Average Price 3rd Party Car Insurance

Average Price of 3rd Party Car Insurance

What is 3rd Party Car Insurance?

Third-party car insurance is a type of auto insurance that protects you from any legal liability when you are at fault for an accident that causes damage or injury to another person’s property or person. It is the minimum level of car insurance coverage that is legally required in most parts of the world. Third-party car insurance does not provide coverage for damage to your own vehicle or any other property.

What Does 3rd Party Car Insurance Cover?

Third-party car insurance covers the cost of any damage or injury you cause to another person’s property or person. This includes medical expenses, repair costs and legal bills. It also covers the cost of any legal action taken against you. It does not cover damage to your own vehicle or any other property.

What is the Average Price of 3rd Party Car Insurance?

The average price of third-party car insurance varies depending on a number of factors, including the type of car you drive, your driving record, and the amount of coverage you purchase. In general, the average cost of third-party car insurance is significantly lower than the cost of comprehensive car insurance. On average, third-party insurance can cost anywhere from $50 to $100 per month.

What Determines the Cost of 3rd Party Car Insurance?

The cost of third-party car insurance is determined by the type of car you drive, the amount of coverage you purchase, and your driving record. Other factors that can affect the cost of third-party car insurance include your age, gender, and location. Insurance companies also take into account the type of car you drive and its safety features when calculating premiums.

How to Lower Your 3rd Party Car Insurance Premium?

There are a few ways to lower your third-party car insurance premium. One way is to increase your deductible. This means that you will pay more out-of-pocket in the event of an accident, but your monthly premiums will be lower. You can also take advantage of discounts offered by insurance companies, such as good driver discounts, multi-car discounts, and loyalty discounts.

Conclusion

Third-party car insurance is an important form of auto insurance that protects you from any legal liability when you are at fault for an accident. The average cost of third-party insurance can range from $50 to $100 per month, depending on a number of factors. There are a few ways to lower your car insurance premium, such as increasing your deductible or taking advantage of discounts offered by insurance companies.

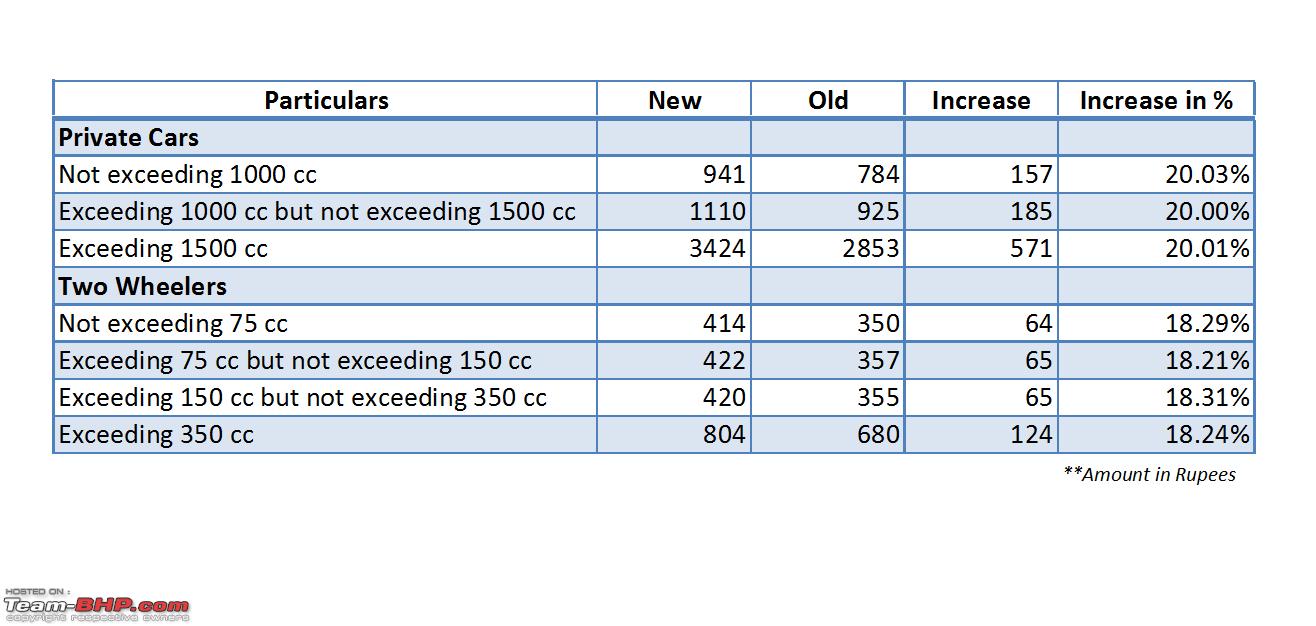

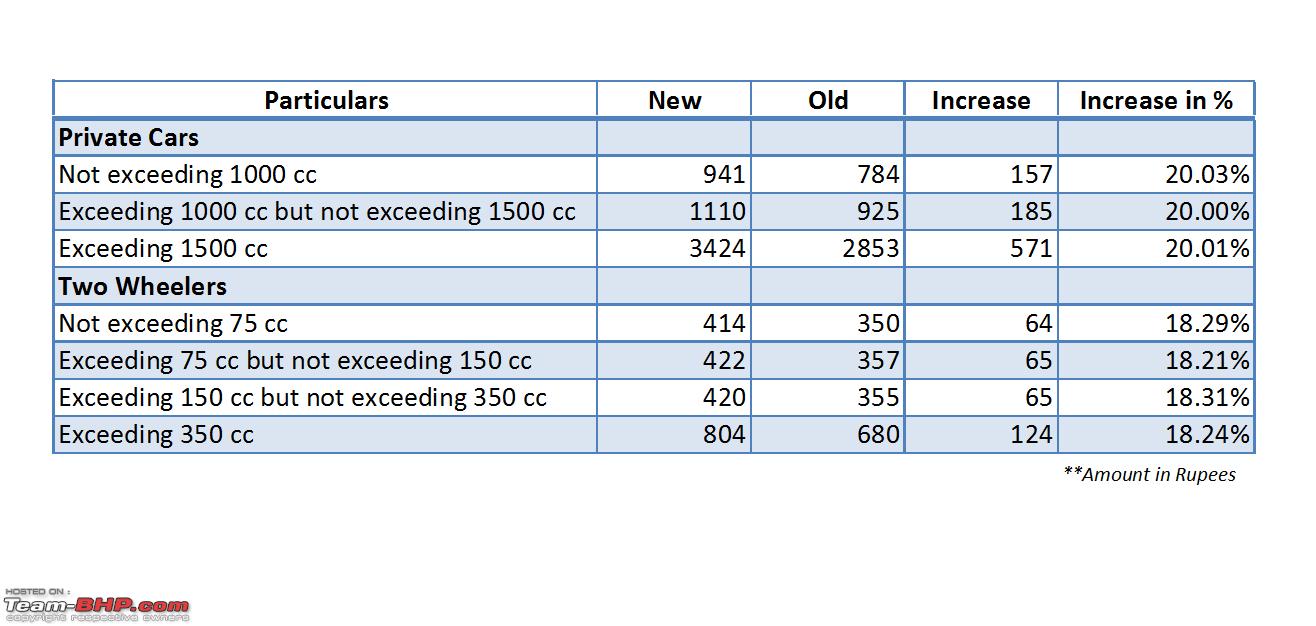

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Insurance Price Uae - akuapprovesing

3rd Party Car Insurance Price - Automative Schooling

SC: Long-term 3rd party insurance a must for cars & bikes at the time

Third Party Vs Comprehensive Car Insurance Policy | Which is Better