What Is A Good Car Insurance

What Is A Good Car Insurance?

What Is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could be incurred in an accident. It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Car insurance can also provide protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects.

What Is A Good Car Insurance?

A good car insurance policy is one that provides enough coverage to meet your needs, without breaking the bank. When looking for a good car insurance policy, it's important to consider the coverage you need, what you can afford and the company's customer service record. It's also a good idea to compare different policies and make sure you're getting the best rate for the coverage you need.

When it comes to coverage, it's important to make sure your policy covers the basics, such as liability coverage and collision coverage. Liability covers you if you cause an accident and are liable for the damages, while collision covers damage to your car if you're in an accident. It's also a good idea to look into additional coverage, such as comprehensive coverage, which covers damage to your car caused by things other than a collision, and uninsured/underinsured motorist coverage, which covers you if you're in an accident with someone who doesn't have insurance or enough insurance.

What To Look For When Choosing A Good Car Insurance?

When shopping for a good car insurance policy, it's important to consider the company's customer service record and the coverage options. You'll also want to pay close attention to the policy terms and conditions, as well as any discounts you may be eligible for. Some insurance companies offer discounts for good drivers, for having multiple policies, for taking a defensive driving course and for having a good credit score.

Additional Car Insurance Coverage

In addition to the basic coverage, some insurance companies offer additional coverage, such as rental car reimbursement, roadside assistance, trip interruption insurance and gap insurance. Rental car reimbursement covers the cost of a rental car if your car is in the shop due to an accident or other covered event. Roadside assistance provides help if you break down, such as towing and jump starts. Trip interruption insurance covers the cost of a hotel room if your car breaks down while you're on a trip. Gap insurance covers the difference between what you owe on your car loan and the value of your car if it's totaled in an accident.

Conclusion

A good car insurance policy should provide enough coverage to meet your needs without breaking the bank. It's important to consider the company's customer service record, the coverage options and any discounts you may be eligible for. It's also a good idea to compare different policies and make sure you're getting the best rate for the coverage you need. Finally, consider additional coverage options, such as rental car reimbursement, roadside assistance and gap insurance.

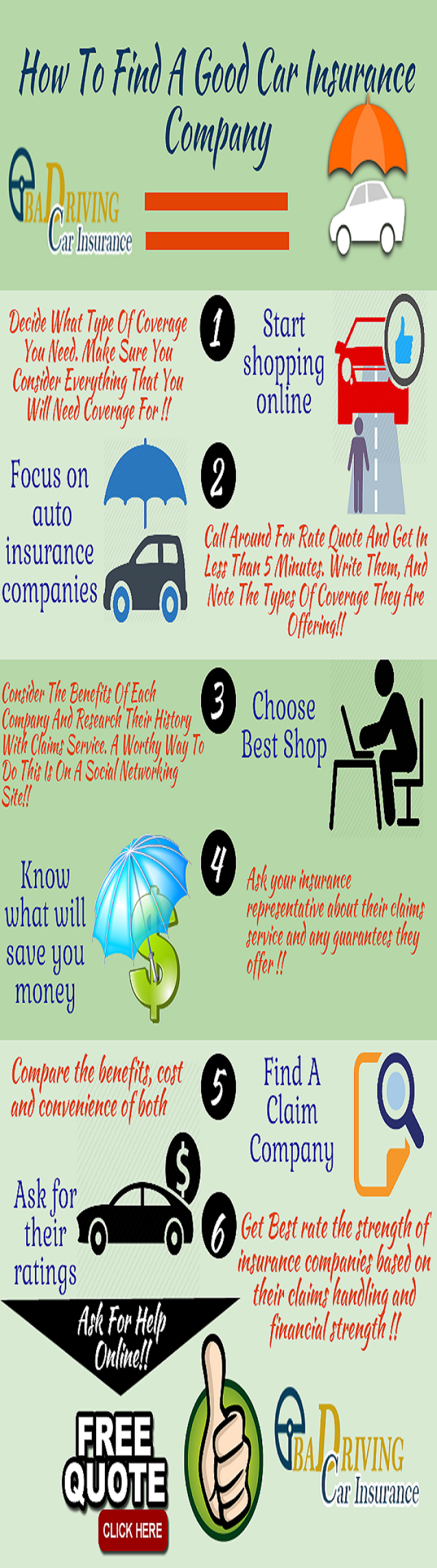

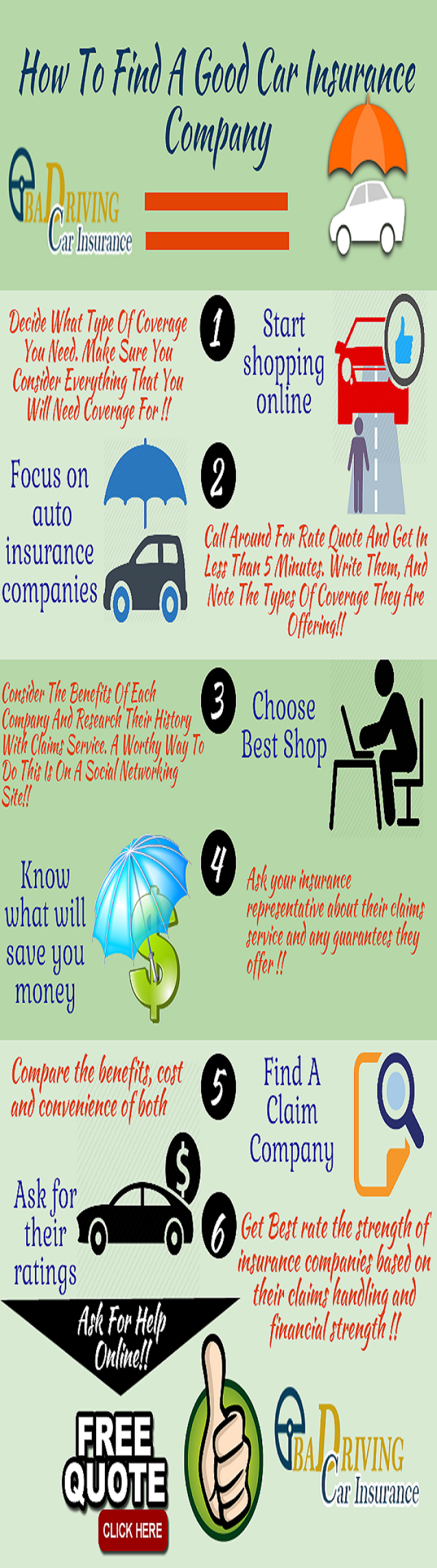

Infographic:- How to find a good car insurance company

List of the Best Car Insurance

7 Types of Car Insurance You Should Consider

Best Full Coverage Insurance Price – Insurance Auto Information

Insurance Company Find Affordable Insurance Coverage For Your Car