Multi Car Insurance Policy Tesco

Everything You Need to Know About Multi Car Insurance Policy Tesco

What is Multi Car Insurance?

Multi car insurance (MCI) is a type of insurance plan that covers multiple vehicles under a single policy. It provides coverage for both the vehicles and the drivers, and is usually cheaper than buying separate policies for each vehicle. With multi car insurance, you can have one policy for two or more vehicles and save money. The coverage is the same as if you bought separate policies for each vehicle, but with the added benefit of a discount for having multiple vehicles insured. It can also provide peace of mind that if something happens to one of the vehicles, the other will be covered as well.

What are the Benefits of Multi Car Insurance?

The main benefit of multi car insurance is that it can save you money. By having multiple vehicles covered under one policy, you may be eligible for discounts that would not be available if you had separate policies for each vehicle. You can also enjoy the convenience of having all of your vehicles covered under one policy, so you don’t have to worry about managing multiple policies. Additionally, multi car insurance can provide peace of mind that all of your vehicles are adequately covered in the event of an accident.

How Much Does Multi Car Insurance Cost?

The cost of multi car insurance depends on a variety of factors. The most important factor is the type of coverage you choose. Other factors that can affect the cost of your policy include the age of the drivers, the make and model of the vehicles, any driving convictions, and the amount of coverage you choose. Generally, the more drivers and vehicles that are covered under the policy, the higher the cost of the policy will be. It is important to compare different policies and providers to find the best deal.

What is Tesco Multi Car Insurance?

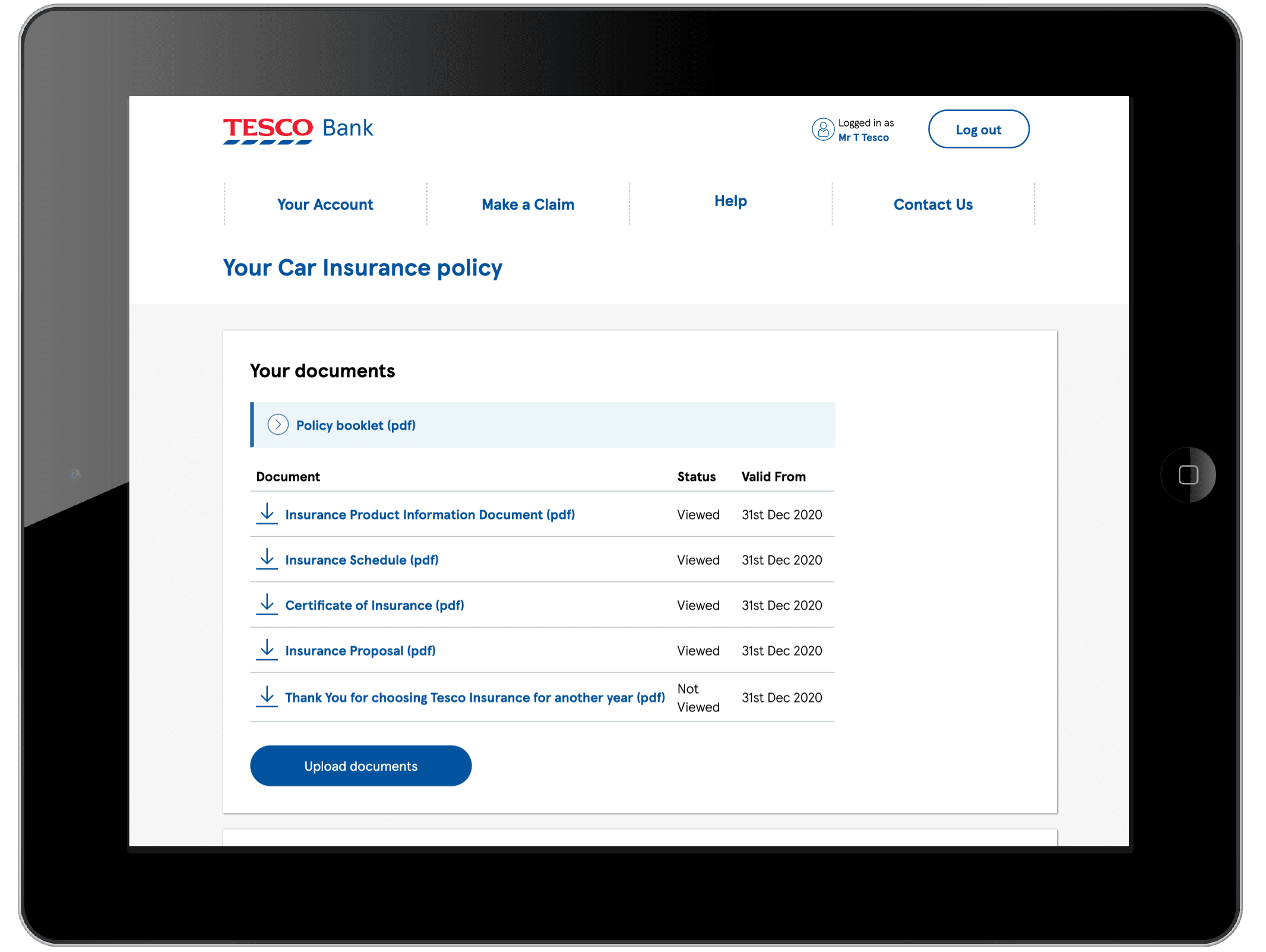

Tesco Multi Car Insurance is a type of policy offered by Tesco Bank. It is designed to cover two or more vehicles under one policy. It provides the same level of coverage as separate policies for each vehicle, but at a discounted rate. It also provides peace of mind that all of the vehicles will be properly covered in the event of an accident. Tesco Multi Car Insurance also offers additional benefits such as a no-claims discount, windscreen cover, and breakdown cover.

How Much Does Tesco Multi Car Insurance Cost?

The cost of Tesco Multi Car Insurance will depend on a variety of factors, such as the type of coverage you choose, the age of the drivers, the make and model of the vehicles, any driving convictions, and the amount of coverage you choose. Generally, the more drivers and vehicles that are covered under the policy, the higher the cost of the policy will be. However, Tesco Multi Car Insurance can be cheaper than buying separate policies for each vehicle, so it is always worth comparing different policies and providers to find the best deal.

Conclusion

Multi car insurance is a great way to save money on insurance for multiple vehicles. Tesco Multi Car Insurance is a type of policy offered by Tesco Bank that provides coverage for two or more vehicles under one policy. The cost of the policy will depend on a variety of factors, but it is usually cheaper than buying separate policies for each vehicle. It is important to compare different policies and providers to find the best deal.

Tesco car insurance contact numbers by Phone Number Customer Service

Tesco Box Car Insurance Number : Tesco Joins The Digital Receipt

Tesco Bank Car Insurance Discount Codes, Sales & Cashback Offers

+28 Search Car Insurance Policy Number Ideas - car insurance

Tesco Motor Insurance - dsigns