Sr22 Insurance Without A Car

What is SR22 Insurance Without A Car?

SR22 insurance is a type of high-risk insurance that is required by the state for drivers who have been convicted of serious traffic violations. SR22 insurance is not a type of auto insurance, but rather a document that is filed with the state that verifies that the driver has taken out an auto insurance policy that meets the state’s minimum requirements. It is important to note that SR22 insurance is not a type of insurance that covers the vehicle, but rather it covers the driver of the vehicle.

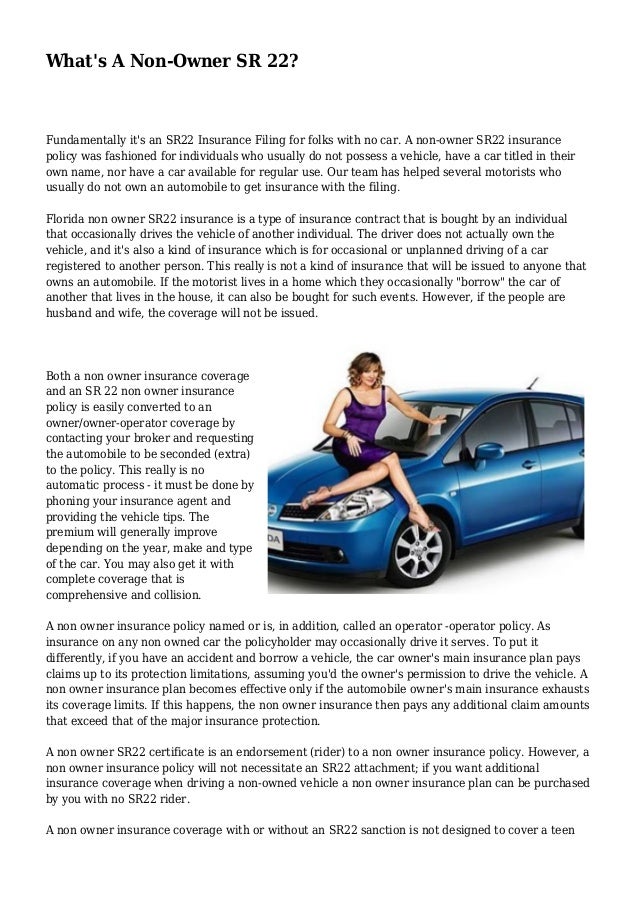

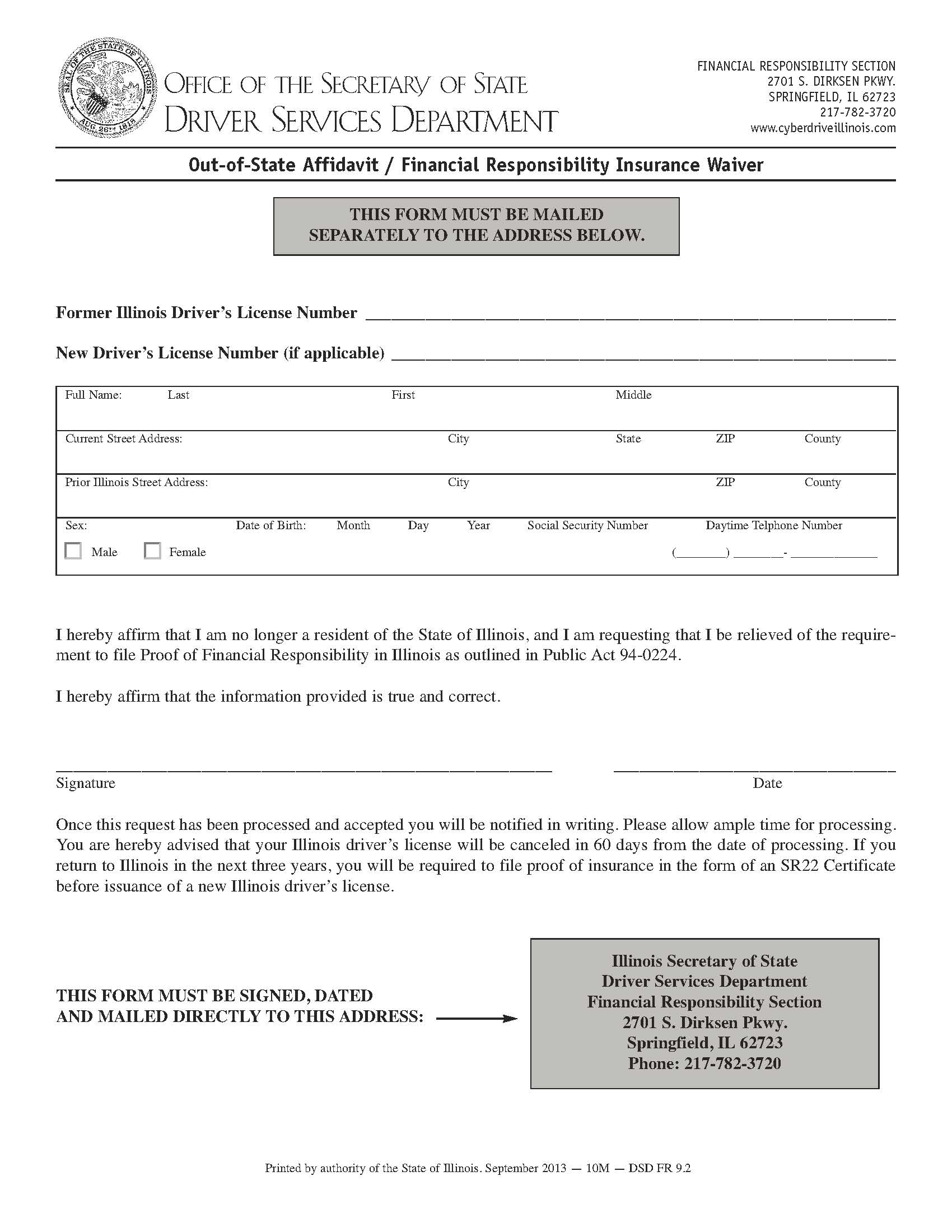

In some states, drivers may be required to carry SR22 insurance even if they do not own a vehicle. This is known as SR22 insurance without a car and is often required for drivers who have had their driver’s license suspended or revoked due to a serious traffic violation. The SR22 document is filed with the state in order to verify that the driver has taken out a policy that meets the state’s minimum requirements, even if the driver does not own a vehicle.

Who Needs SR22 Insurance Without A Car?

SR22 insurance without a car is generally required for drivers who have had their driver’s license suspended or revoked due to serious traffic violations such as DUI, reckless driving, or driving without insurance. The SR22 document is filed with the state in order to verify the driver has taken out a policy that meets the state’s minimum requirements, even if the driver does not own a vehicle. Each state has different SR22 filing requirements, so it’s important to check with your state’s DMV to make sure you meet the requirements.

