Can I Use My Hsa To Buy Covid Tests

Can I Use My HSA to Buy Covid Tests?

What is an HSA?

An HSA, or Health Savings Account, is a tax-advantaged savings account that allows individuals to pay for qualified medical expenses. HSAs are available to those enrolled in a high-deductible health plan (HDHP). These plans usually offer a lower premium than traditional health plans, but require the individual to pay a higher deductible before receiving coverage. Money in an HSA can be used to pay for out-of-pocket medical expenses, like deductibles, copayments, coinsurance, and other qualified medical expenses.

Can I Use My HSA to Buy Coronavirus Tests?

The short answer is yes; the longer answer is it depends. The IRS recently announced that HSAs are allowed to be used to pay for Coronavirus testing costs. However, the IRS also stated that HSA funds can only be used for testing that is medically necessary. This means that if you are asymptomatic and do not have any reason to believe you have been exposed to the virus, the cost of testing may not be a qualified medical expense and the funds may not be used to pay for the test.

What if I Have Symptoms?

If you have symptoms or suspect you may have been exposed to the virus, the cost of testing would likely be considered a qualified medical expense, and you would be able to use your HSA to pay for the test. The IRS has not specified what type of documentation a taxpayer would need to provide in order to prove the test was medically necessary, so it is best to consult a tax professional for more information.

What Other Expenses Can I Use My HSA For?

In addition to Coronavirus testing costs, HSAs can be used to pay for a variety of other eligible medical expenses. These include, but are not limited to, prescription medications, doctor visits, lab fees, and vision and dental expenses. HSAs can also be used to pay for over-the-counter medications, as long as a prescription is obtained from a doctor. Additionally, HSA funds can be used to pay for certain types of health insurance premiums, such as long-term care insurance.

Are There Any Restrictions on HSA Funds?

Yes, there are a few restrictions on HSA funds. First, funds must be used for qualified medical expenses; any funds used for non-eligible expenses are subject to income tax and a 20% penalty. Additionally, funds must be used for expenses incurred after the HSA has been established; funds cannot be used to pay for medical expenses that occurred prior to the establishment of the account. Finally, it is important to remember that an HSA is a tax-advantaged account and funds must be used for eligible expenses in order to maintain the tax benefits.

Conclusion

In conclusion, HSAs can be used to pay for Coronavirus testing costs, as long as the test is medically necessary. Other eligible medical expenses that can be paid with HSA funds include prescription medications, doctor visits, lab fees, and vision and dental expenses. It is important to remember that funds must be used for qualified medical expenses in order to maintain the tax benefits associated with the HSA.

