Average Car Insurance Cost In Las Vegas

Average Car Insurance Cost In Las Vegas

Introduction

Las Vegas is known for its bright lights and exciting nightlife, but the city is also known for its car insurance rates. In fact, Nevada is the sixth most expensive state for car insurance. The average cost of auto insurance in Las Vegas can range from $1,200 to $2,000 a year, depending on your driving record, age, and other factors.

Car insurance is a necessity for Las Vegas residents, especially if you own a car. But with so many different companies offering various coverage options, it can be difficult to choose the right policy. To make the process easier, it’s important to understand the average cost of car insurance in Las Vegas and the factors that can affect your rate.

Factors That Affect Your Rate

Your age, driving record, type of vehicle, and credit score are all factors that can affect your car insurance rate in Las Vegas. Younger drivers typically pay higher rates due to their inexperience on the road, but rates for older drivers can also be high based on their driving record. The type of vehicle you drive can also affect your rate, with luxury and sports cars typically costing more to insure. Finally, your credit score can also have an impact on your rate, with lower scores typically leading to higher rates.

Minimum Coverage Requirements

In Nevada, drivers are required to have minimum car insurance coverage in order to drive legally. This includes liability coverage, which covers any damage you may cause to another vehicle in an accident, and uninsured/underinsured motorist coverage, which covers any damage caused by an uninsured or underinsured driver. The minimum liability coverage requirements are 15/30/10, which means you must have coverage of at least $15,000 for bodily injury per person, $30,000 for total bodily injury, and $10,000 for property damage.

Discounts

Las Vegas drivers can qualify for a variety of discounts on their car insurance, some of which can significantly reduce their premiums. For example, if you’re a good driver with a clean driving record, you may qualify for a good driver discount. If you’re a student, you may qualify for a student discount. And if you’re a member of certain organizations or groups, you may qualify for a discount as well.

Average Cost of Car Insurance in Las Vegas

The average cost of car insurance in Las Vegas is between $1,200 and $2,000 a year, depending on your age, driving record, and other factors. But the cost can vary significantly from one company to the next, so it’s important to shop around and compare rates to get the best deal.

Conclusion

The cost of car insurance in Las Vegas can be high, but there are ways to save. Shopping around and comparing rates is the best way to find the best deal, and qualifying for discounts can also help reduce your premiums. Ultimately, it’s important to understand the average cost of car insurance in Las Vegas and the factors that can affect your rate so you can make an informed decision.

I want to make Article for seo perpouse and ranking on google search engine. Create a news blog article about Average Car Insurance Cost In Las Vegas, in relaxed English. The article consists of at least 6 paragraphs. Every paragraphs must have a minimum 200 words. Create in html file form without html and body tag. first title using

tag. sub title using and tags. Paragraphs must use

tags. Paragraphs must use

tags.

Average Car Insurance Cost In Las Vegas

Introduction

Las Vegas is known around the world as a city of bright lights and exciting nightlife, but one thing that many people don’t know is that car insurance rates in the city can be quite high. In fact, Nevada is considered the sixth most expensive state in the country when it comes to car insurance. The average cost of car insurance in Las Vegas can range from around $1,200 to $2,000 a year, depending on a variety of factors including your driving record, age, and type of vehicle.

For Las Vegas drivers, car insurance is a must. But with so many different companies offering various coverage options, it can be difficult to choose the right policy. To make the process easier, it’s important to understand the average cost of car insurance in Las Vegas and the factors that can affect your rate.

Factors That Affect Your Rate

Your age, driving record, type of vehicle, and credit score are all factors that can affect your car insurance rate in Las Vegas. Younger drivers typically pay higher rates due to their inexperience on the road, but rates for older drivers can also be high based on their driving record. The type of vehicle you drive can also affect your rate, with luxury and sports cars typically costing more to insure. Finally, your credit score can also have an impact on your rate, with lower scores typically leading to higher rates.

Minimum Coverage Requirements

In Nevada, drivers are required to have minimum car insurance coverage in order to drive legally. This includes liability coverage, which covers any damage you may cause to another vehicle in an accident, and uninsured/underinsured motorist coverage, which covers any damage caused by an uninsured or underinsured driver. The minimum liability coverage requirements are 15/30/10, which means you must have coverage of at least $15,000 for bodily injury per person, $30,000 for total bodily injury, and $10,000 for property damage.

Discounts

Las Vegas drivers can qualify for a variety of discounts on their car insurance, some of which can significantly reduce their premiums. For example, if you’re a good driver with a clean driving record, you may qualify for a good driver discount. If you’re a student, you may qualify for a student discount. And if you’re a member of certain organizations or groups, you may qualify for a discount as well.

