What Is Liability Policy In Motor Insurance

What Is Liability Policy In Motor Insurance?

Motor insurance is an important aspect of owning a car, motorcycle or any other form of motor vehicle. It is a form of insurance that covers you financially in case of an accident or damage to your vehicle. Liability insurance is an optional form of insurance that offers additional protection when you are at fault for an accident. It covers the cost of any damage to the property or bodily injury of another person that you may be responsible for.

What Does Liability Insurance Cover?

Liability insurance covers the cost of medical expenses, property damage, legal fees, and other costs associated with an accident that you may be found liable for. It also covers the cost of any damage to your vehicle caused by another driver. If you were found to be at fault, you would be responsible for the cost of repairs to your vehicle as well as the cost of any legal fees or medical expenses incurred by the other party. Liability insurance can be a lifesaver in these situations, as it can help you cover these costs and save you from a potentially hefty financial burden.

How Much Does Liability Insurance Cost?

The cost of liability insurance varies depending on the type of coverage you choose. Generally, liability insurance is relatively inexpensive and can be purchased for a few hundred dollars per year. However, the cost of liability insurance can vary depending on the state you live in, your driving record, the type of vehicle you own, and the amount of coverage you purchase.

Why Do I Need Liability Insurance?

Liability insurance is an important form of insurance for any driver, regardless of their driving record. Even the most experienced and responsible drivers can make mistakes, and accidents can happen in the blink of an eye. In the event of an accident, liability insurance can help protect you from the financial burden of any damage or injury you may be held responsible for. It can also help protect you from the cost of any legal fees or medical expenses that may be incurred.

How Do I Get Liability Insurance?

Liability insurance can be purchased from most auto insurance providers. You can either purchase a standard policy that covers a set amount of coverage or purchase an add-on policy that provides additional coverage. You may also be able to purchase a separate policy just for liability insurance if you already have an auto insurance policy. When shopping for liability insurance, it is important to compare rates and coverage to ensure you are getting the best deal.

Conclusion

Liability insurance is an important form of insurance for any driver. It can provide financial protection in the event of an accident and can help protect you from the cost of repairs, legal fees, and medical expenses. It is important to compare rates and coverage to ensure you are getting the best deal for your needs.

What Is Liability Policy In Motor Insurance?

Motor insurance is an important aspect of owning a car, motorcycle or any other form of motor vehicle. It is a form of insurance that covers you financially in case of an accident or damage to your vehicle. Liability insurance is an optional form of insurance that offers additional protection when you are at fault for an accident. It covers the cost of any damage to the property or bodily injury of another person that you may be responsible for.

What Does Liability Insurance Cover?

Liability insurance covers the cost of medical expenses, property damage, legal fees, and other costs associated with an accident that you may be found liable for. It also covers the cost of any damage to your vehicle caused by another driver. If you were found to be at fault, you would be responsible for the cost of repairs to your vehicle as well as the cost of any legal fees or medical expenses incurred by the other party. Liability insurance can be a lifesaver in these situations, as it can help you cover these costs and save you from a potentially hefty financial burden.

How Much Does Liability Insurance Cost?

The cost of liability insurance varies depending on the type of coverage you choose. Generally, liability insurance is relatively inexpensive and can be purchased for a few hundred dollars per year. However, the cost of liability insurance can vary depending on the state you live in, your driving record, the type of vehicle you own, and the amount of coverage you purchase.

Why Do I Need Liability Insurance?

Liability insurance is an important form of insurance for any driver, regardless of their driving record. Even the most experienced and responsible drivers can make mistakes, and accidents can happen in the blink of an eye. In the event of an accident, liability insurance can help protect you from the financial burden of any damage or injury you may be held responsible for. It can also help protect you from the cost of any legal fees or medical expenses that may be incurred.

How Do I Get Liability Insurance?

Liability insurance can be purchased from most auto insurance providers. You can either purchase a standard policy that covers a set amount of coverage or purchase an add-on policy that provides additional coverage. You may also be able to purchase a separate policy just for liability insurance if you already have an auto insurance policy. When shopping for liability insurance, it is important to compare rates and coverage to ensure you are getting the best deal.

Conclusion

Liability insurance is an important form of insurance for any driver. It can provide financial protection in the event of an accident and can help protect you from the cost of repairs, legal fees, and medical expenses. It is important to compare rates and coverage to ensure you are getting the best deal for your needs.

