Cancellation Of Motor Insurance Policy

Cancellation of Motor Insurance Policy: Overview and Tips

What is Motor Insurance?

Motor insurance is a type of insurance that provides financial protection for your vehicle. It protects you from any losses or damages that may occur as a result of an accident, theft or other incident. Motor insurance is also known as car insurance or auto insurance, and it can be purchased from a variety of different companies. Motor insurance is an important part of owning a vehicle, as it can help to protect you from financial losses if an accident or other incident occurs. Motor insurance is typically required by law in most countries, and it is important to understand the various types of coverage that may be included in your policy.

What is Cancellation of Motor Insurance Policy?

Cancellation of motor insurance policy is the process of terminating a motor insurance policy prior to its expiration date. This process can happen for a variety of reasons, such as if you no longer need the coverage, if you are switching insurers, or if you are unable to pay the premiums. In some cases, it may be possible to cancel the policy without incurring any fees or penalties, but this is not always the case. It is important to understand the process of cancellation and any potential fees or penalties associated with it before making the decision to cancel your policy.

Why Would You Want to Cancel Your Motor Insurance Policy?

There are a variety of reasons why you may want to cancel your motor insurance policy. Perhaps you no longer need the coverage, or you are switching to another insurer that offers better coverage or lower premiums. You may also be looking to save money by cancelling your policy, as premiums can be quite expensive. However, it is important to understand that cancelling your policy may result in penalties or fees, so it is important to weigh the pros and cons before making the decision.

What Are the Steps for Cancelling a Motor Insurance Policy?

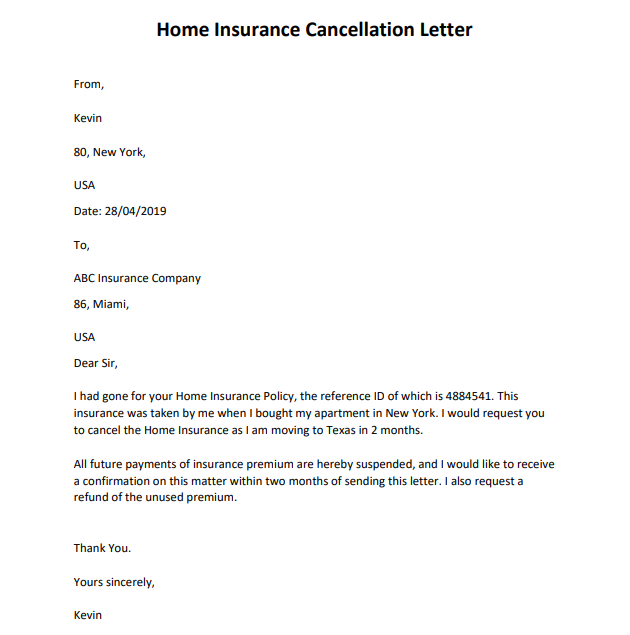

The steps for cancelling a motor insurance policy vary depending on the insurer and the type of policy you have. Generally, the first step is to contact your insurer to inform them of your decision to cancel the policy. The insurer may require you to provide proof of cancellation, such as a copy of the signed cancellation form. The insurer may also require you to pay any outstanding premiums, fees or penalties associated with the policy. Once the cancellation is complete, you should receive a confirmation letter or email from the insurer.

What Are the Potential Fees and Penalties for Cancelling a Motor Insurance Policy?

The potential fees and penalties for cancelling a motor insurance policy vary depending on the insurer and the type of policy you have. Generally, if you cancel your policy before it expires, you may be required to pay a cancellation fee, which is typically a percentage of the total premium. In some cases, you may also be required to pay a penalty for cancelling the policy early, which can be quite expensive. It is important to understand the potential fees and penalties before making the decision to cancel your policy.

Tips for Cancelling Motor Insurance Policy

When cancelling your motor insurance policy, there are a few tips to keep in mind. First, make sure to read the terms and conditions of your policy carefully before making any decision. This will help you understand the fees and penalties associated with cancelling your policy. Secondly, make sure to contact your insurer as soon as possible to inform them of your decision to cancel the policy. Finally, make sure to keep all the relevant documents and paperwork related to the policy, as this can help you if you need to make a claim in the future.

