Low Cost Oklahoma Auto Insurance

Low Cost Oklahoma Auto Insurance

Finding Affordable Car Insurance in Oklahoma

Drivers in Oklahoma are always looking for ways to save on car insurance. With rising costs, it is important to find the best rate possible, but it is also important to make sure that you are getting the right coverage for the right price. Fortunately, there are some great ways to find a low cost Oklahoma auto insurance policy that is right for you.

Know Your Options

The first step in finding the right car insurance policy is to know your options. There are many different types of auto insurance policies available, from basic liability coverage to comprehensive coverage. Knowing which type of coverage is right for you is essential in finding the best rate. Many insurance companies offer discounts for certain types of coverage, so it is important to know what is available.

Research the Companies

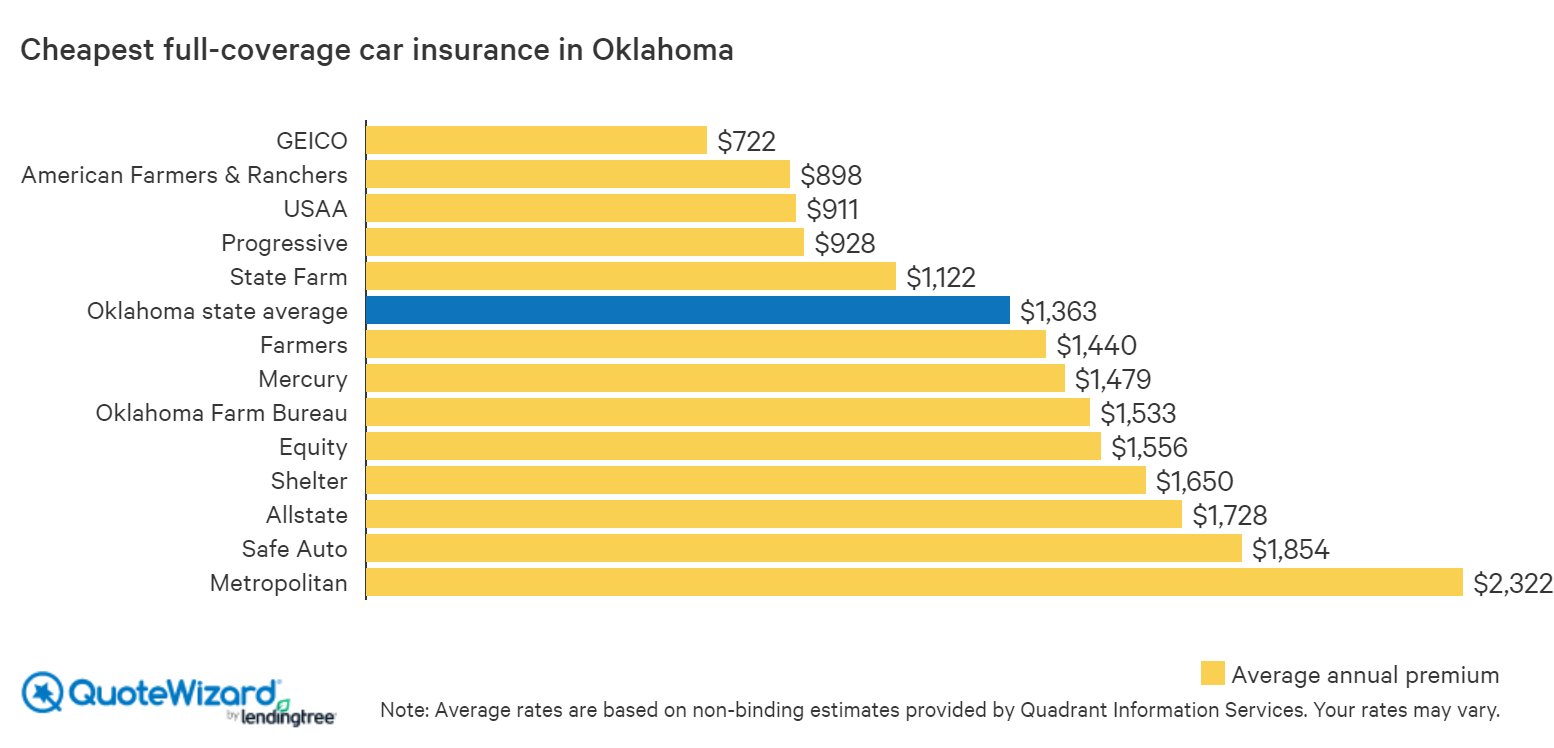

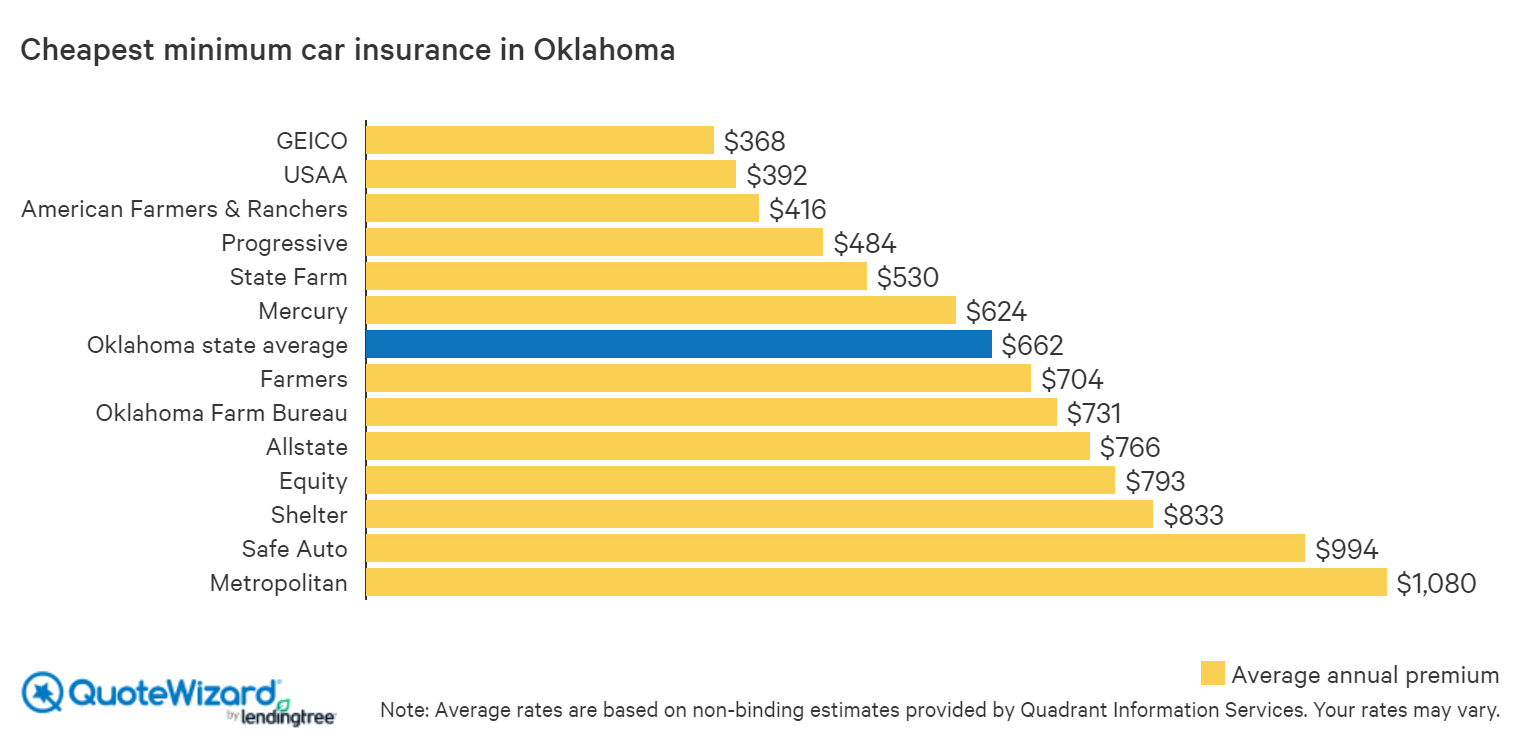

Once you know what type of coverage you need, it is important to research the different insurance companies in Oklahoma. Find out what their rates are, their customer service ratings, and any discounts they may offer. Doing your homework can help you find the best rate and coverage for your needs.

Shop Around

