How Much Does Insurance Cost With Turo

How Much Does Insurance Cost With Turo?

What is Turo?

Turo is a car-sharing service that connects car owners with travelers looking to rent a vehicle for a few days or a few weeks. Through the Turo platform, car owners can rent out their vehicles to travelers, and travelers can rent cars from car owners. With Turo, travelers can find the perfect car to fit their needs, from luxury vehicles to practical family cars. It's an easy and convenient way to rent a car and make some extra cash for the car owner. But what about the insurance costs associated with Turo?

What Insurance Do You Need for Turo?

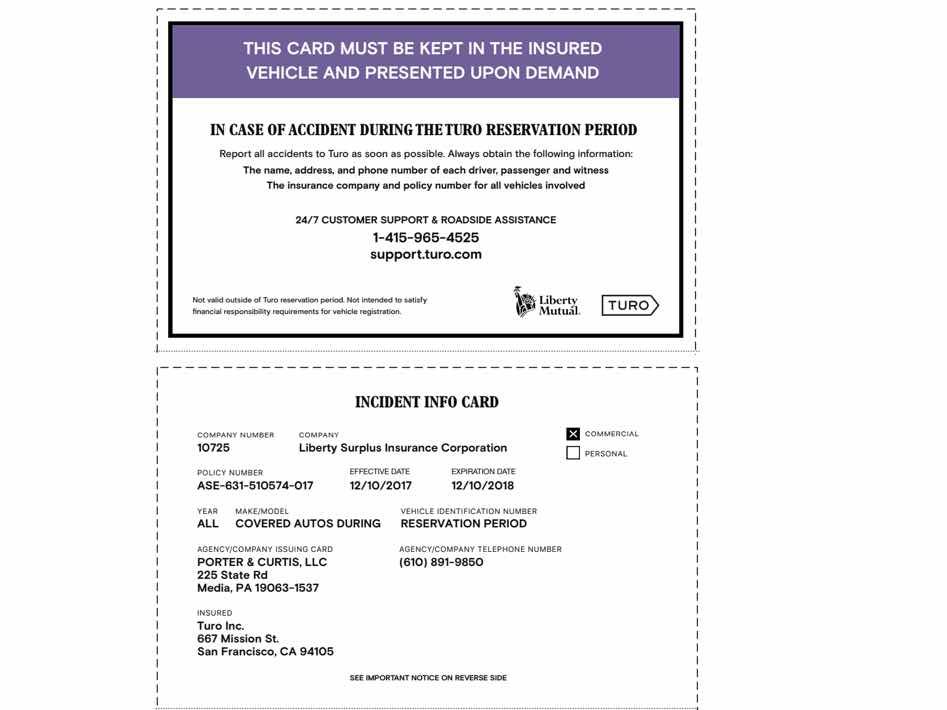

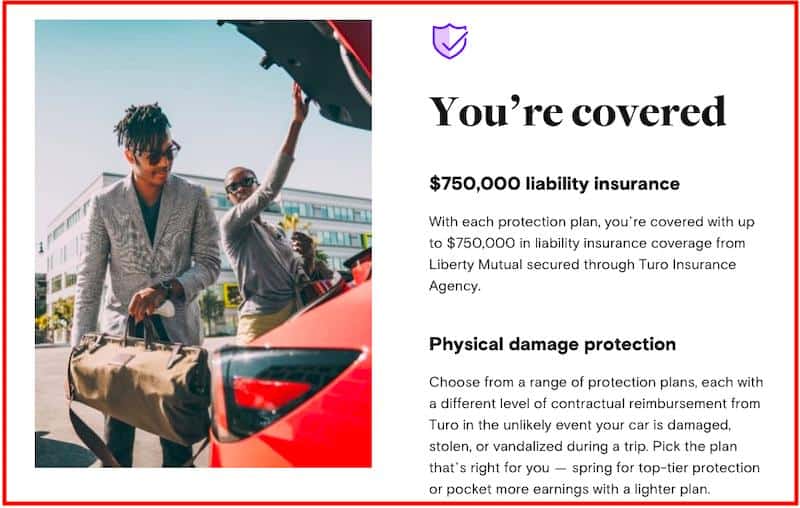

Turo provides insurance coverage for car owners and travelers. Turo's insurance coverage includes primary liability coverage and physical damage coverage. The primary liability coverage covers up to $1 million in damage to other cars and property, and up to $2 million in bodily injury protection. The physical damage coverage protects the owner's car, up to its actual cash value, in the event of a collision, theft, or vandalism. The owner's existing auto insurance will be the primary coverage, and the Turo insurance will be the secondary coverage.

What Does Insurance Cost With Turo?

The cost of insurance with Turo varies depending on the car and the traveler's location. In most cases, Turo charges a 20% fee for insurance coverage. This fee is added to the price of the rental and is included in the total cost of the trip. For example, if the rental car costs $200 per day, then the insurance fee would be $40 for the day. This fee is included in the total cost of the rental and is paid by the traveler.

Are There Any Other Fees?

In addition to the insurance fee, Turo also charges an additional fee for certain types of rentals. For example, if the car is rented for more than 28 days, then Turo will charge an additional $20 fee. Additionally, if the car is rented in a state that requires additional coverage, then Turo may charge an additional fee for that coverage. The additional fee will vary depending on the type of coverage and the state where the car is rented.

Do I Need to Buy Additional Insurance?

In most cases, the Turo insurance coverage is sufficient. However, if the traveler is planning on taking the car on a road trip or using it for commercial purposes, then they may need to purchase additional coverage. The additional coverage can be purchased through Turo, or through the traveler's own auto insurance provider. The additional coverage will provide greater protection in the event of an accident.

Conclusion

Renting a car with Turo is a great way to save money and get the perfect car for your needs. But it's important to understand the insurance costs associated with Turo. Turo provides primary liability and physical damage coverage, and in most cases, the insurance fee is included in the total cost of the rental. However, if the car is rented for more than 28 days, or if the car is rented in a state that requires additional coverage, then Turo may charge an additional fee. Additionally, travelers may need to purchase additional insurance coverage if they are taking the car on a road trip or using it for commercial purposes.

Turo Review: How Renting Out Our Cars on Turo Turned Into a Free Tesla

Turo, the 'Airbnb for cars,' could upend the car-rental industry

17+ Best Money Making Apps For Fast Cash in 2023 (Ranked)

Rent Your Car and Start Making Money On Turo - Make $500+ Monthly!

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures