Who Offers The Best Gap Insurance

Tuesday, September 16, 2025

Edit

Who Offers The Best Gap Insurance?

Understanding Gap Insurance

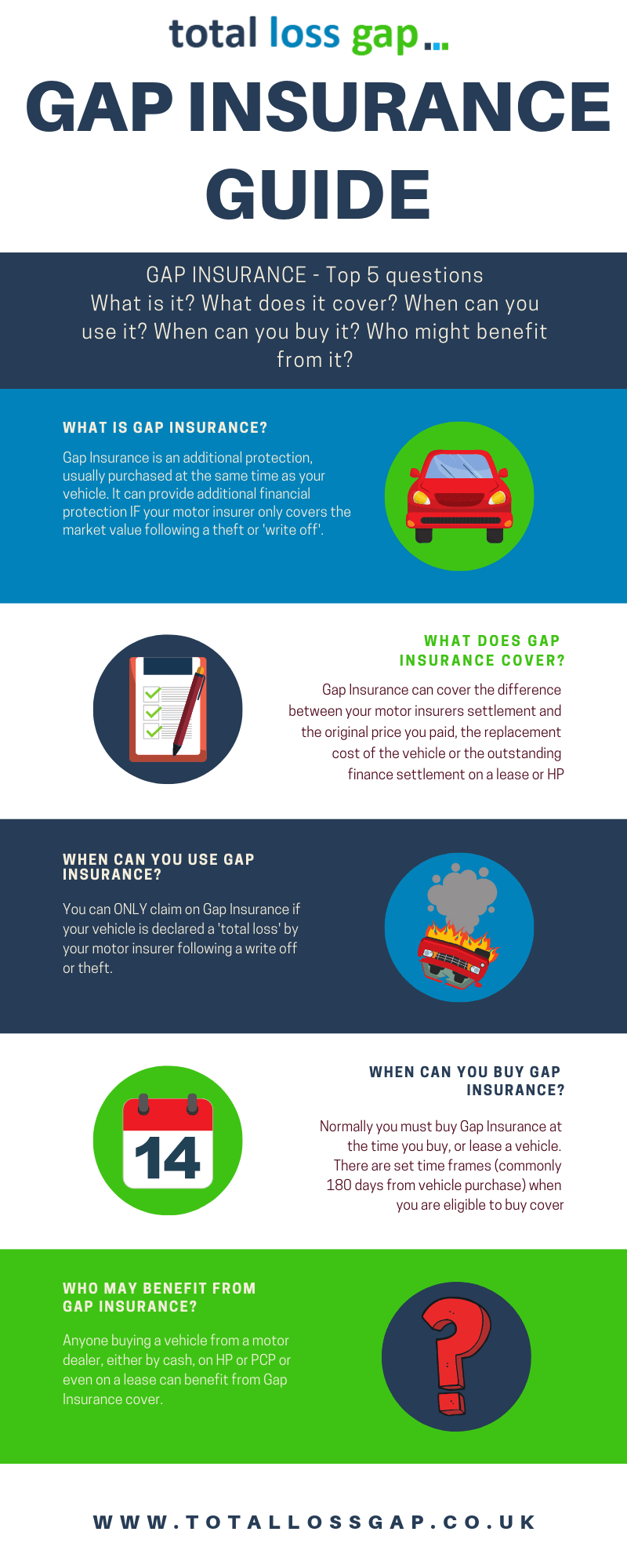

Gap insurance, also known as Guaranteed Asset Protection or Loan/Lease Payoff Coverage, is a type of coverage that can provide protection to drivers in the event of an accident. It is designed to help cover the difference between the amount of money owed on a loan or lease and the actual value of the vehicle in the event of a total loss. That way, you don't have to worry about being stuck with an expensive loan payment on a vehicle that you no longer have.

Gap insurance is typically available to drivers who have taken out a loan or lease on a new or used vehicle. It is important to note that if you are paying cash for a vehicle, you will not be eligible for Gap insurance. It is also important to note that Gap insurance is not the same as comprehensive or collision insurance, which are required in most states.

Who Offers The Best Gap Insurance?

When it comes to finding the best Gap insurance provider, it can be a bit tricky. Many insurance companies offer Gap insurance, but not all of them offer the same coverage or levels of protection. It is important to do your research and compare different providers to make sure you are getting the best coverage for your money.

One way to narrow down your search is to look for companies that specialize in Gap insurance. These companies typically offer more comprehensive coverage and may even offer additional benefits such as roadside assistance and car rental reimbursement.

It is also important to look for companies that offer competitive rates. You should also be aware of any additional fees that may be associated with the coverage.

Finally, it is important to make sure the company you choose has a good reputation and is backed by a reliable insurer. Be sure to read reviews and do your own research to make sure you are getting the best coverage for your money.

What to Look for in a Gap Insurance Provider

In addition to looking for a provider that offers competitive rates and comprehensive coverage, there are other things to consider when selecting a Gap insurance provider.

First, you should make sure the provider you choose offers a wide variety of coverage options. Different vehicles require different levels of coverage, so it is important to make sure the company you choose can provide the coverage you need.