What Does SR22 Insurance Without A Car Cover?

SR22 insurance without a car covers the driver of a vehicle and not the vehicle itself. It is a document that is filed with the state that verifies that the driver has taken out an auto insurance policy that meets the state’s minimum requirements. It is important to note that SR22 insurance does not provide any financial protection if an accident were to occur – it only verifies that the driver has taken out a policy that meets the state’s minimum requirements.

How Much Does SR22 Insurance Without A Car Cost?

The cost of SR22 insurance without a car will vary depending on the state and the individual’s driving record. Generally, SR22 insurance without a car will be more expensive than a standard auto insurance policy due to the increased risk associated with the driver. It is important to shop around and compare rates from multiple insurance companies in order to find the most affordable option.

How Do I Get SR22 Insurance Without A Car?

The process of getting SR22 insurance without a car is relatively simple. First, you should contact your state’s DMV to make sure you meet the requirements for filing an SR22 document. Then, contact your auto insurance company or a specialty insurance company to get a quote for SR22 insurance without a car. Once you have a quote, you can purchase the policy and the insurance company will file the SR22 document with the state.

What's A Non-Owner SR 22?

Sr22 Insurance Without A Vehicle / How To Get Cheap SR22 Insurance

Sr22 Insurance Without A Vehicle / How To Get Cheap SR22 Insurance

What is SR 22 Insurance? | Ogletree Financial

Illinois SR22 Insurance Quotes - YouTube