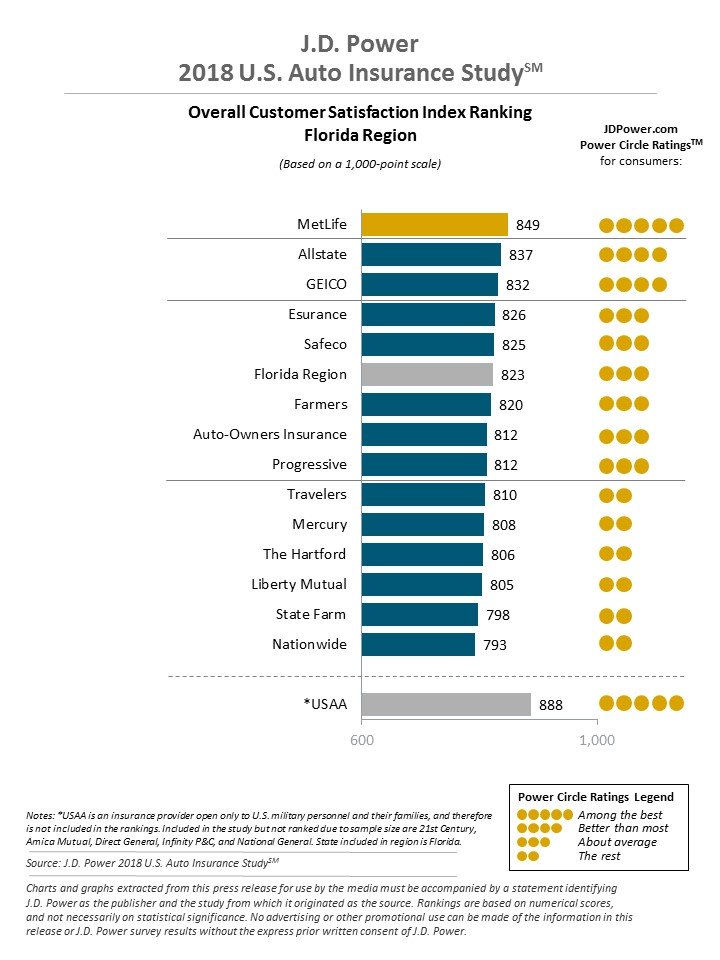

When looking for a non-standard auto insurance carrier in Florida, it is important to compare rates and coverage options to find the best deal. Many of these companies offer discounts for those who qualify, so it is important to ask about them. It is also important to read the policy carefully to make sure that it meets your needs. Additionally, it is important to make sure that the company is reputable and reliable. It is a good idea to read customer reviews to get a better idea of how the company operates.

Finding Affordable Non-Standard Coverage

Non-standard auto insurance can be expensive, but there are ways to save money. One of the best ways to save money is to shop around and compare rates. There are also discounts available for those who qualify, such as good student discounts, safe driver discounts, and multi-car discounts. Additionally, it is important to keep a clean driving record to avoid any additional fees or costs. Finally, it is important to consider raising your deductible if you are willing to take on more financial responsibility.

Conclusion

Non-standard auto insurance can be a great way for higher risk drivers to get the coverage they need. There are a number of non-standard carriers operating in the state of Florida, and it is important to compare rates and coverage options to find the best deal. Additionally, there are a number of ways to save money on non-standard auto insurance, such as shopping around, taking advantage of discounts, and raising your deductible. With the right coverage, higher risk drivers can get the protection they need at an affordable price.

2019's Best Car Insurance Companies in Florida| Florida Insurance Quotes

How Much Is Car Insurance In Florida Per Month? (6 Facts)

Auto Insurance: Auto Insurance In Florida

Lowest Auto Insurance Rates In Florida : 2021 Best Cheap Car Insurance

Automobile Insurance Coverage That is Required for Florida Drivers