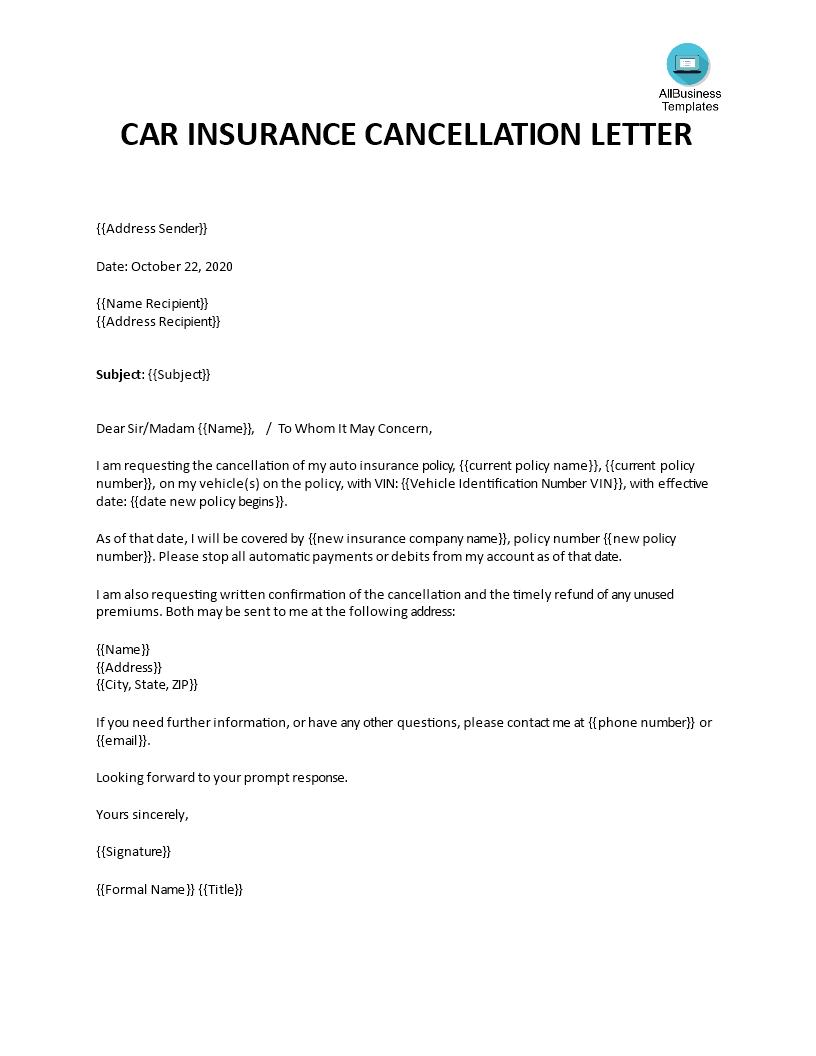

Car Insurance Cancellation Letter | Templates at allbusinesstemplates.com

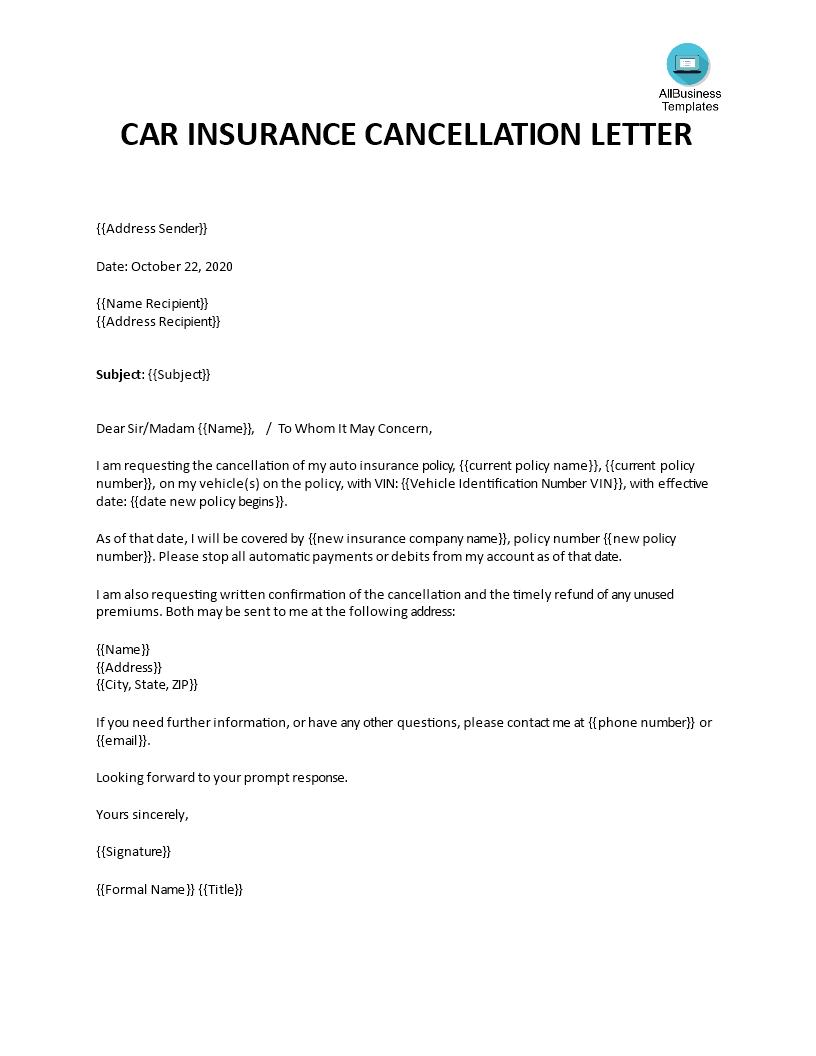

Cancelled Car Insurance / Printable insurance cancellation request form

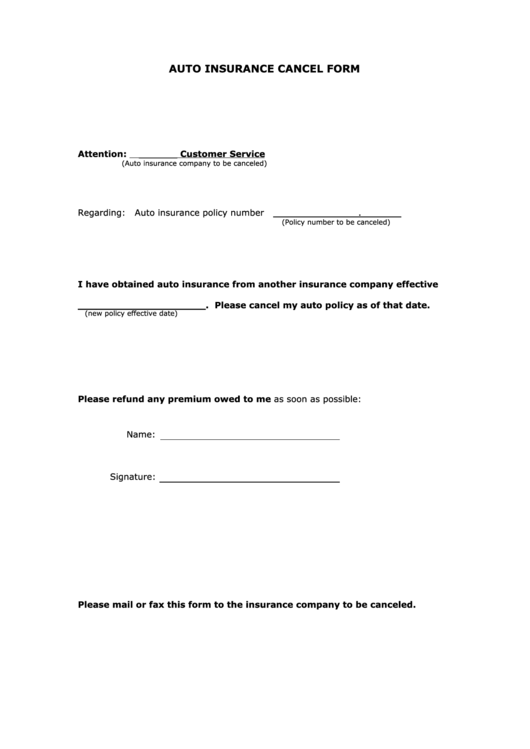

Insurance Cancellation Letter Template Samples - Letter Template Collection

Powerful Insurance Cancellation Letter Samples and Format

FREE 9+ Cancellation Policy Templates in PDF