It is also important to look for a provider that offers additional benefits such as roadside assistance and car rental reimbursement. These benefits can be incredibly helpful in the event of an accident and can provide peace of mind.

Finally, you should also look for a provider that has a good reputation and is backed by a reliable insurer. Doing your research and reading reviews can help you make sure you are choosing a reputable provider that can provide the coverage you need.

Conclusion

Gap insurance is an important type of coverage for drivers who have taken out a loan or lease on a new or used vehicle. It is designed to help cover the difference between the amount of money owed on a loan or lease and the actual value of the vehicle in the event of a total loss.

When it comes to finding the best Gap insurance provider, it is important to do your research and compare different providers to make sure you are getting the best coverage for your money. Look for companies that specialize in Gap insurance, offer competitive rates, provide a wide variety of coverage options, and have a good reputation. Doing your research and reading reviews can help you make sure you are choosing a reputable provider that can provide the coverage you need.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

GAP Insurance - Explained in a Complete Guide | TotalLossGap

Buying A Car Gap Insurance ~ designologer

Gap insurance – Is it worth it?

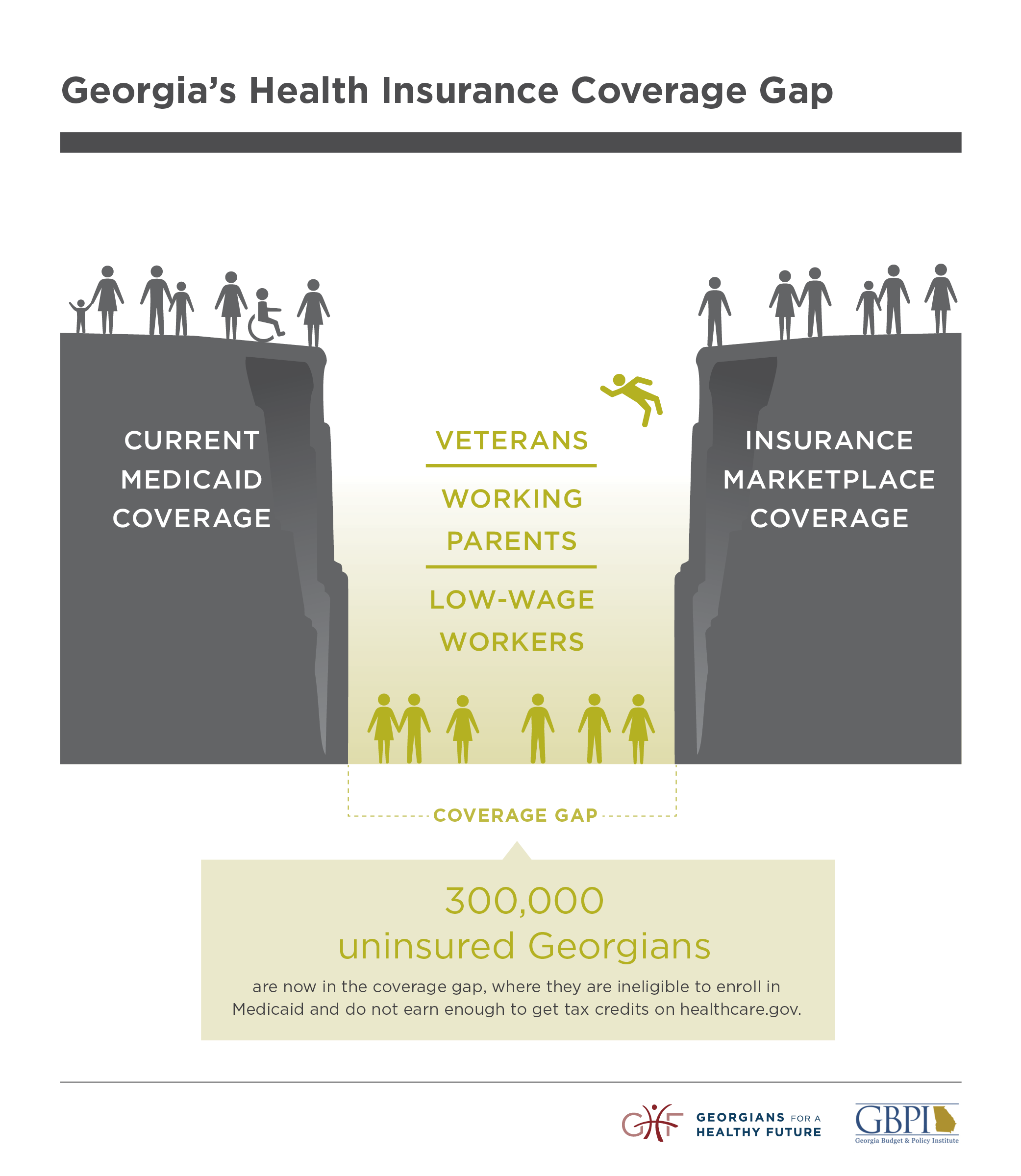

New illustrated Medicaid resource – Georgians for a Healthy Future