Low Cost Full Coverage Car Insurance

Low Cost Full Coverage Car Insurance

Finding The Cheapest Full Coverage

Finding the cheapest full coverage car insurance can be a daunting task. With so many variables, it can be hard to decide which type of coverage is right for you. It’s important to understand that full coverage car insurance is more expensive than basic liability coverage, but it also provides more protection. Full coverage car insurance typically includes comprehensive, collision, and liability coverage. Every driver should consider the benefits of full coverage to determine if it is worth the extra cost. Purchasing full coverage car insurance can give you peace of mind and financial protection in the event of an accident.

Tips for Finding the Cheapest Full Coverage

There are a few tips you can use to help you find the cheapest full coverage car insurance. First, shop around and compare rates from different insurance companies. This will help you find the best rate. You should also consider raising your deductible. The higher your deductible, the lower your premium payments will be. Additionally, you may be able to save money by bundling your car insurance with other policies such as homeowners or renters insurance. Finally, some insurance companies offer discounts if you have a good driving record or if you have taken a defensive driving course.

The Benefits of Low Cost Full Coverage

Low cost full coverage car insurance offers several benefits. One of the main benefits is that it provides financial protection if you are involved in an accident. Full coverage car insurance will pay for repairs to your vehicle, as well as any property damage or bodily injury you may cause. Additionally, it can provide coverage for any medical costs you may incur. This type of coverage is also beneficial if you are in an accident and the other party does not have insurance. Finally, having full coverage car insurance can protect you from the financial devastation of an accident.

Factors That Affect Your Premiums

There are several factors that can affect your premiums for low cost full coverage car insurance. Your age, gender, driving record, and the type of car you drive can all affect your premiums. Additionally, the amount of coverage you purchase and the deductible you choose will have an impact on your premiums. Finally, the insurance company you choose and the discounts they offer can also affect your premiums.

Low Cost Full Coverage Is an Investment

Low cost full coverage car insurance is an investment in your financial security. It can provide you with the peace of mind of knowing that you are covered if you are involved in an accident. It can also save you money in the long run, as it will pay for any repairs or medical costs you may incur. With so many variables to consider, shopping around for the best rate is essential. Taking the time to compare rates and discounts from different insurance companies is the best way to find the cheapest full coverage car insurance.

Low Cost Full Coverage Auto Insurance with Cheapest Rates

Full coverage car insurance in california by Promax Insurance Agency

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

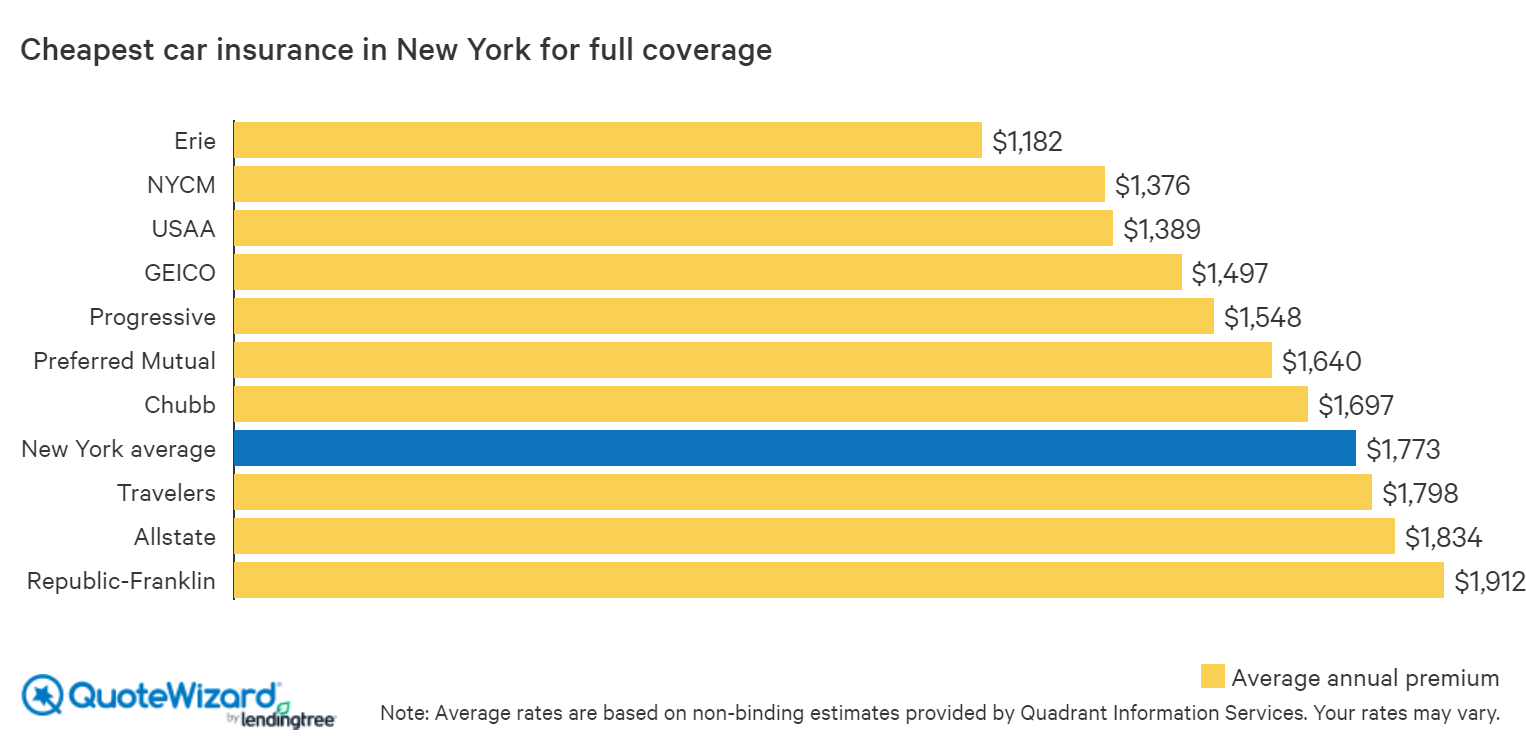

The Cheapest Car Insurance in New York | QuoteWizard