Car Insurance For Teens Cost

Everything You Need to Know About Car Insurance For Teens Cost

As a teen, you’re probably excited to start driving on your own. There’s no doubt that having your own car can give you a sense of freedom and independence. But, before you head out on the road, you need to figure out the cost of car insurance for teens. It’s important to know what to expect when it comes to insurance premiums. That way, you can budget accordingly and prepare for the associated costs.

What Is the Average Cost for Car Insurance for Teens?

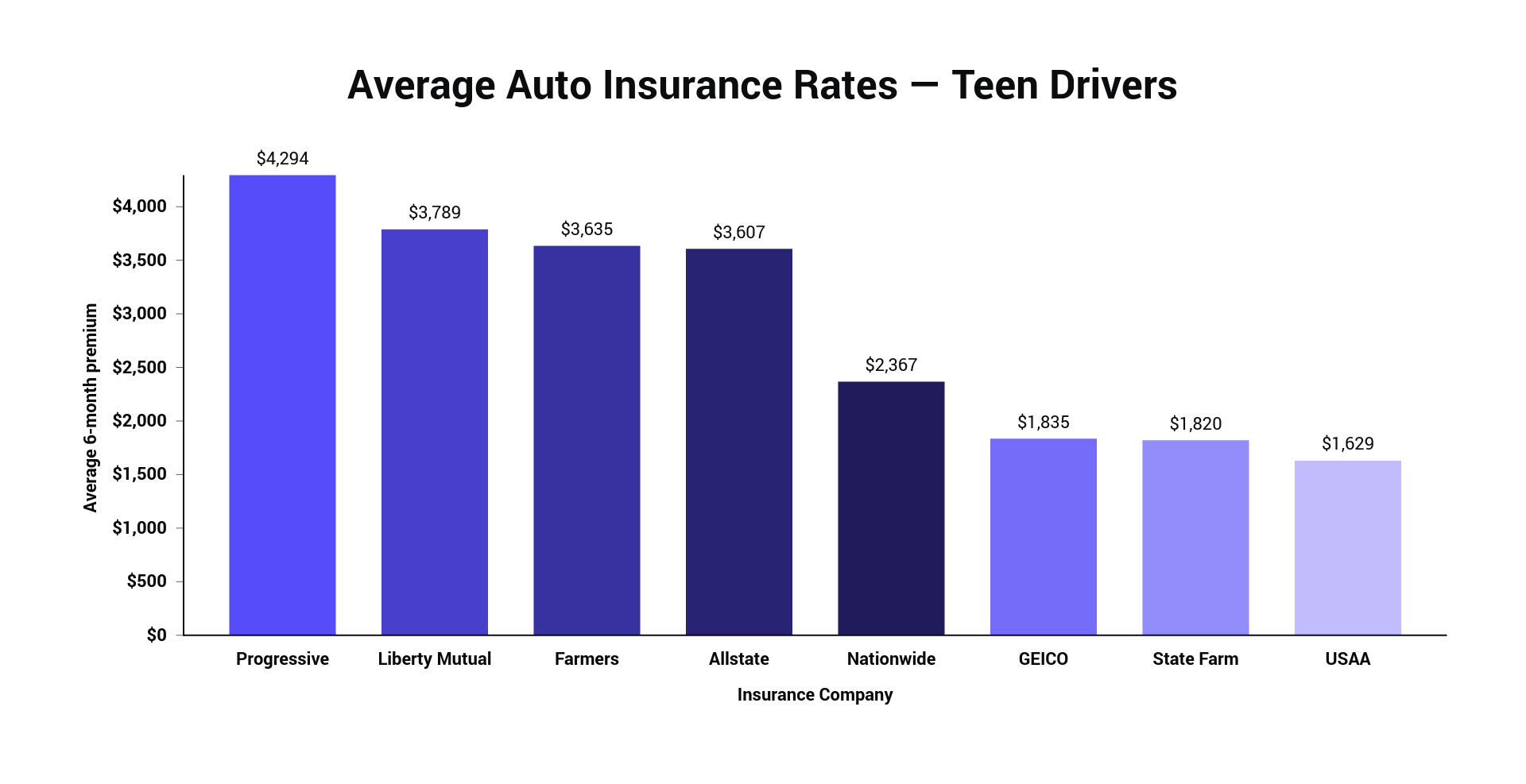

The average cost of car insurance for teens is higher than for any other age group. This is because teens are more likely to get into accidents as they gain experience driving. As such, insurance companies charge higher premiums to cover their risks. According to the website Insurance.com, the average cost of car insurance for 16-year-olds is $8,226 per year. This cost can vary greatly depending on the type of car you drive, your location, and the insurance coverage you choose.