Average Cost of Car Insurance in Las Vegas

The average cost of car insurance in Las Vegas is between $1,200 and $2,000 a year, depending on your age, driving record, and other factors. But the cost can vary significantly from one company to the next, so it’s important to shop around and compare rates to get the best deal.

Conclusion

The cost of car insurance in Las Vegas can be high, but there are ways to save. Shopping around and comparing rates is the best way to find the best deal, and qualifying for discounts can also help reduce your premiums. Ultimately, it’s important to understand the average cost of car insurance in Las Vegas and the factors that can affect your rate so you can make an informed decision.

Cheap Car Insurance in Las Vegas

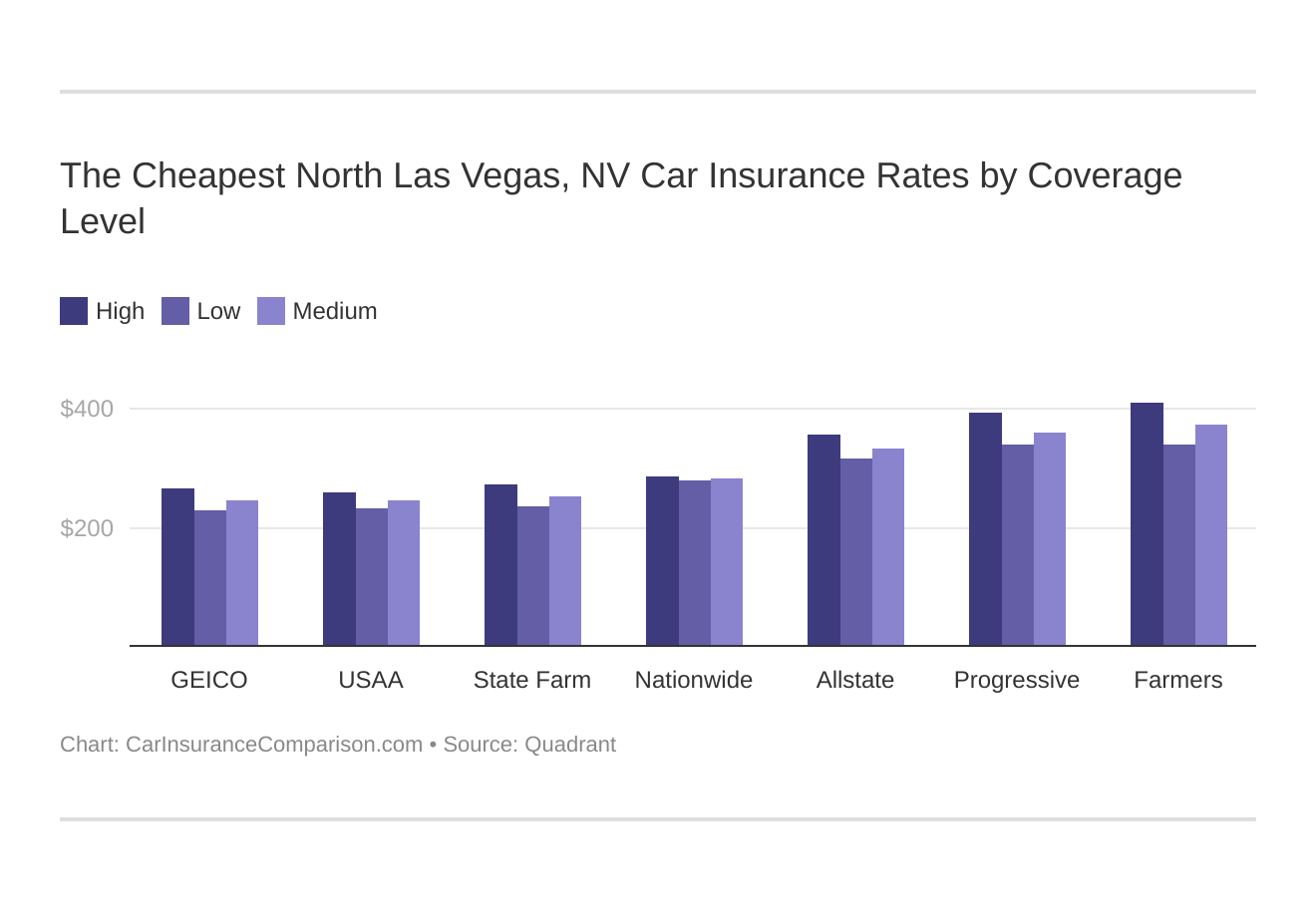

Car Insurance in North Las Vegas

The average cost of car insurance in the US, from coast to coast

Common Automobile Insurance coverage Charges by Age and Gender

Nevada Car Insurance Cost for 2021 - Rates, Rankings, Comparisons