Does Usaa Do Gap Insurance

Friday, September 19, 2025

Edit

Does USAA Do Gap Insurance?

What is Gap Insurance and How Does it Work?

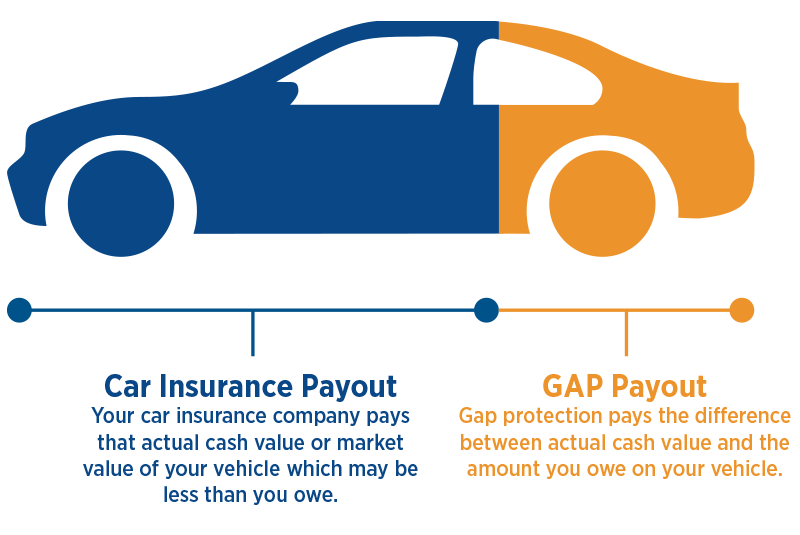

Gap insurance is a type of car insurance that covers the difference between what an insurance company pays out on a claim and what is owed on a car loan. It is typically used when a person has purchased a vehicle and put down a large down payment or purchased a car with a loan. Gap insurance can help cover any difference between the amount of money that is owed on the loan and the amount of money the insurance company pays out on a claim.

For example, if a person bought a car for $20,000 and put down a $5,000 down payment and then got in an accident, the insurance company might only pay out $15,000 on the claim. Gap insurance would then cover the remaining $5,000 that is owed on the loan. Without gap insurance, the person would be responsible for paying the remaining balance on the loan.

Does USAA Offer Gap Insurance?

USAA does offer gap insurance to its customers. USAA gap insurance is available to customers who have purchased their vehicles with a loan and have their loan serviced by USAA Bank. It is not available to those who purchased their vehicles with cash or through a lease.

USAA gap insurance covers the gap between the total amount of the loan and the amount of money the insurance company will pay out on a claim. It also covers taxes, late fees, and other expenses that may be due as a result of a total loss.

USAA gap insurance is offered in two different forms. The first is the "Declining Deductible" plan, which decreases the deductible amount over time. The second is the "Retention" plan, which keeps the deductible amount the same over the term of the loan.

Benefits of USAA Gap Insurance

There are several benefits to having USAA gap insurance. One of the most important benefits is the peace of mind that comes with knowing that you are covered in the event of a total loss. Having gap insurance can also help to prevent you from being stuck with a large bill in the event of a total loss.

Another benefit of having USAA gap insurance is that it can help to protect you from any late fees or other expenses that may be due as a result of a total loss. USAA gap insurance can also help to reduce your out-of-pocket expenses in the event of a total loss.

Drawbacks of USAA Gap Insurance

The biggest drawback of USAA gap insurance is that it is only available to those who have their car loan serviced by USAA Bank. This means that those who purchased their vehicles with cash or through a lease are not eligible for USAA gap insurance.

Another potential drawback is that USAA gap insurance is only available for a limited period of time. The maximum term for USAA gap insurance is 48 months, which means that if your loan is longer than 48 months, you will need to purchase a separate gap insurance policy.

Bottom Line

USAA gap insurance can be a great resource for those who have purchased their vehicles with a loan and have their loan serviced by USAA Bank. It can help to provide peace of mind by covering the difference between what is owed on the loan and what the insurance company pays out on a claim. It can also help to reduce out-of-pocket expenses in the event of a total loss. However, it is important to remember that USAA gap insurance is only available for a limited period of time and is not available to those who purchased their vehicles with cash or through a lease.

USAA Gap Insurance Review 2022 [Deep Secrets Uncovered] - Life

![Does Usaa Do Gap Insurance USAA Gap Insurance Review 2022 [Deep Secrets Uncovered] - Life](https://mytopinsuranceblogs.com/wp-content/uploads/2021/03/USAA-gap-insurance-quote.jpg)

What Is Gap Insurance? - Lexington Law

What is GAP Insurance and Why Do You Need It? - Toyota of Seattle

Guaranteed Asset Protection | Texas Car GAP Insurance | CRCU

What is Gap Insurance? Infographic