Learn the Different Types of Car Insurance Policies

Auto Insurance Liability Limits: What Do The Numbers Mean? | Visual.ly

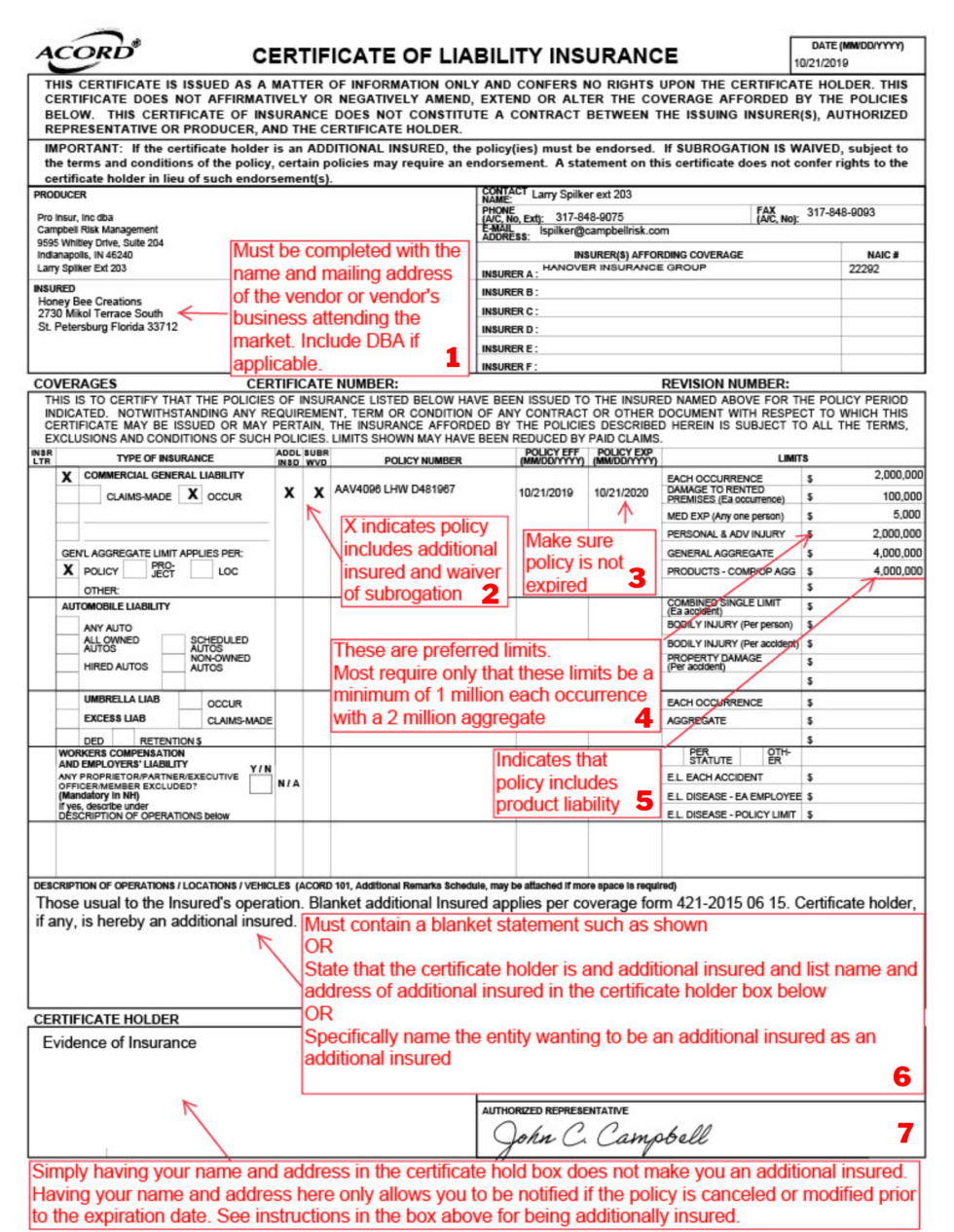

How to Read Your Certificate of Liability Insurance - Campbell Risk

Basic Liability Auto Insurance | 844-495-6293 call today!

What Is Liability Insurance? | Allstate