Auto Insurance For High Risk Drivers In Michigan

Tuesday, September 23, 2025

Edit

Auto Insurance for High-Risk Drivers in Michigan

Why Auto Insurance is Necessary for High-Risk Drivers

Auto insurance is a must-have for all drivers in Michigan, regardless of their risk level. High-risk drivers, in particular, need to make sure they have adequate coverage to protect themselves from any unexpected costs associated with their driving. The state of Michigan requires that all drivers carry a minimum amount of liability coverage in order to legally drive on the state’s roads. This means that high-risk drivers must make sure they have enough coverage to meet the state’s requirements. Failure to do so could result in fines, license suspension, or even jail time.

In addition to the legal requirements, having auto insurance for high-risk drivers is important for financial protection. High-risk drivers may be more likely to get into accidents, and if they don’t have enough coverage, they may find themselves responsible for the costs of damages and injuries. Auto insurance can help protect drivers from these kinds of costs.

Types of Auto Insurance for High-Risk Drivers in Michigan

High-risk drivers in Michigan may choose from several types of auto insurance coverage. The most common type of coverage is liability coverage, which is required by the state. This type of coverage pays for damages and injuries caused by the insured driver. It also pays for legal costs if the driver is sued.

High-risk drivers may also choose to purchase collision and comprehensive coverage. Collision coverage pays for damage to the insured vehicle caused by an accident. Comprehensive coverage pays for damage to the insured vehicle caused by something other than an accident, such as theft or natural disasters.

High-risk drivers may also want to consider purchasing uninsured/underinsured motorist coverage. This type of coverage pays for damages and injuries caused by an uninsured or underinsured driver. This coverage is important for high-risk drivers, as they may be more likely to be involved in an accident with an uninsured or underinsured driver.

Factors That Affect Auto Insurance for High-Risk Drivers in Michigan

There are several factors that can affect the cost of auto insurance for high-risk drivers in Michigan. Some of these factors include:

• The driver’s age, gender, and driving record.

• The type of vehicle being insured.

• The amount of coverage purchased.

• The insurance company’s policy.

The cost of auto insurance for high-risk drivers in Michigan may also be affected by any discounts they may be eligible for. For example, high-risk drivers may be eligible for a good driver discount or a multi-car discount.

Getting Auto Insurance for High-Risk Drivers in Michigan

High-risk drivers in Michigan can get auto insurance from a number of different sources. They can purchase insurance from a local insurance agent or from an online provider. It’s important to shop around and compare quotes from different insurers to make sure you’re getting the best rate.

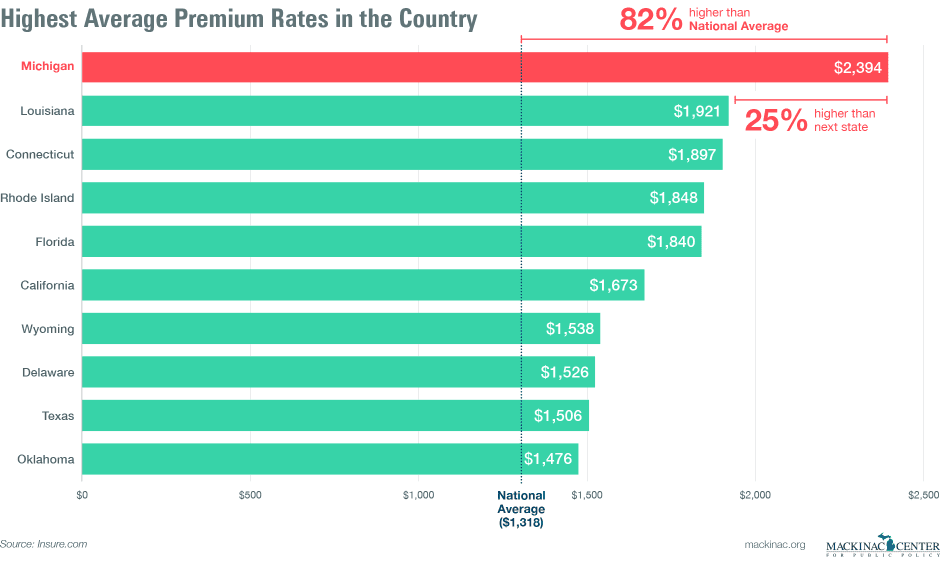

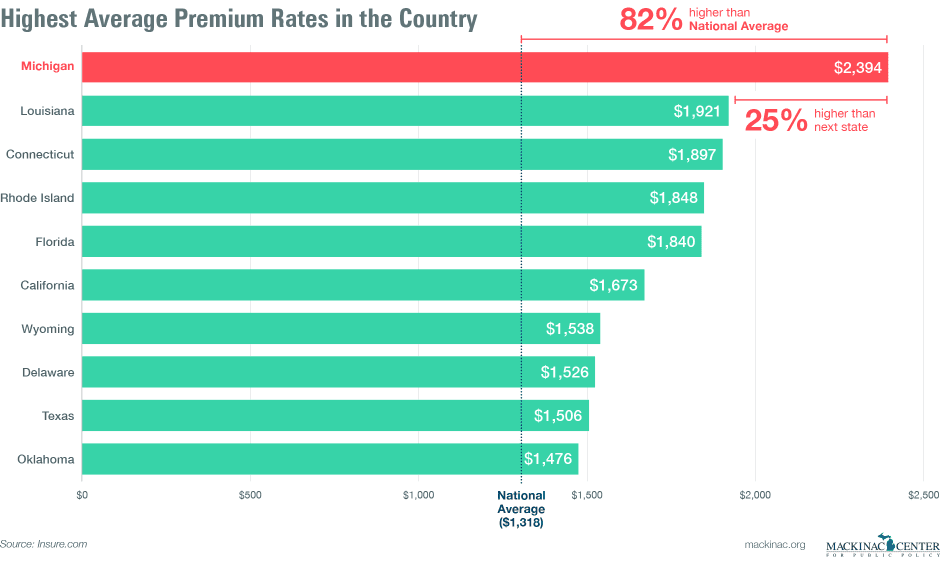

It’s also important to remember that auto insurance for high-risk drivers in Michigan may be more expensive than for other drivers. This is because high-risk drivers are considered to be more likely to get into an accident. However, it’s still important to make sure you have enough coverage to protect yourself financially.

Conclusion

High-risk drivers in Michigan need to make sure they have adequate auto insurance coverage to protect themselves financially. There are several types of coverage available, and it’s important to compare quotes from different insurers in order to get the best rate. It’s also important to remember that auto insurance for high-risk drivers may be more expensive than for other drivers. However, having the right amount of coverage is essential for protecting yourself financially.

What’s Wrong With Auto Insurance in Michigan – Mackinac Center

Auto Insurance Reform - How Much Will Michigan Auto Insurance Reform

Auto Insurance Michigan Online - All Insurances

Auto Insurance for High Risk Drivers - 2017 High Risk Auto Insurance

High-Risk Drivers Can Get Cheaper Car Insurance - Find Out How