What Does Multi Peril Crop Insurance Cover

What Does Multi Peril Crop Insurance Cover?

Introduction

Multi-peril crop insurance is an important tool for farmers to protect against losses caused by natural disasters or other events that can threaten their crops. It is a form of financial protection that covers a variety of risks and can provide peace of mind to farmers who are unsure of what the future holds. It is an essential part of risk management for farmers, as it provides financial protection against losses that could be caused by a variety of factors. This article will discuss what multi-peril crop insurance covers and why it is important.

What Does Multi Peril Crop Insurance Cover?

Multi-peril crop insurance covers a variety of risks, including losses caused by natural disasters, such as drought, flooding, and hail. It also covers losses caused by pests and diseases, as well as other risks, such as market fluctuation and low yields. Multi-peril crop insurance can also cover losses caused by human error, such as improper application of fertilizer or herbicide. In addition, some policies may also cover losses due to equipment failure or crop contamination.

How Does Multi-Peril Crop Insurance Work?

Multi-peril crop insurance works by providing farmers with financial protection against losses that could be caused by a variety of factors. The coverage will vary depending on the policy, but generally, the insurance company will pay out a percentage of the losses that are covered by the policy. The insurance company will also take into account the farmer's production costs, such as seed and fertilizer, as well as the value of the crop at the time of the loss.

Why Is Multi-Peril Crop Insurance Important?

Multi-peril crop insurance is important because it can help farmers protect their crops and their livelihoods. Natural disasters, such as floods and droughts, can cause significant losses for farmers, and the financial protection provided by multi-peril crop insurance can help them recover from these losses. In addition, it can help farmers manage the risk of market fluctuations, low yields, and other risks that can threaten their crops. Without this financial protection, farmers may be unable to continue farming and may be forced to sell their farms.

Conclusion

Multi-peril crop insurance is an important tool for farmers to protect against losses caused by natural disasters or other events that can threaten their crops. It is a form of financial protection that covers a variety of risks and can provide peace of mind to farmers who are unsure of what the future holds. Multi-peril crop insurance can help farmers manage the risk of market fluctuations, low yields, and other risks that can threaten their crops, and it can help them recover from losses caused by natural disasters. Without this financial protection, farmers may be unable to continue farming and may be forced to sell their farms.

Research Report 78: Multi-peril crop insurance - Kondinin Group Bookstore

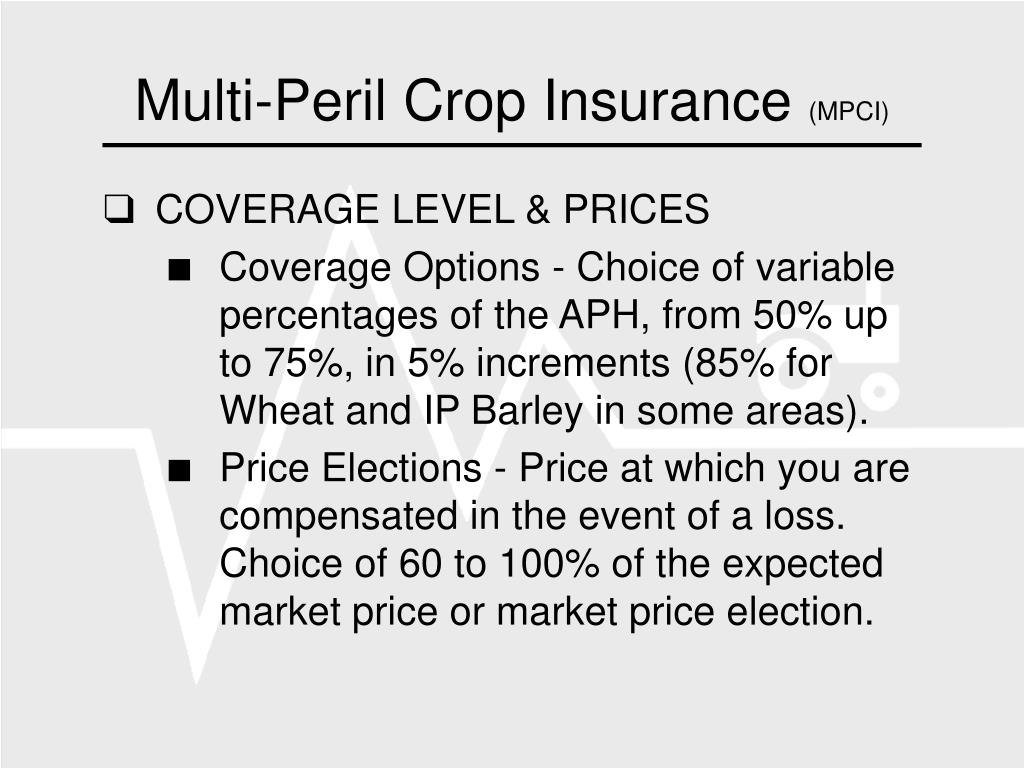

PPT - Multiple Peril Crop Insurance (MPCI) PowerPoint Presentation

PPT - DISCLAIMER PowerPoint Presentation, free download - ID:211732

Crop Insurance Companies - Insurance Providers Crop Insurance Keeps

PPT - Crop Insurance Overview of Primary Market in US PowerPoint