Cheap General Liability Insurance Coverage Lawn Care Business

Thursday, September 18, 2025

Edit

Cheap General Liability Insurance for Lawn Care Businesses

Why is General Liability Insurance Important for Lawn Care Businesses?

Having the right insurance coverage is important for any business, and lawn care businesses are no exception. General liability insurance protects lawn care businesses from potential legal and financial liabilities that may arise from injury or property damage caused by their services. This coverage can be essential for protecting the business and its assets from costly lawsuits that may arise from providing lawn care services. Furthermore, it can also help to protect the reputation of the business, as well as its employees, from potential claims that may arise due to negligence or other factors.

What Does General Liability Insurance Cover?

General liability insurance can provide protection for a variety of potential liabilities that may arise from providing lawn care services. This type of insurance can cover costs associated with medical expenses, legal fees, property damage, and even libel or slander related to the business. Additionally, it can also provide coverage for personal injury or advertising errors, making it a vital part of any lawn care business’s insurance portfolio.

What Are the Benefits of Having General Liability Insurance?

Having general liability insurance can be beneficial in many ways for lawn care businesses. The most obvious benefit is the protection it provides from potential liabilities, such as lawsuits or medical bills, that may arise from providing lawn care services. In addition to this, this type of insurance can also provide peace of mind for the business owners, knowing that they are protected in the event of a claim. Furthermore, general liability insurance can also help to protect the business’s reputation and its employees, as it can provide coverage for libel or slander related to the business.

How Much Does General Liability Insurance Cost?

The cost of general liability insurance will vary based on the type of coverage and the specific needs of the business. Generally, the cost will depend on the size of the business, the type of services it provides, and the amount of coverage desired. Additionally, the cost will also be based on the provider, as different providers may offer different rates and discounts. However, in most cases, general liability insurance for a lawn care business can be relatively inexpensive, making it a cost-effective way to protect the business and its assets.

Where Can I Find Cheap General Liability Insurance for My Lawn Care Business?

Finding the right insurance provider is key to getting the best coverage at the most affordable rate. Many insurance providers offer general liability insurance for lawn care businesses, and it’s important to shop around to find the best deal. Additionally, many local and national associations provide discounts for their members, so it’s worth checking with organizations such as the National Association of Landscape Professionals or the Professional Lawn Care Association of America for potential savings.

Conclusion

General liability insurance is an important part of any lawn care business’s insurance portfolio, and it can provide valuable protection from potential liabilities. This type of insurance can be relatively inexpensive, making it a cost-effective way to protect the business and its assets. Additionally, many businesses and organizations provide discounts for their members, so it’s worth checking with local and national associations for potential savings. Ultimately, having the right insurance coverage can be essential for protecting the business, as well as its employees, from potential claims that may arise due to negligence or other factors.

