Best Vehicles For Insurance Rates

Best Vehicles for Insurance Rates

Understanding Insurance Rates

Insurance rates are determined by a variety of factors, including the type of car you drive and your driving record. The cost of insurance is based on the amount of risk associated with insuring a particular vehicle. Generally, the higher the risk, the more expensive the insurance. Therefore, understanding the different types of cars and the risks associated with them is important when shopping for the best insurance rates.

Types of Vehicles

There are several types of vehicles that can be considered when looking for the best insurance rates. Sedans, coupes, hatchbacks, and minivans are all popular choices for those looking to save on auto insurance. These vehicles are typically less expensive to insure than larger cars, such as SUVs and pickup trucks. Additionally, newer cars are typically less expensive to insure than older cars due to the fact that they are equipped with the latest safety features.

Safety Features

When shopping for a new car, it is important to look for vehicles that are equipped with the latest safety features. Anti-lock brakes, airbags, and other safety features can help reduce the cost of insurance. It is also important to consider the car's crash test ratings and other safety features when shopping for the best insurance rates.

Location

The location of the vehicle can also have an impact on the cost of insurance. If the vehicle will be driven in an area that has a higher risk of accidents, the insurance rates may be higher than if the vehicle is driven in an area with lower risk of accidents. Additionally, if the vehicle will be driven in an area where the weather is unpredictable, the insurance rates may be higher.

Driving Record

The driver's personal driving record is also taken into consideration when determining the cost of insurance. Drivers with clean records typically pay less for insurance than those with multiple tickets or accidents. Additionally, those with a history of reckless driving may be charged higher insurance rates.

Shopping Around

When shopping for the best insurance rates, it is important to compare quotes from multiple insurance companies. Different companies may offer different rates, so it is important to compare quotes from a variety of companies in order to get the best deal. Additionally, it is important to be honest when applying for insurance, as lying about one's driving record can result in higher rates.

