How To Add Sr22 To Geico

Monday, September 8, 2025

Edit

How To Add Sr22 To Geico

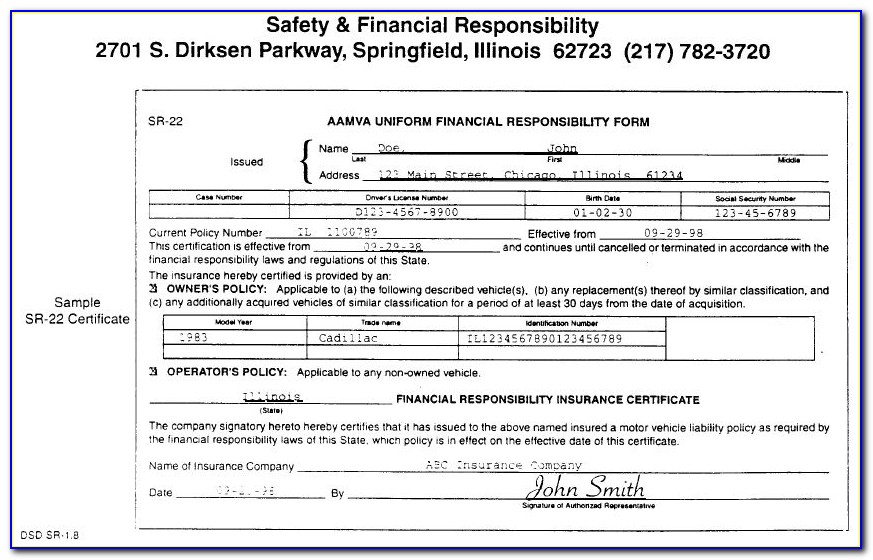

What is an SR-22?

An SR-22 is a form of auto insurance that is required by some states for drivers who have been arrested for Driving Under the Influence (DUI) or Driving While Intoxicated (DWI). The SR-22 is a certificate of financial responsibility that must be filed with the state in order to reinstate the drivers license. It is also required for drivers that have had their license suspended or revoked due to a serious moving violation like reckless driving. The SR-22 form is a contract between an insurance company and the state that the driver will maintain the required minimum liability insurance for a specified period of time.

What is Geico?

Geico is one of the largest auto insurance companies in the United States. It has been providing insurance for more than 75 years, and it is well known for its low rates and great customer service. Geico offers a wide range of insurance policies, including SR-22 coverage. Geico's SR-22 policies provide the required minimum liability coverage and the peace of mind that comes with being insured by a trusted and reliable company.

How Do I Add SR-22 Coverage To Geico?

Adding SR-22 coverage to Geico is a simple process. First, you will need to contact a Geico representative and provide them with the required information. This includes your full name, date of birth, Social Security number, and driver's license number. You will also need to provide them with information about the incident that led to the need for the SR-22. Once the Geico representative has all of the information, they will be able to provide you with a quote for your SR-22 coverage.

What Does SR-22 Coverage Include?

SR-22 coverage from Geico includes the required minimum liability coverage for the state in which you are filing the SR-22. This includes Bodily Injury Liability and Property Damage Liability. Bodily Injury Liability covers injuries to other people caused by you or your vehicle. Property Damage Liability covers damage to someone else's property caused by you or your vehicle. Geico also offers additional coverage options that can be added to your SR-22 policy, such as Comprehensive coverage, Collision coverage, and Uninsured/Underinsured Motorist coverage.

What Are The Benefits Of Geico's SR-22 Coverage?

Geico's SR-22 coverage offers several benefits. First, it is backed by a trusted and reliable company. Geico has a long history of providing quality auto insurance coverage, and it is well known for its low rates and great customer service. In addition, Geico offers a wide range of coverage options, so you can customize your policy to meet your specific needs. Finally, Geico offers discounts for safe drivers, which can help you save money on your SR-22 coverage.

Conclusion

Adding SR-22 coverage to Geico is a simple process. Geico is a trusted and reliable company that provides great customer service and low rates. They also offer a wide range of coverage options, so you can customize your policy to meet your specific needs. Geico also offers discounts for safe drivers, which can help you save money on your SR-22 coverage. If you need SR-22 coverage, Geico is an excellent choice.

Sr22 insurance geico - insurance

Geico SR22 Insurance Review | Top Ten Reviews

Non Owner Car Insurance Geico Sr22 - Insurance Reference

Cirrus SR22 8000 series • Flight Simulator 2020

What Is A Sr22 Form - Form : Resume Examples #JxDNPLwON6