Car Insurance In New York

Car Insurance in New York: What You Should Know

What is Car Insurance?

Car insurance is an agreement between a driver and an insurer, in which the insurer agrees to provide financial coverage to the driver in the event of an accident or other damage. This agreement is typically made in exchange for a monthly or annual premium. Car insurance is important in New York because it can provide financial protection in case of an accident or other damage to your vehicle. It can also provide protection against theft, vandalism, and other liabilities. In addition, car insurance in New York can help cover medical expenses for those injured in an accident.

Types of Car Insurance in New York

There are several different types of car insurance available in New York. The most common type is liability insurance, which covers the costs of any damages to another person or property caused by the insured driver. Comprehensive insurance provides coverage for a variety of other damages, such as fire, theft, and vandalism. Collision coverage pays for damages to your vehicle caused by a collision with another car or object. Uninsured/underinsured motorist coverage provides protection if you are in an accident with a driver who does not have insurance or does not have enough insurance to cover the costs of the accident.

Minimum Car Insurance Requirements in New York

In New York, drivers are required to carry a minimum amount of car insurance coverage. This includes liability coverage of at least $25,000 per person and $50,000 per accident for bodily injury liability, as well as $10,000 per accident for property damage liability. Drivers are also required to carry uninsured/underinsured motorist coverage of at least $25,000 per person and $50,000 per accident. In addition, New York law requires drivers to carry personal injury protection coverage of at least $50,000 per person.

Additional Coverage Options

In addition to the minimum coverage requirements, drivers in New York have the option to purchase additional car insurance coverage. This includes higher liability limits, collision and comprehensive coverage, rental car reimbursement, towing and labor coverage, and more. Drivers may also be able to purchase additional coverage such as gap insurance, which pays the difference between the value of your vehicle and the amount you owe if your car is totaled in an accident.

Finding the Best Car Insurance for You

When looking for car insurance in New York, it is important to shop around and compare quotes from different companies. Be sure to compare not only the cost, but also the coverage options and customer service ratings. Additionally, be sure to read the terms and conditions of any policy before signing up. This will help ensure that you are getting the coverage you need at a price you can afford.

Conclusion

Car insurance is an important part of driving in New York. It can provide financial protection in the event of an accident, theft, or other damage. Drivers in New York are required to carry a minimum amount of car insurance coverage, and they have the option to purchase additional coverage if they choose. When shopping for car insurance, be sure to compare quotes from different companies and read the terms and conditions of any policy before signing up.

