Can You Insure A Rebuilt Title

Can You Insure A Rebuilt Title?

What Is A Rebuilt Title?

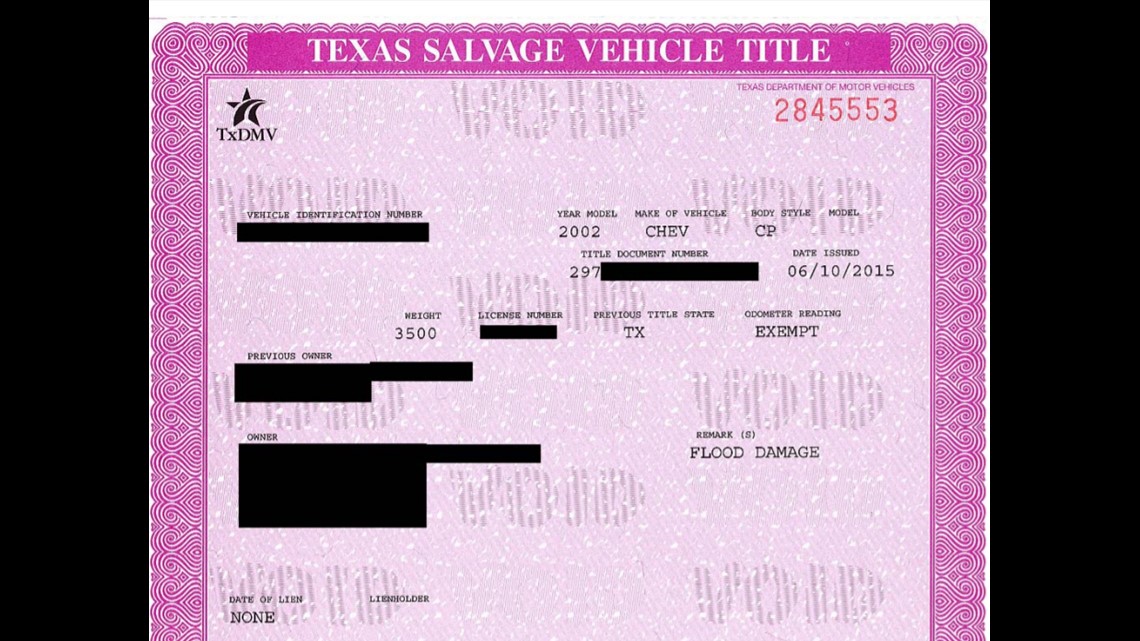

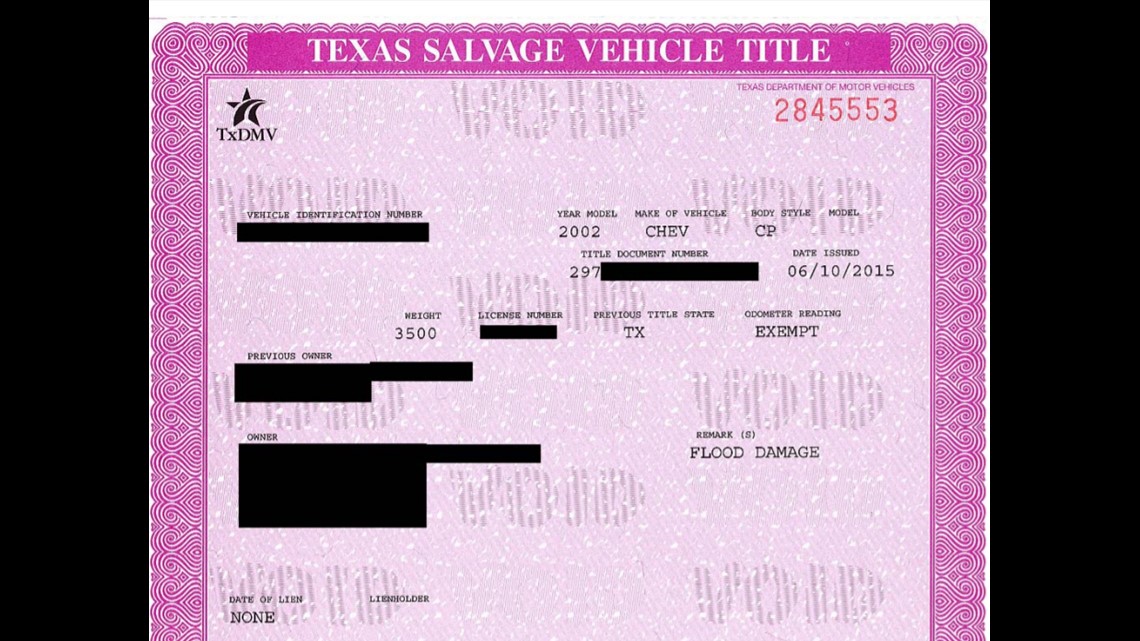

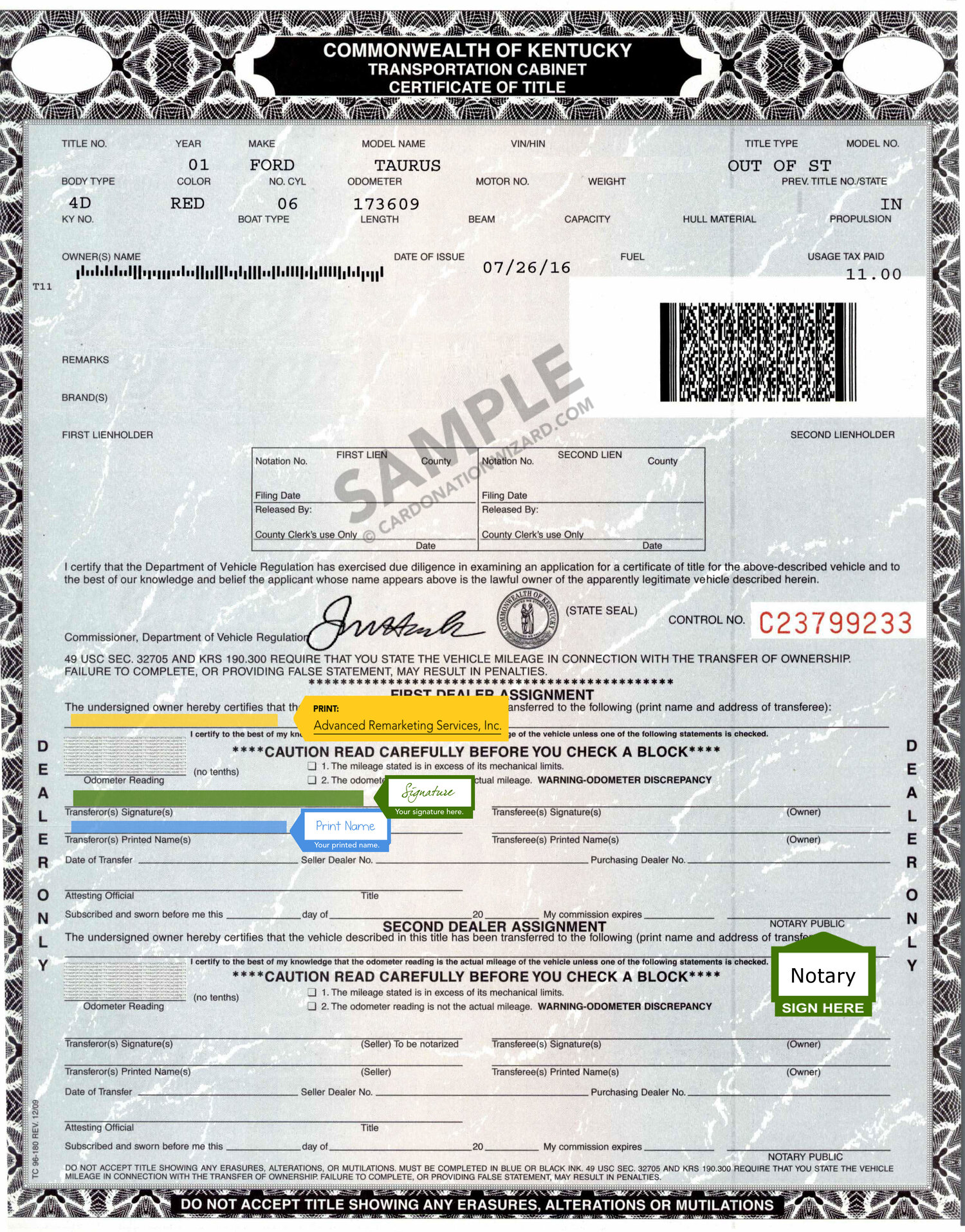

Rebuilt titles are titles given to vehicles that have been salvaged due to a major accident, flood damage, or other major mechanical issue. These vehicles are then repaired and restored to their original condition, and the title is changed to reflect this. For example, a vehicle that was previously a “salvage title” may be changed to a “rebuilt title” after it is restored.