Where to buy PCR and antigen at-home COVID test kits

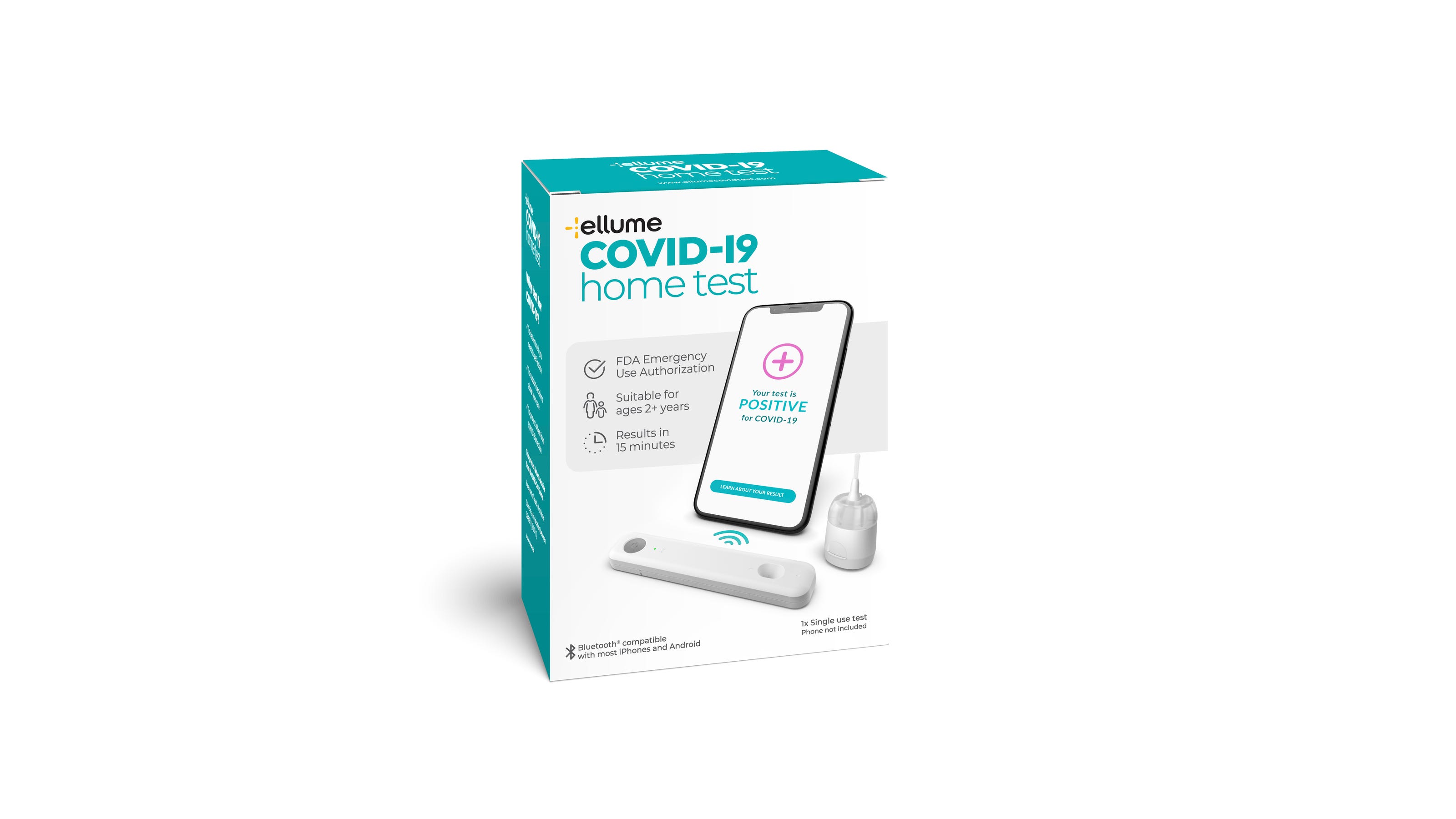

FDA authorizes first home COVID-19 test without prescription, Ellume

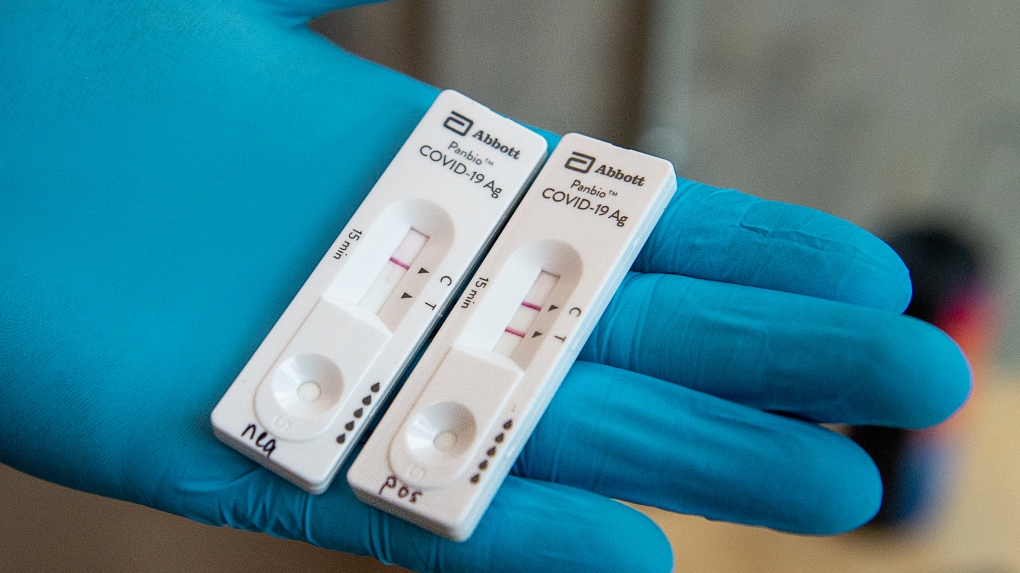

17 long-term care homes in Ottawa implement rapid COVID-19 testing

COVID-19 Test - Abbott’s BinaxNOW™ Ag At-Home Kit 3 Pack | Optum Store

Health Canada Authorizes Canada’s First Rapid COVID-19 Antibody Test