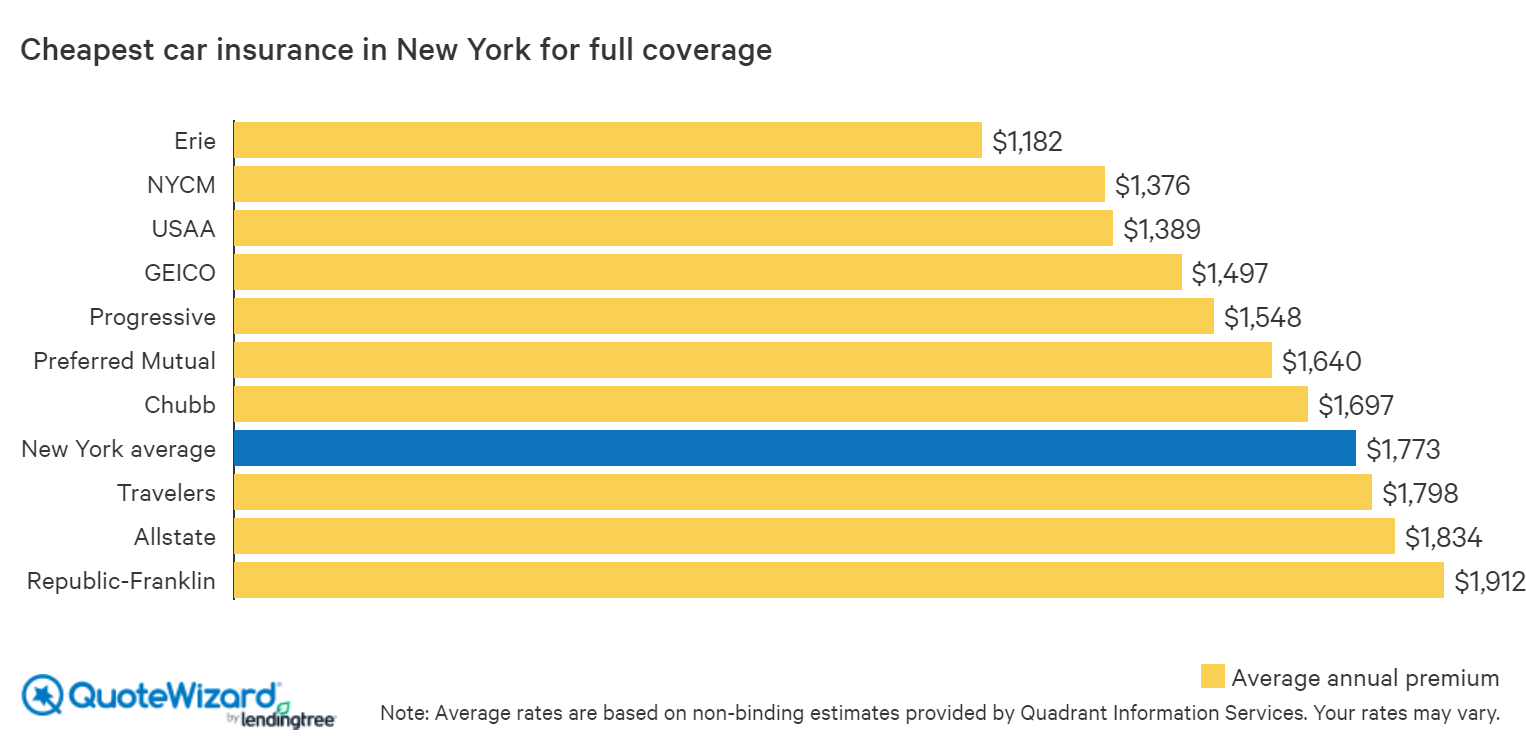

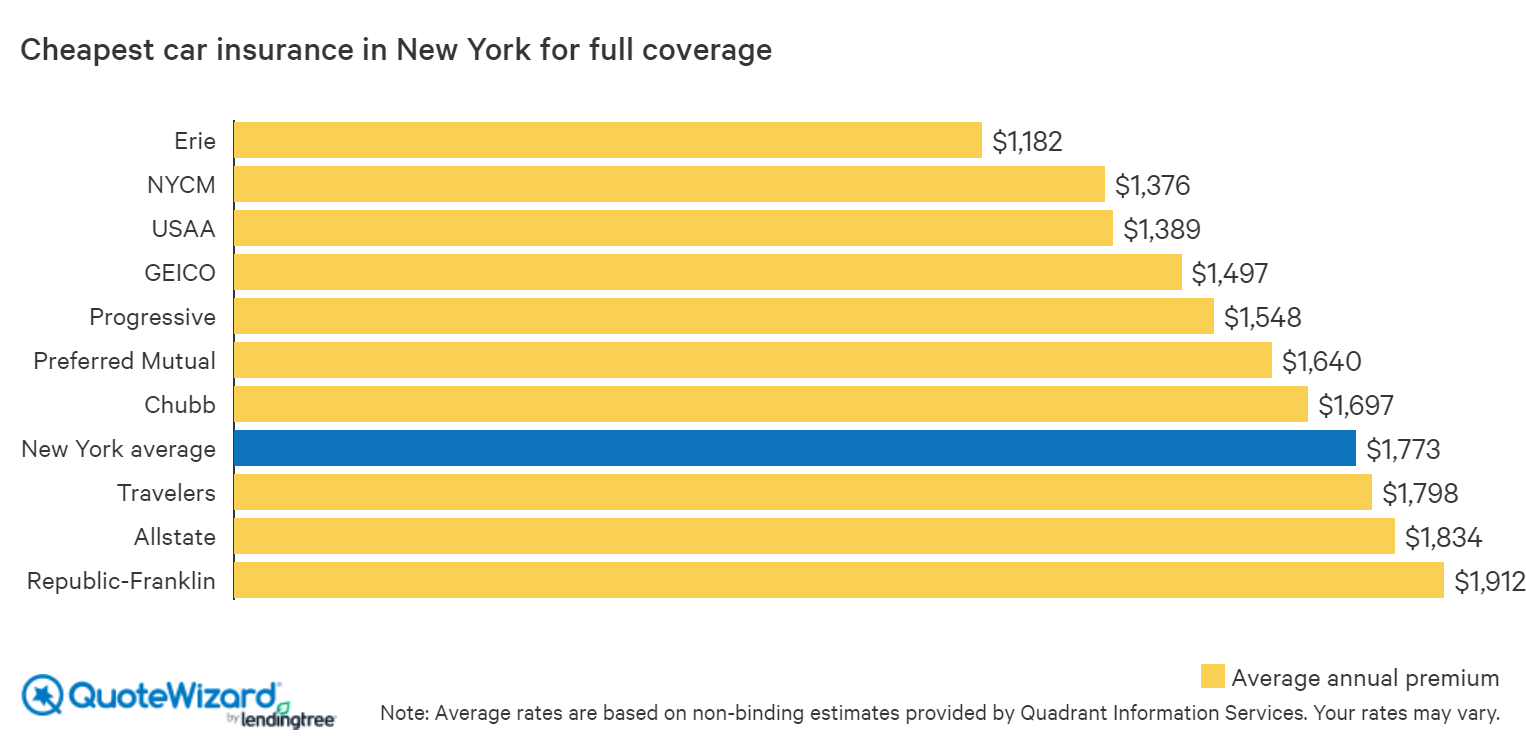

The Cheapest Car Insurance in New York | QuoteWizard

Cheap Car Insurance in New York 2019

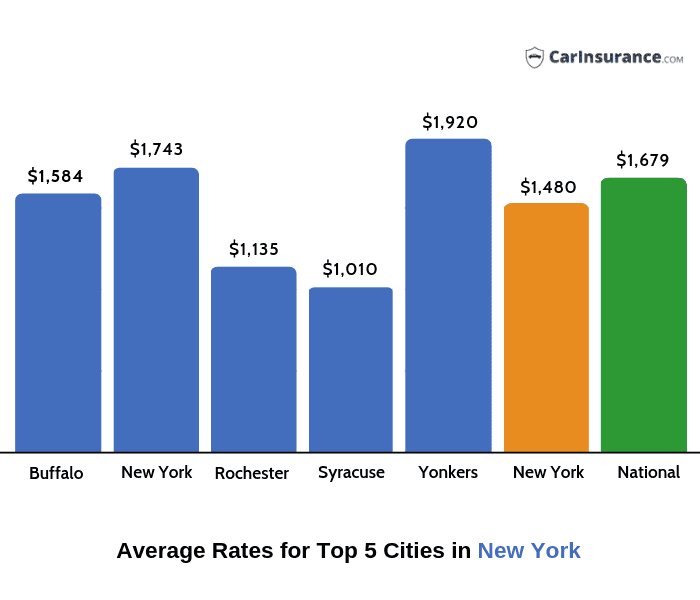

Car Insurance in New York - Find Best & Cheapest Car Insurance in NY

Who Has the Cheapest Auto Insurance Quotes in New York? - ValuePenguin

Who Has the Cheapest Auto Insurance Quotes in New York? - ValuePenguin