Factors That Impact the Cost of Car Insurance for Teens

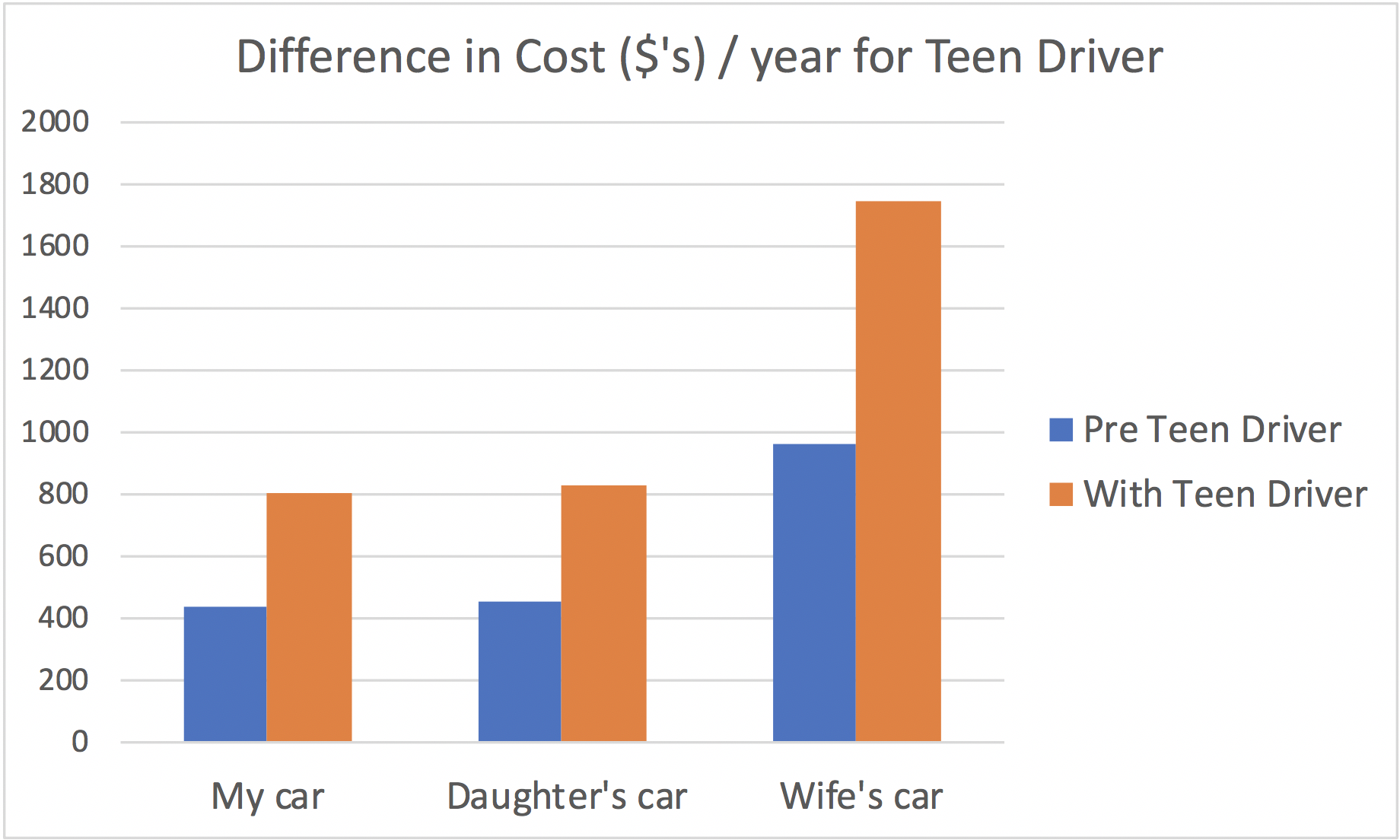

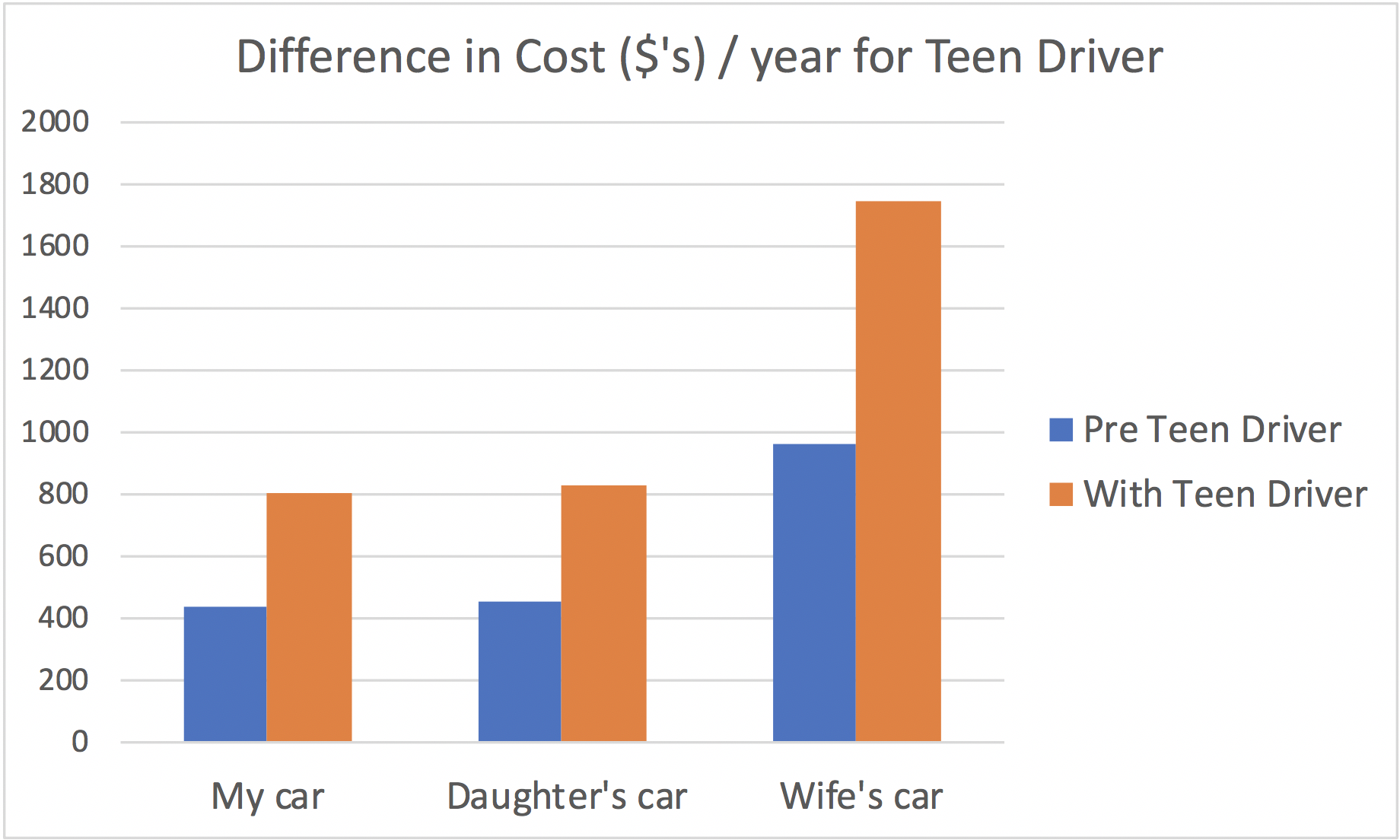

There are several factors that influence the cost of car insurance for teens. Perhaps the most important factor is the type of car you drive. Insurance companies view certain types of cars as more likely to get into an accident, and they charge higher premiums for these types of cars. In addition, your location can also affect the cost of car insurance for teens. Insurance companies charge higher premiums in areas with higher accident rates. Finally, the coverage you choose can also impact your premiums. If you choose higher coverage limits, you will have to pay more for car insurance for teens.

