Third Party Insurance Claim Settlement

Third Party Insurance Claim Settlement: Everything You Need to Know

What is Third Party Insurance Claim Settlement?

Third party insurance claim settlement is a process wherein an insurance company pays out a claim on behalf of an insured party, who is the third party. In the case of an accident, the insurance company pays out the claim to the injured party. This type of claim settlement is usually done in cases of accidents involving vehicles, but can also apply to other types of claims. The claim can be paid out either through an out-of-court settlement or through a court of law.

Why is Third Party Insurance Claim Settlement Important?

Third party insurance claim settlement is important because it provides a way for the insured party to receive compensation for any losses or damages that they may have incurred. In the case of an accident, the insurance company will pay out a claim to the injured party. This not only provides them with the financial assistance they need during a difficult time, but it also helps to ensure that justice is served. Without this type of settlement, the injured party may not be able to receive the financial compensation they deserve.

Who Is Eligible for Third Party Insurance Claim Settlement?

In order to be eligible for third party insurance claim settlement, the insured party must be the owner of the vehicle involved in the accident. They must also prove that the other party is at fault for the accident, and that the accident caused the insured party to suffer damages. The insured party must also be able to provide proof of their losses, such as medical bills or property damage. Furthermore, the insured party must also have proof of insurance coverage.

How Does Third Party Insurance Claim Settlement Work?

Once the insured party has provided the necessary documents, the insurance company will assess the claim and determine the amount of compensation that should be paid out. If the claim is accepted, the insurance company will then contact the other party to negotiate a fair settlement. Once the settlement has been agreed upon, the insurance company will pay out the claim. In some cases, the settlement may be paid in one lump sum or in several installments.

What Are the Benefits of Third Party Insurance Claim Settlement?

The benefit of third party insurance claim settlement is that it provides a way for the insured party to receive the financial compensation they deserve for any losses or damages suffered due to an accident. This type of claim settlement also helps to ensure that justice is served, as the other party is held responsible for their actions. Furthermore, the settlement process can often be completed quickly and without the need to go to court.

Conclusion

Third party insurance claim settlement is an important process that helps to ensure that justice is served and that the insured party is able to receive the financial compensation they deserve. In order to be eligible for this type of claim, the insured party must prove that the other party is at fault and that they have suffered losses or damages due to the accident. Once all of the necessary documents have been provided, the insurance company will assess the claim and determine the amount of compensation that should be paid out. This type of claim settlement can provide the insured party with the financial assistance they need during a difficult time.

Third Party Claim Form - Fill Online, Printable, Fillable, Blank

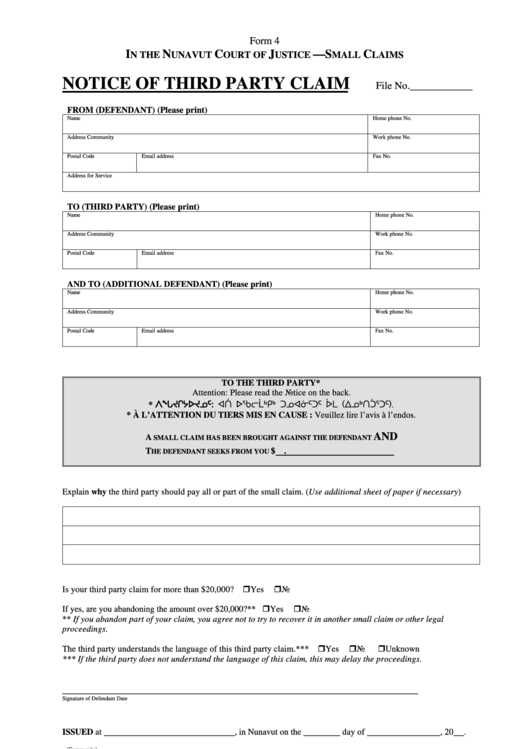

Form 4 - Notice Of Third Party Claim printable pdf download

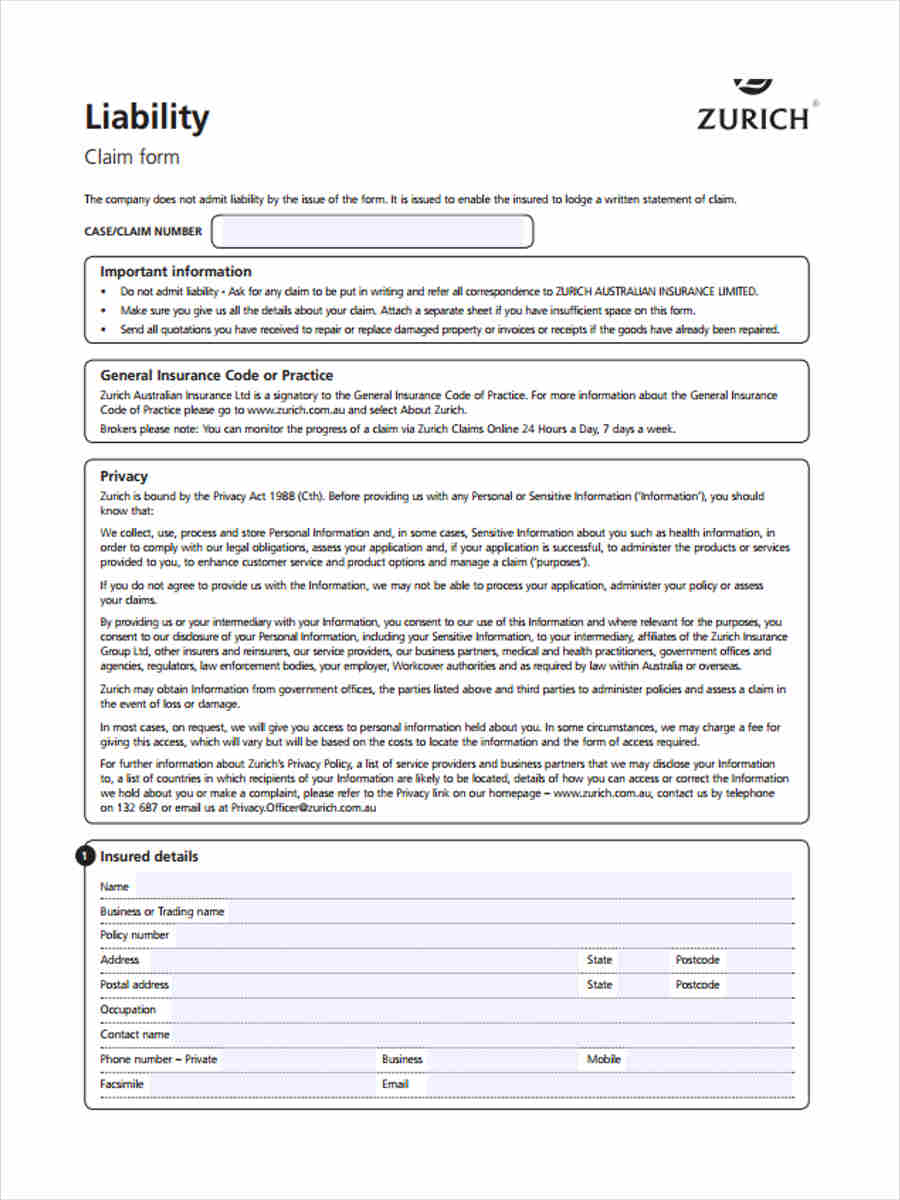

FREE 5+ Third Party Liability Forms in PDF

Third Party Property Car Insurance | iSelect

Third Party Two Wheeler Insurance Claim