State Farm Insurance Liability Coverage

Everything You Need to Know About State Farm Insurance Liability Coverage

What is State Farm Insurance Liability Coverage?

State Farm Insurance Liability Coverage is an insurance policy that helps protect you against losses that you may incur as a result of an accident or other incident. It is an important type of insurance that is required in many states in order to legally operate a motor vehicle. State Farm Insurance Liability Coverage provides protection for bodily injury and property damage that you may cause to another person or their property, as well as legal defense costs in the event that you are sued. This type of coverage is also known as “Third-Party Liability”.

What Does State Farm Insurance Liability Coverage Include?

State Farm Insurance Liability Coverage includes both Bodily Injury Liability and Property Damage Liability. Bodily Injury Liability pays for medical expenses, lost wages, and other costs that may arise due to an injury caused by you to another person. Property Damage Liability pays for damage that you cause to another person’s property. This includes automobiles, buildings, fences, and other property owned by the injured party. Additionally, State Farm Insurance Liability Coverage includes coverage for legal defense costs in the event that you are sued.

What are the Benefits of State Farm Insurance Liability Coverage?

The primary benefit of State Farm Insurance Liability Coverage is that it helps protect you from the financial losses that may arise due to an accident or other incident. This type of coverage is especially important if you are found to be at fault for an accident, as it will help cover the costs of any damages that you may cause. Additionally, it can help cover legal defense costs in the event that you are sued. This type of coverage is also important if you are involved in an incident that results in damage to another person’s property, as it will help cover the costs of repairing or replacing the property.

How Much Does State Farm Insurance Liability Coverage Cost?

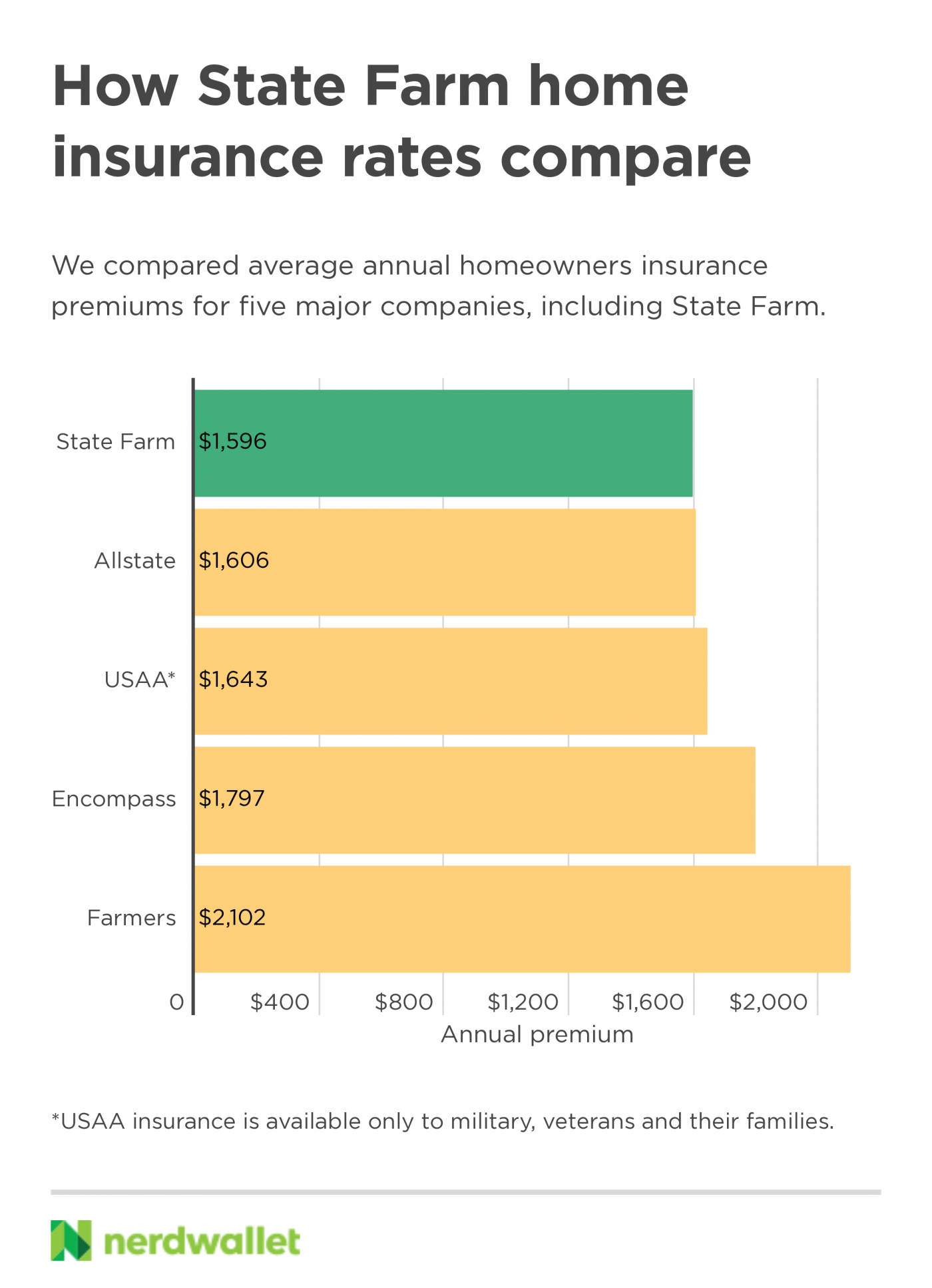

The cost of State Farm Insurance Liability Coverage will depend on a variety of factors, such as your age, driving record, and the type of vehicle that you own. Generally, the cost of this type of coverage will be less expensive than other types of insurance coverage. It is important to shop around and compare different insurance policies in order to find the best deal on your State Farm Insurance Liability Coverage.

What are the Limitations of State Farm Insurance Liability Coverage?

State Farm Insurance Liability Coverage does not cover damages that you may cause to your own property. Additionally, it does not cover damages that are caused by an uninsured or underinsured driver. This type of coverage also does not cover punitive damages or the cost of repairing or replacing your own vehicle. In addition, it does not cover any medical expenses incurred by you as a result of an accident.

Conclusion

State Farm Insurance Liability Coverage is an important type of insurance that helps protect you from financial losses that may arise due to an accident or other incident. It is important to understand the coverage that is included in this type of policy in order to make sure that you are adequately protected. Additionally, it is important to compare different policies in order to find the best deal on your State Farm Insurance Liability Coverage.

How Does State Farm Rideshare Insurance Work?

State Farm Home Insurance Review 2021 - NerdWallet

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

State Farm Car Insurance PDF | Corporate Law | Insurance

State Farm General Liability Insurance For Contractors - blog.pricespin.net