Once you know what type of coverage you need and which companies you are considering, it is time to start shopping around. Compare the rates and coverage of different companies and make sure you are getting the best deal. Don't forget to ask about any discounts you may be eligible for, such as good driver discounts or safe driver discounts. Also, be sure to ask about any additional services or benefits that may be available, such as roadside assistance or rental car coverage.

Check Your Credit Score

Your credit score can have a major impact on your car insurance rates. Insurance companies use your credit score to determine your risk level, so it is important to check your credit score before applying for a policy. If your credit score is low, you may be able to find a better rate by raising your credit score.

Review Your Policy

Once you have found a policy that fits your needs, it is important to review the policy to make sure it is the right one for you. Make sure you understand the coverage and any exclusions, and read the policy thoroughly. This will help ensure that you are getting the coverage you need at the best rate possible.

Finding a low cost Oklahoma auto insurance policy is possible. With a little research and some shopping around, you can find the policy that is right for you and your budget. Take the time to understand your options and shop around to find the best rate and coverage for your needs.

Cheap Car Insurance in Oklahoma City - Auto Insurance Agency by Ben

Buy Cheap Car Insurance in Oklahoma | QuoteWizard

Who Has The Cheapest Auto Insurance Quotes in Tulsa, OK? - ValuePenguin

Buy Cheap Car Insurance in Oklahoma | QuoteWizard

Low Cost Insurance Cars - Batam Info