How to Save Money on Car Insurance for Teens

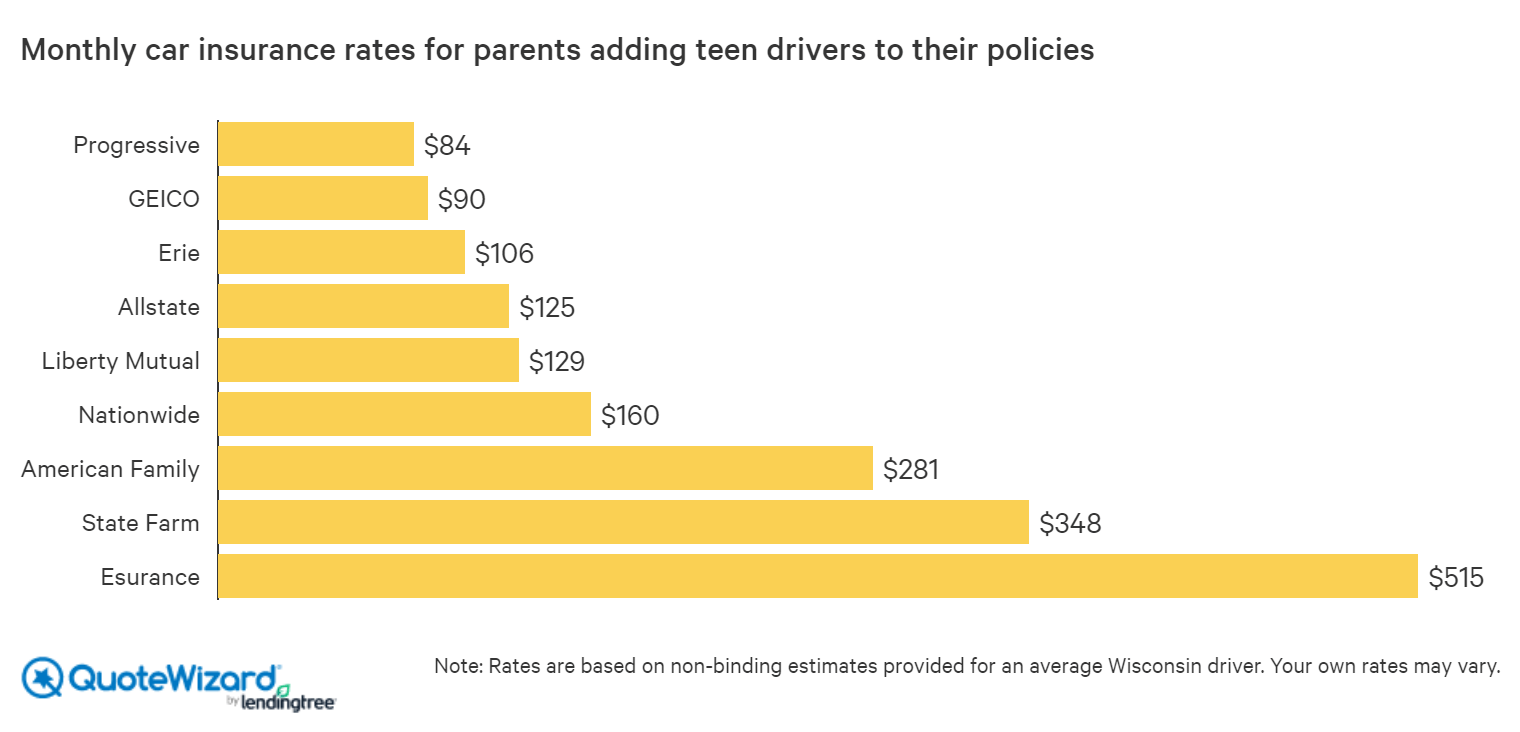

There are several ways to save money on car insurance for teens. First, make sure to shop around for the best rates. Different insurance companies offer different rates, so it’s important to compare quotes from a few different companies. Second, consider raising your deductible. Increasing your deductible can lower your premiums, but make sure you can cover the deductible if you do get into an accident. Finally, consider taking a driver’s education class. Many insurance companies offer discounts to teens who complete a driver’s education class.

Tips for Shopping for Car Insurance for Teens

Shopping for car insurance for teens can be overwhelming. Here are some tips to help you get the best deal. First, make sure you understand the types of coverage available. There are several types of coverage, such as liability, collision, and comprehensive. Knowing the types of coverage and what they cover can help you choose the right policy for you. Second, consider getting multiple quotes from different insurance companies. This will help ensure you are getting the best rate. Finally, make sure to read the fine print of any policy you are considering. This will help you understand the coverage limits, deductibles, and other important details.

Conclusion

Car insurance for teens can be expensive, but there are ways to save money. Make sure to shop around for the best rates, consider increasing your deductible, and take a driver’s education class. These steps can help you get the best deal on car insurance for teens. It’s important to understand the types of coverage available and read the fine print of any policy you are considering. Taking the time to research car insurance for teens can help you save money in the long run.

How I saved more than $1,000 on car insurance for my teenager - ValChoice

Best Car Insurance for Teens | QuoteWizard

Cheap Car Insurance for Teens Infographic | Cheap Car Insurance | Car

Finding the Cheapest Car Insurance for Teens | Cheap car insurance, Car

Average Car Insurance Cost For 22 Year Old Male - Car Retro