It's important to note that there is a difference between a rebuilt title and a salvage title. Salvage titles are given to vehicles that have been deemed a total loss due to an accident, flood, etc. Rebuilt titles are given to vehicles that have been repaired and restored to their original condition.

Can You Insure A Rebuilt Title?

In most cases, you can insure a vehicle with a rebuilt title. However, it is important to note that the cost of insurance may be higher than it would be for a vehicle with a clean title. This is because rebuilt vehicles are seen as higher risk by insurers and may be more prone to problems in the future.

It is also important to note that some insurers may not offer coverage for a rebuilt title vehicle. If you are looking to insure a vehicle with a rebuilt title, it is best to shop around and compare quotes from different insurers. This will help you find the best coverage at the best price.

What Factors Impact the Cost of Insurance for a Rebuilt Title?

The cost of insurance for a vehicle with a rebuilt title will depend on a variety of factors. These include the age and make/model of the vehicle, the driving record of the insured, the amount of coverage requested, and the insurer's underwriting guidelines.

It is also important to note that some insurers may offer discounts for vehicles with rebuilt titles. If you are looking to save money on insurance, be sure to ask your insurer if they offer any discounts for vehicles with rebuilt titles.

Tips For Finding Affordable Insurance For A Rebuilt Title

When shopping for insurance for a vehicle with a rebuilt title, it is important to compare quotes from multiple insurers. This will help you find the best coverage at the most affordable price. Additionally, be sure to ask your insurer about any discounts they may offer for vehicles with rebuilt titles.

Conclusion

In conclusion, it is possible to insure a vehicle with a rebuilt title. However, it is important to note that the cost of insurance may be higher than it would be for a vehicle with a clean title. Additionally, some insurers may not offer coverage for a rebuilt title vehicle, so it is important to shop around and compare quotes from different insurers. Finally, be sure to ask your insurer about any discounts they may offer for vehicles with rebuilt titles.

Texas Rebuilt Motorcycle Titles - MotorCycle Review

What is Rebuilt Title Car? How can your Insure one?

How To Sell A Rebuilt Title Car - Title Choices

Liability Insurance For Rebuilt Title / How To Insure A Salvage Or

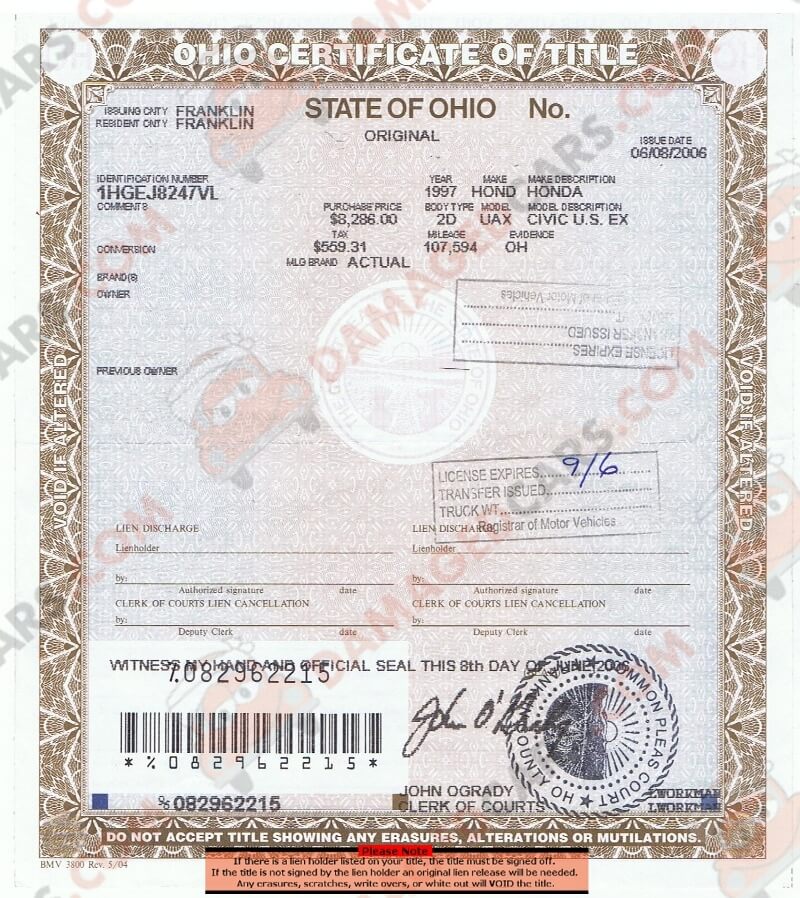

Ohio Motor Car Title - How to transfer a vehicle, rebuilt or lost titles.