Define Hired And Non Owned Auto Coverage

What is Hired and Non-Owned Auto Coverage?

Hired and Non-Owned Auto Coverage is a type of insurance policy specifically designed to cover vehicles that are hired or leased for business purposes, but are not owned by the business itself. This type of coverage is also known as hired car liability insurance and is sometimes referred to as non-owned auto insurance. It is important to understand that this type of coverage is not the same as commercial auto insurance. It is a separate policy that is used to supplement commercial auto insurance.

What Does Hired and Non-Owned Auto Coverage Cover?

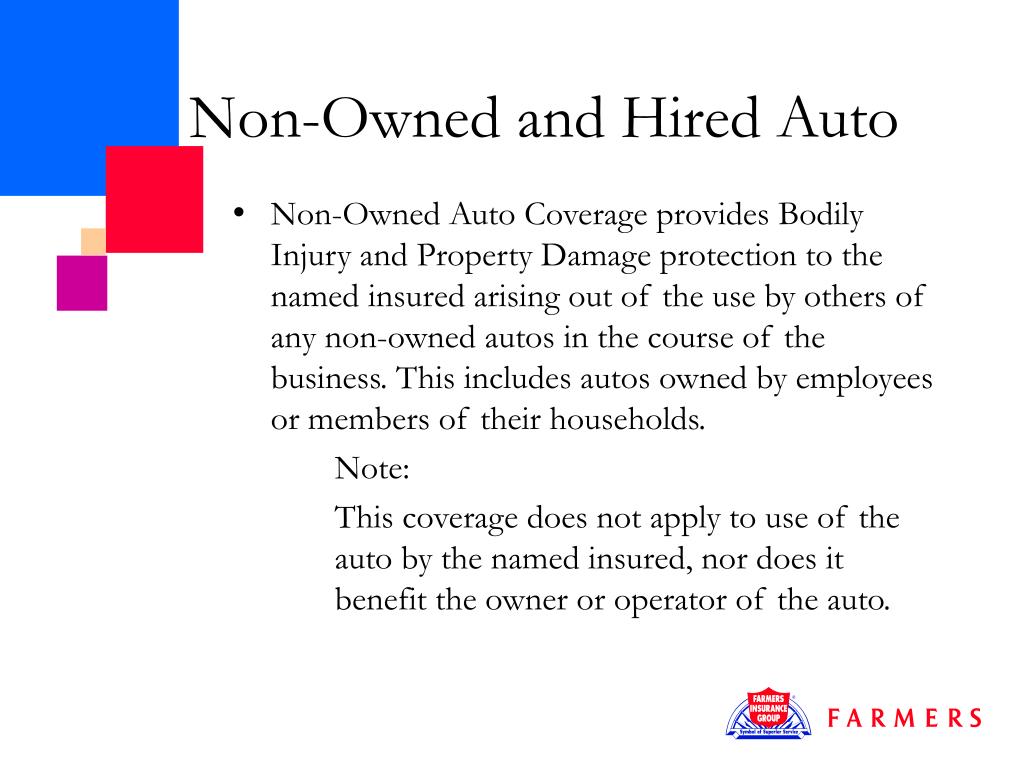

Hired and Non-Owned Auto Coverage will provide protection for a business if an accident occurs while a vehicle is being used for business purposes, but the business does not own the vehicle. This type of coverage will help to cover the costs of any liability, property damage and medical expenses that may arise from the accident. This type of coverage can also provide coverage for any uninsured or underinsured motorists involved in the accident.

When is Hired and Non-Owned Auto Coverage Necessary?

Hired and Non-Owned Auto Coverage is necessary for businesses that do not own their own vehicles, but will occasionally hire or lease vehicles for business purposes. This type of coverage is especially important for businesses that use leased or rented vehicles on a regular basis. It is important to note that this type of coverage is not intended to replace commercial auto insurance, but rather to supplement it.

What Does Hired and Non-Owned Auto Coverage Cost?

The cost of Hired and Non-Owned Auto Coverage will vary depending on the type of coverage being purchased, the amount of coverage purchased, and the type of vehicle being used for business purposes. Generally, the cost of this type of coverage is relatively inexpensive, as it is designed to provide additional coverage for businesses. The cost of this type of coverage is typically much lower than the cost of commercial auto insurance.

What Are the Benefits of Hired and Non-Owned Auto Coverage?

The primary benefit of Hired and Non-Owned Auto Coverage is that it provides businesses with additional coverage that is not included in their commercial auto insurance policy. This type of coverage can help to protect businesses from any liability and property damage that may arise from an accident involving a hired or leased vehicle. Additionally, this type of coverage can provide coverage for any uninsured or underinsured motorists involved in the accident.

Conclusion

Hired and Non-Owned Auto Coverage is a type of insurance policy specifically designed to cover vehicles that are hired or leased for business purposes, but are not owned by the business itself. This type of coverage is important for businesses that do not own their own vehicles, but will occasionally hire or lease vehicles for business purposes. The cost of this type of coverage is typically much lower than the cost of commercial auto insurance, and it provides businesses with additional coverage that is not included in their commercial auto insurance policy.

Hired/Non-Owned Auto Coverage | BIG Insurance Solutions

PPT - COMMERCIAL REAL ESTATE PowerPoint Presentation, free download

Non Owned Auto Insurance: Business's Safety Net - Agency Height

Hired And Non Owned Auto - Car Sale and Rentals

What Is Hired and Non-Owned Auto Insurance? - Hourly, Inc.