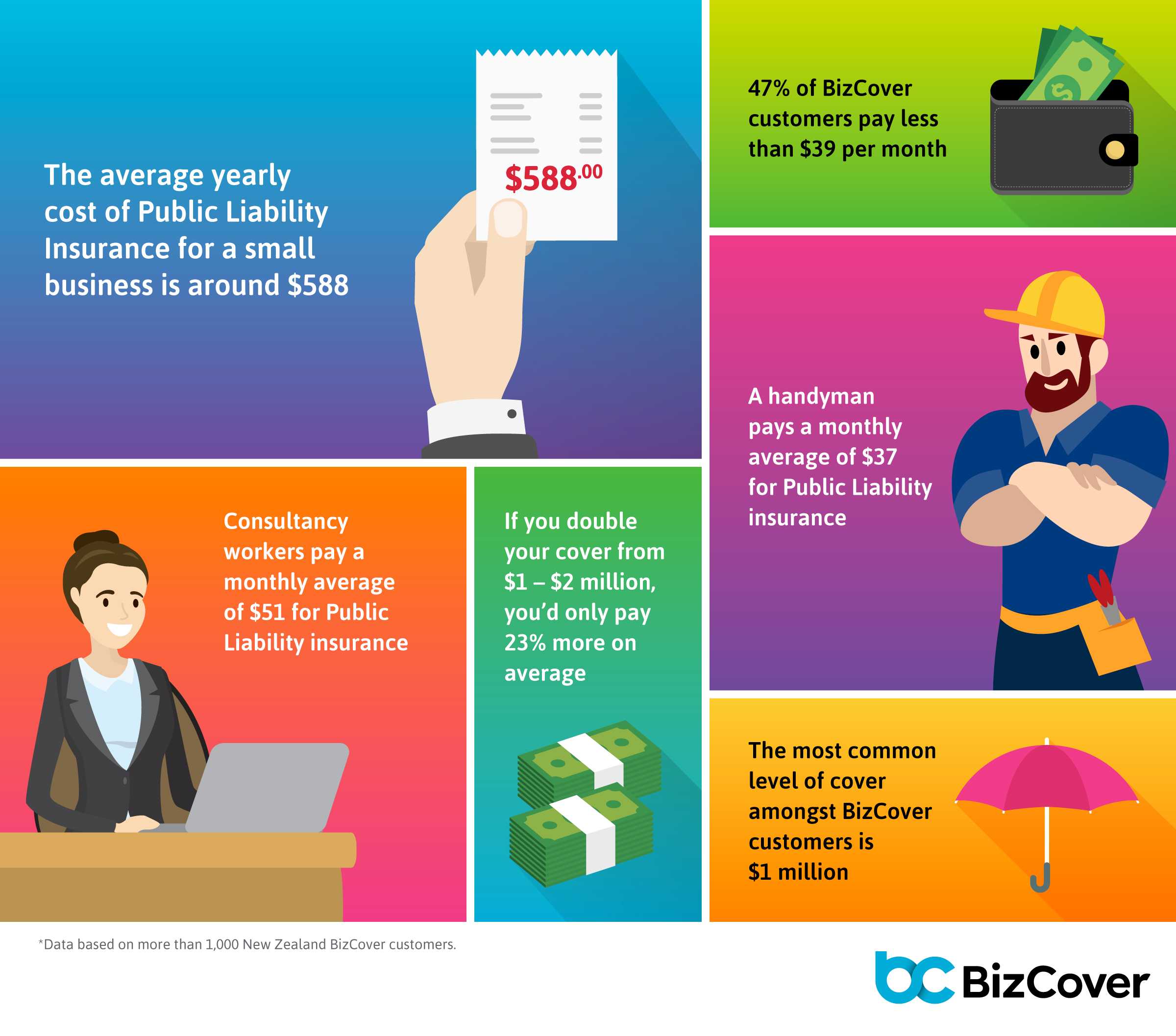

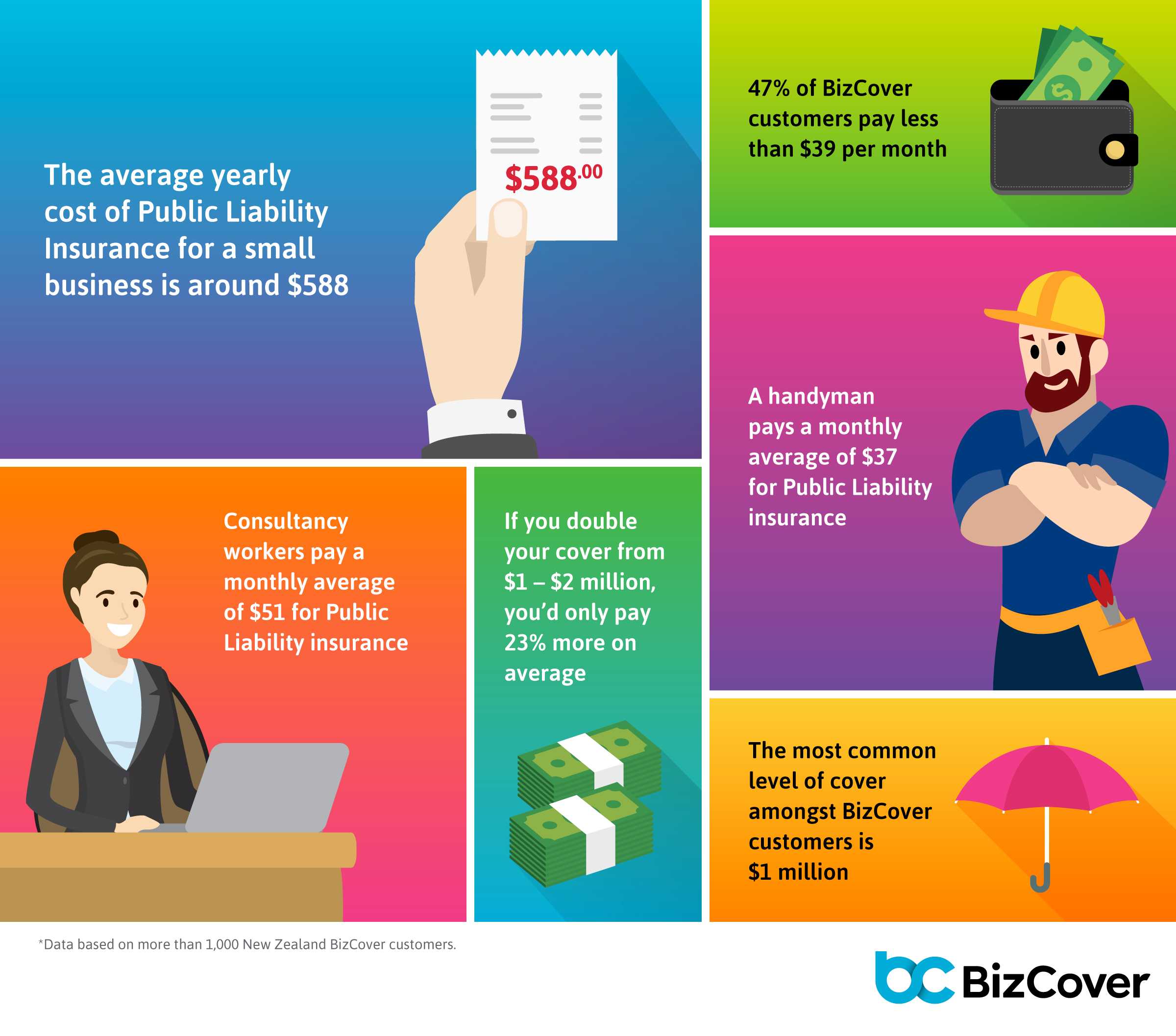

What does Public Liability Insurance Cost? | BizCover NZ

How to Protect Your Business From Unpredictable Events With General