Top 10 Car Insurance Rates 2019 | EINSURANCE

Car Insurance Rates By Age And Gender - INURANC

Proven Tips How To Get Lowest Car Insurance Rates - Funender.com

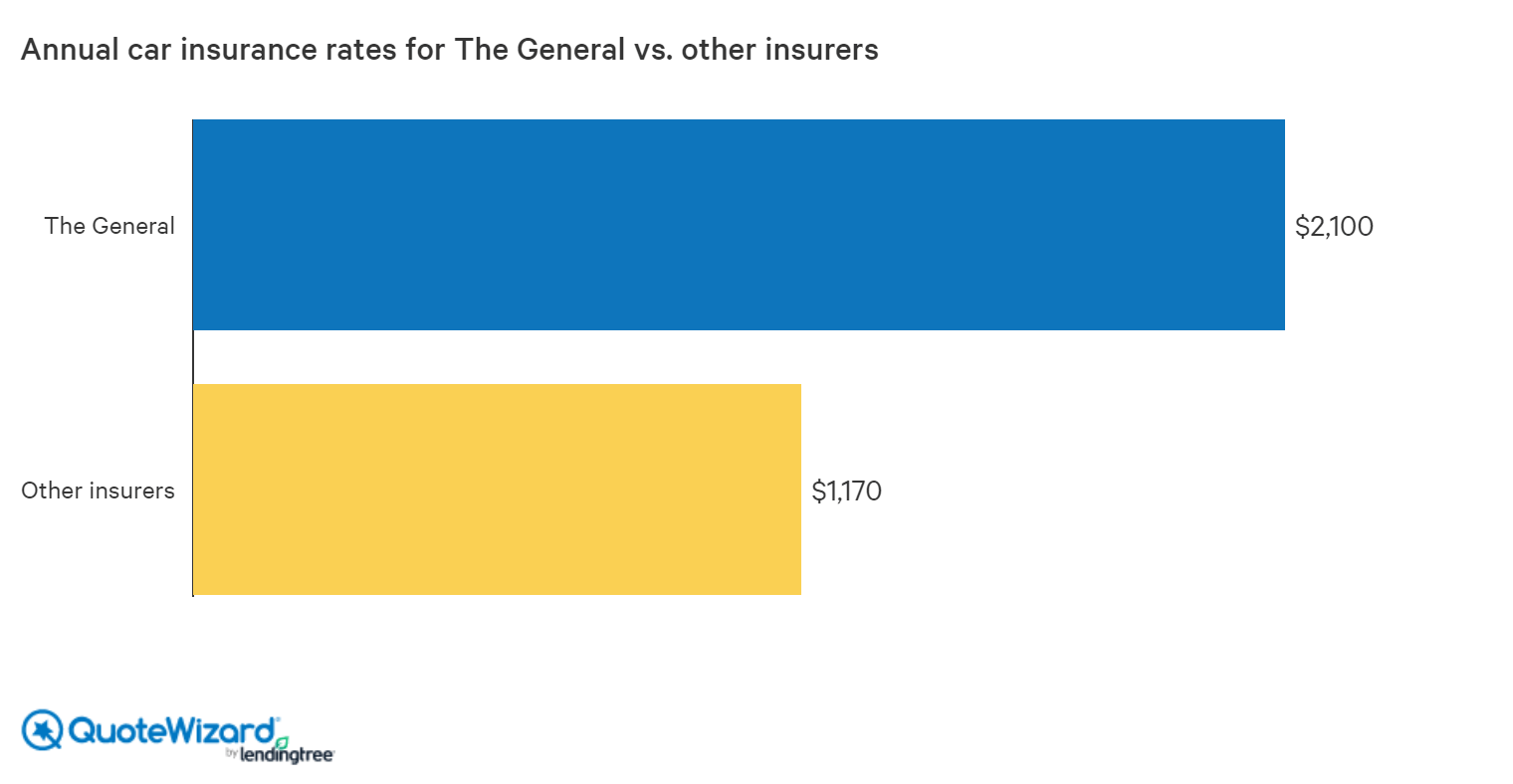

The General Insurance Review: Good Choice for High-Risk Drivers

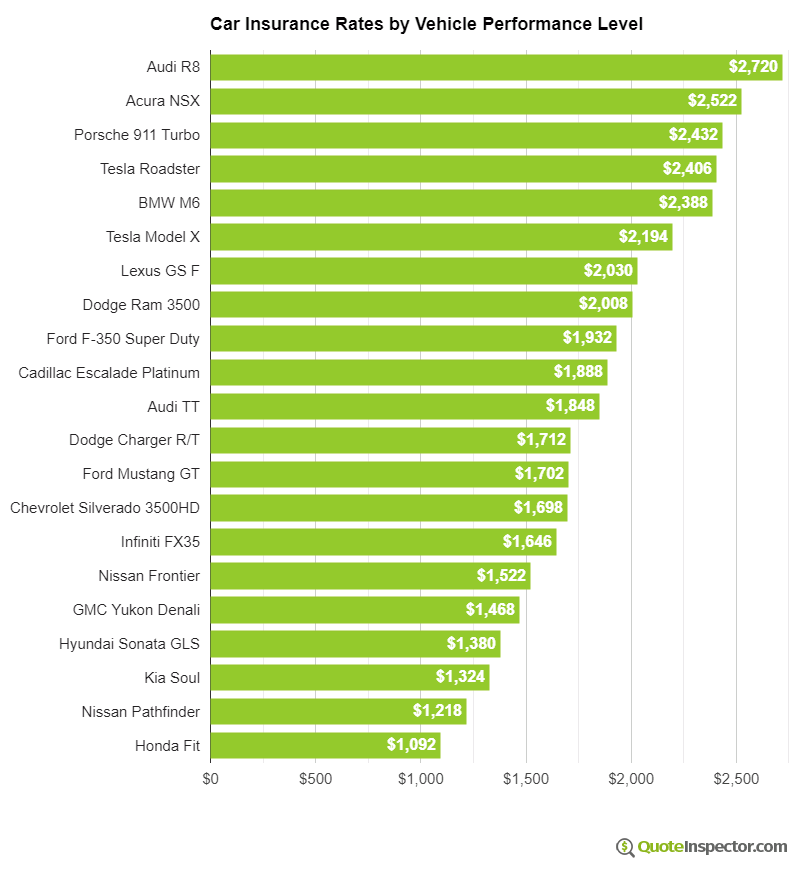

Car Insurance Rate Comparison By Model - Wedding Ideas and Inspiration