Car Insurance For 50 Years And Over

Car Insurance for Drivers Over 50 Years Old

Why is Car Insurance More Expensive for Drivers Over 50?

When someone turns 50, they often start to worry about their car insurance costs increasing. This isn't usually the case, but it's an understandable concern. While age is only one factor that affects car insurance premiums, it can have an impact. Statistically, drivers over 50 have more accidents than younger drivers, which means that insurers could view them as a greater risk and charge them more for their premiums. Age is just one of the many factors that insurers take into account when calculating a driver's premium, but it's important to understand how it affects your car insurance policy.

What Factors Affect Car Insurance for Drivers Over 50?

When it comes to car insurance for drivers over 50, there are a few factors that can affect the cost of your premiums. Your driving record, the type of vehicle you drive, and the amount of coverage you choose are all important factors, but age can still be a determining factor. Insurance companies use data to determine how likely a driver is to get into an accident, and they view drivers over 50 as being more likely to get into an accident than younger drivers. However, this isn't always the case, and there are other factors that can affect your premiums.

How Can Drivers Over 50 Save Money on Car Insurance?

Although car insurance for drivers over 50 can be more expensive than for younger drivers, there are still ways to save money. Shopping around for the best rates is one of the most effective ways to save money on car insurance. Insurers have different rates and policies, so it's important to compare different companies to make sure you're getting the best deal. Additionally, there are discounts available for drivers over 50, such as multi-car discounts, low-mileage discounts, and good driver discounts. Taking advantage of these discounts can help you save money on your car insurance.

What Are The Benefits of Car Insurance for Drivers Over 50?

Car insurance for drivers over 50 can be beneficial in a number of ways. For one, it can provide financial protection in case of an accident. Additionally, it can give drivers peace of mind knowing that they are covered in case of an accident. Furthermore, it can help cover any legal costs that may arise from an accident. Finally, car insurance can help ensure that drivers over 50 maintain a good driving record, as having a good driving record can lead to lower premiums.

Conclusion:

Car insurance for drivers over 50 can be more expensive than for younger drivers, but there are still ways to save money. Shopping around for the best rates, taking advantage of discounts, and having a good driving record can all help to keep premiums low. Additionally, car insurance can provide financial protection and peace of mind in case of an accident. Car insurance for drivers over 50 is important for keeping them safe on the road.

Over-50s Hit Hardest As Insurance Premiums Rise

Over 50s Car Insurance | Post Office Money

Average Car Insurance By State / Minnesota Auto Insurance Made Easy

Average Cost of Electric Car Insurance UK 2020 | NimbleFins

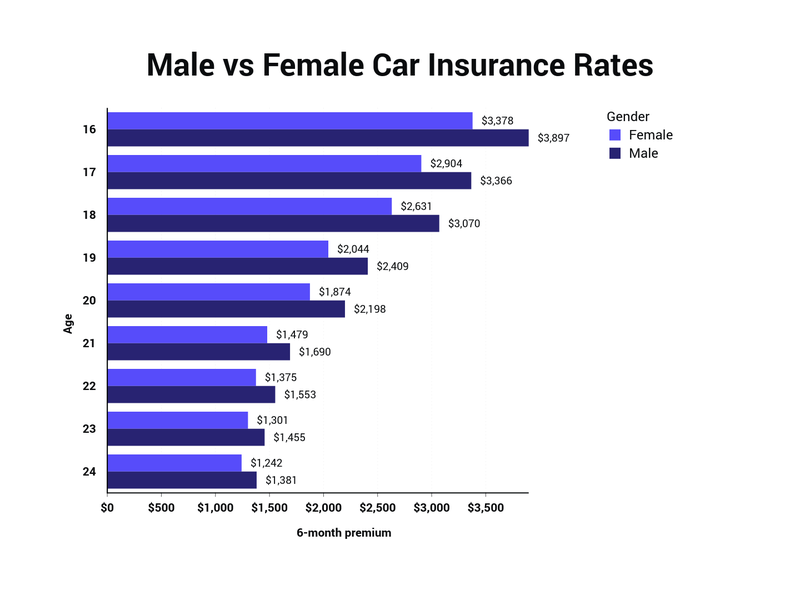

Male vs. Female Car Insurance Rates | The Zebra