What is General Liability Insurance? - YouTube

afusondesign: General Liability Insurance Coverage

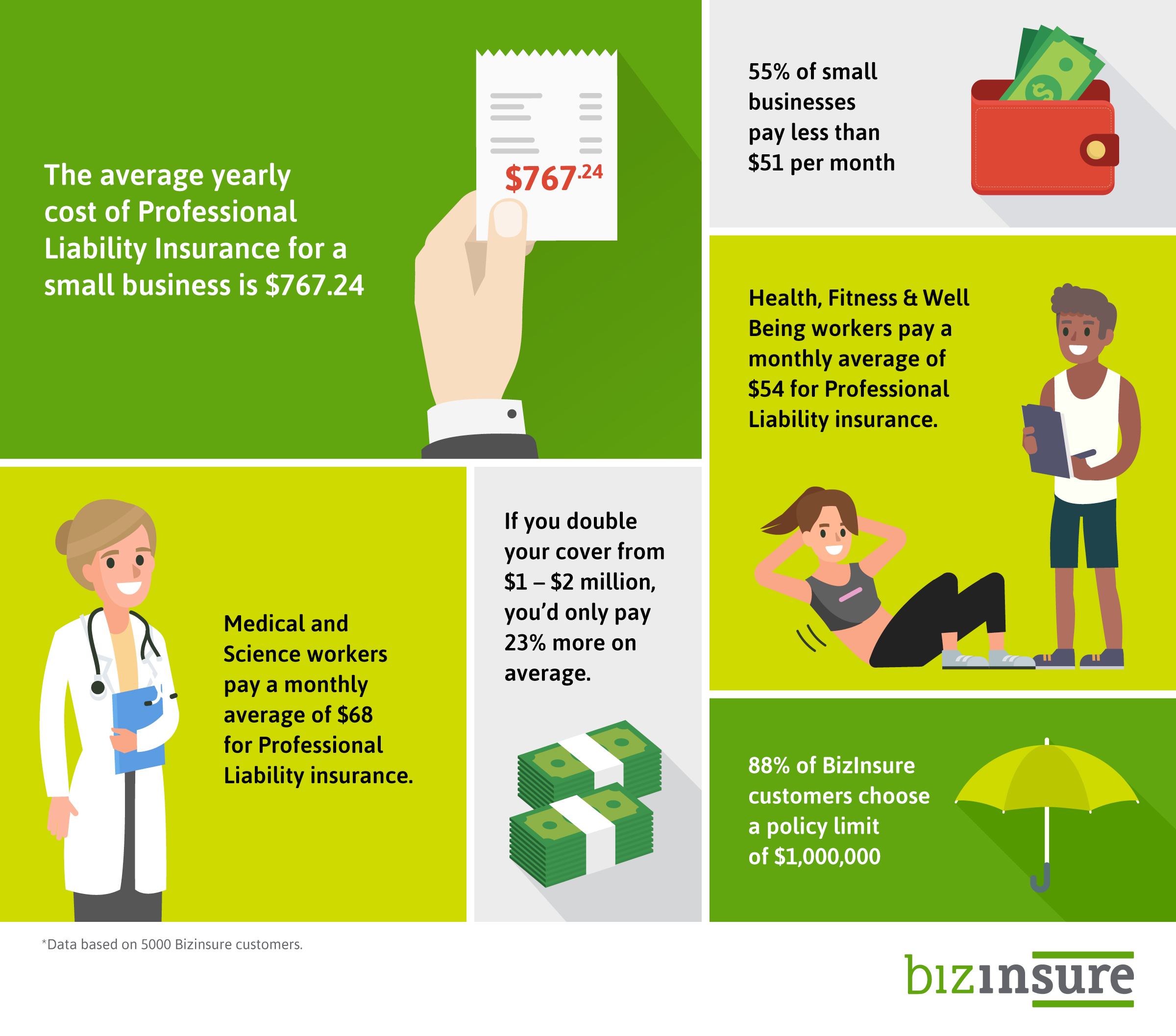

How Much Does Professional Liability Insurance Cost? - BizInsure