Be Wiser Car Insurance Cancellation Policy

Sunday, October 12, 2025

Edit

Be Wiser Car Insurance Cancellation Policy

What is Be Wiser Car Insurance Cancellation Policy?

Be Wiser Car Insurance Cancellation Policy is the policy that applies to customers who are looking to cancel their car insurance with Be Wiser. This policy outlines the process for cancelling a policy as well as the consequences of cancelling a policy. It is important to understand the Be Wiser Car Insurance Cancellation Policy before making a decision to cancel your policy.

Be Wiser is a UK-based car insurance provider that offers a range of car insurance policies designed to meet the needs of different customers. Be Wiser is known for its competitive premiums and comprehensive cover, as well as its excellent customer service.

When Can You Cancel Your Be Wiser Car Insurance Policy?

You can cancel your Be Wiser car insurance policy at any time. However, you will be charged a cancellation fee if you cancel before the end of the policy period. The cancellation fee will depend on how long you have had the policy and how much of the premium you have paid.

If you cancel your policy within 14 days of the start date, you will receive a full refund of any premiums paid. If you cancel after 14 days, you will receive a refund of any premiums paid less the cancellation fee.

What Are The Consequences Of Cancelling Your Be Wiser Car Insurance Policy?

If you cancel your Be Wiser car insurance policy, you will no longer have the benefit of the cover provided by the policy. This means that if you have an accident or suffer a loss, you will not be able to make a claim on your policy.

In addition, you may be liable for any costs incurred in relation to the accident or loss. This includes the cost of repairs, the cost of any medical treatment and the cost of any legal fees associated with the claim.

You may also be liable for any costs incurred in relation to the cancellation of your policy. This includes the cost of any cancellation fees and the cost of any outstanding premiums.

How Do You Cancel Your Be Wiser Car Insurance Policy?

You can cancel your Be Wiser car insurance policy by contacting Be Wiser directly. You can do this by phone, email or post.

When you contact Be Wiser to cancel your policy, you will need to provide your policy number and the date on which you want the policy to be cancelled.

Be Wiser will then cancel the policy and inform you of any cancellation fees or unpaid premiums that you may be liable for.

Conclusion

The Be Wiser Car Insurance Cancellation Policy outlines the process and consequences of cancelling a policy. It is important to understand the policy before making a decision to cancel your policy.

Be Wiser provides a range of car insurance policies and excellent customer service. If you are looking for a competitively priced policy with comprehensive cover, Be Wiser may be the right choice for you.

Car Insurance from Be Wiser - YouTube

Bewiser Car Insurance | bewisercarinsurance

Tail Coverage Insurance Example References - Galeries

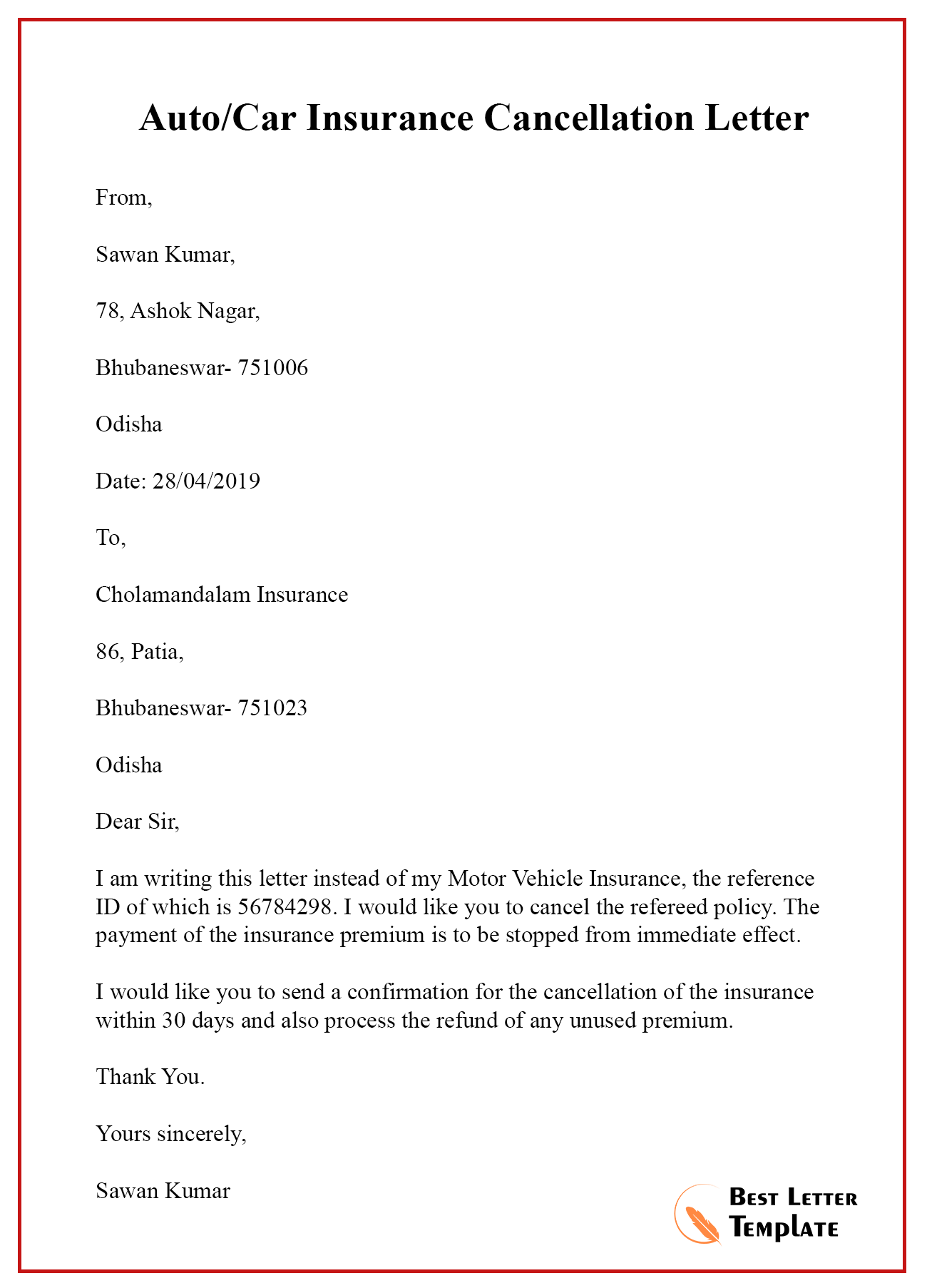

Sample Car Insurance Cancellation Letter | Auto Insurance Letter

Insurance Cancellation Letter Template - Format Sample & Example (2022)