Progressive Loan Lease Payoff Vs Gap Insurance

Progressive Loan Lease Payoff Vs Gap Insurance

What is Progressive Loan Lease Payoff?

Progressive Loan Lease Payoff (PLP) is a type of coverage offered by Progressive Insurance that helps cover the difference between a car loan or lease balance and the amount paid by the insurance company if a car is stolen or totaled. This coverage can be beneficial for those who have a loan or lease, as it could help cover the remaining balance on the loan or lease in the event of a total loss. It can also help protect a credit score, as the remaining balance on the loan or lease would not be the responsibility of the borrower.

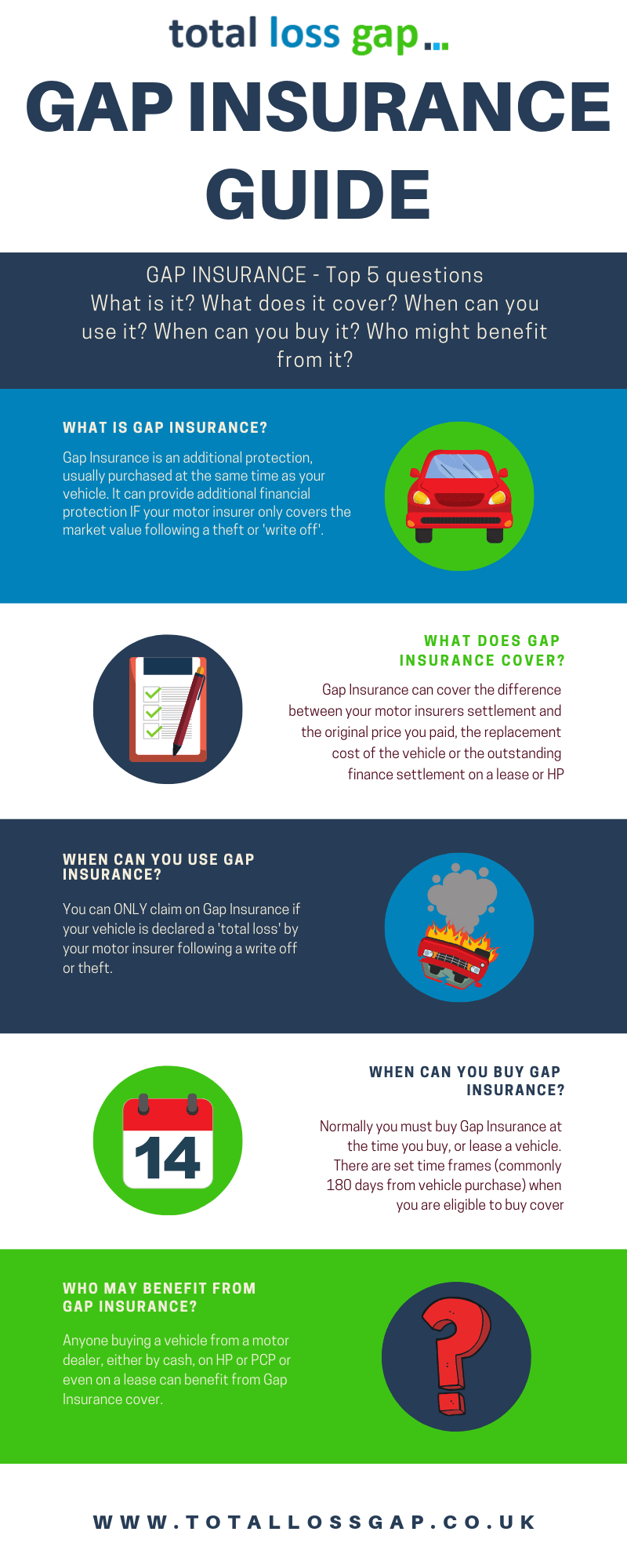

What is Gap Insurance?

Gap insurance is a type of coverage that helps to cover the difference between the actual cash value of a vehicle and the amount owed on the loan or lease. This coverage helps to protect borrowers in the event that their vehicle is totaled, as it can help to pay off the remaining balance on the loan or lease. Gap insurance can be beneficial for those who have recently purchased a vehicle, as the vehicle may depreciate in value more quickly than the outstanding balance on the loan or lease.

How Progressive Loan Lease Payoff is Different from Gap Insurance?

The primary difference between Progressive Loan Lease Payoff and Gap Insurance is that PLP covers the remaining balance on a loan or lease in the event of a total loss due to theft or accident, while Gap Insurance only covers the difference between the actual cash value of the vehicle and the amount owed on the loan or lease. In addition, PLP is only available through Progressive Insurance, while Gap Insurance is available through most major insurance companies.

When to Choose PLP or Gap Insurance?

The decision of whether to choose PLP or Gap Insurance depends on the individual’s particular circumstances. For those who have recently purchased a vehicle and may be at risk of owing more than the vehicle is worth, Gap Insurance may be the better option. For those who have a loan or lease and want to ensure that the remaining balance is covered in the event of a total loss, PLP may be the better option.

Pros and Cons of Progressive Loan Lease Payoff & Gap Insurance

The main benefit of Progressive Loan Lease Payoff is that it covers the remaining balance on a loan or lease in the event of a total loss due to theft or accident. The main downside of this coverage is that it is only available through Progressive Insurance. The main benefit of Gap Insurance is that it covers the difference between the actual cash value of the vehicle and the amount owed on the loan or lease. The main downside is that it does not cover the remaining balance on a loan or lease in the event of a total loss.

Final Thoughts

Progressive Loan Lease Payoff and Gap Insurance can both be beneficial for those who have recently purchased a vehicle or have a loan or lease. It is important to understand the differences between the two types of coverage and to consider one’s individual circumstances when deciding which type of coverage is best. Ultimately, both types of coverage can help to protect a borrower’s credit score and provide peace of mind in the event of a total loss.

Get Gap Insurance for New and Leased Cars - Insurance.com

What Is The Difference Between Gap Insurance And Loan Lease Payoff

What is Gap insurance and the difference between Lease / Loan payoff

GAP Insurance - Explained in a Complete Guide | TotalLossGap

Should You Have Guaranteed Asset Protection? - Advia Credit Union