Pay Per Mile Auto Insurance

What Is Pay Per Mile Auto Insurance?

Pay Per Mile auto insurance is a type of car insurance that charges you a premium based on the number of miles you drive. This type of insurance is designed to help those who don’t drive often, or who don’t drive very far, save on their car insurance. It usually works by allowing you to purchase a base rate, and then when you drive over a certain number of miles, you pay an additional fee for each mile driven.

How Does Pay Per Mile Auto Insurance Work?

Pay Per Mile auto insurance works by allowing you to purchase a base rate, and then when you drive over a certain number of miles, you pay an additional fee for each mile driven. This means that you only pay for the miles that you actually drive. For example, if you purchase a plan that charges $0.05 per mile and you drive 100 miles in a month, then your total cost for that month is $5.

Who Is Pay Per Mile Auto Insurance Best Suited For?

Pay Per Mile auto insurance is best suited for those who don’t drive often or don’t drive very far. This type of insurance is perfect for people who are retired or are only driving to work a few days a week. It’s also great for those who are looking to save money on their car insurance but still want to be covered in case of an accident.

What Are the Benefits of Pay Per Mile Auto Insurance?

The main benefit of Pay Per Mile auto insurance is that it can help you save money on your car insurance. Since you’re only paying for the miles you actually drive, you don’t have to pay for any extra miles that you don’t use. This can add up to substantial savings over a year, especially if you don’t drive very often. It’s also a great option for those who don’t want to be stuck in a long-term contract with a traditional car insurance company.

Are There Any Drawbacks to Pay Per Mile Auto Insurance?

The main drawback of Pay Per Mile auto insurance is that it can be difficult to estimate how many miles you’ll be driving in a given month or year. If you find yourself driving more miles than you anticipated, then your costs can quickly add up. Additionally, some Pay Per Mile auto insurance plans may not cover all of the same benefits that a traditional car insurance plan would. For example, some plans may not include rental car coverage or towing.

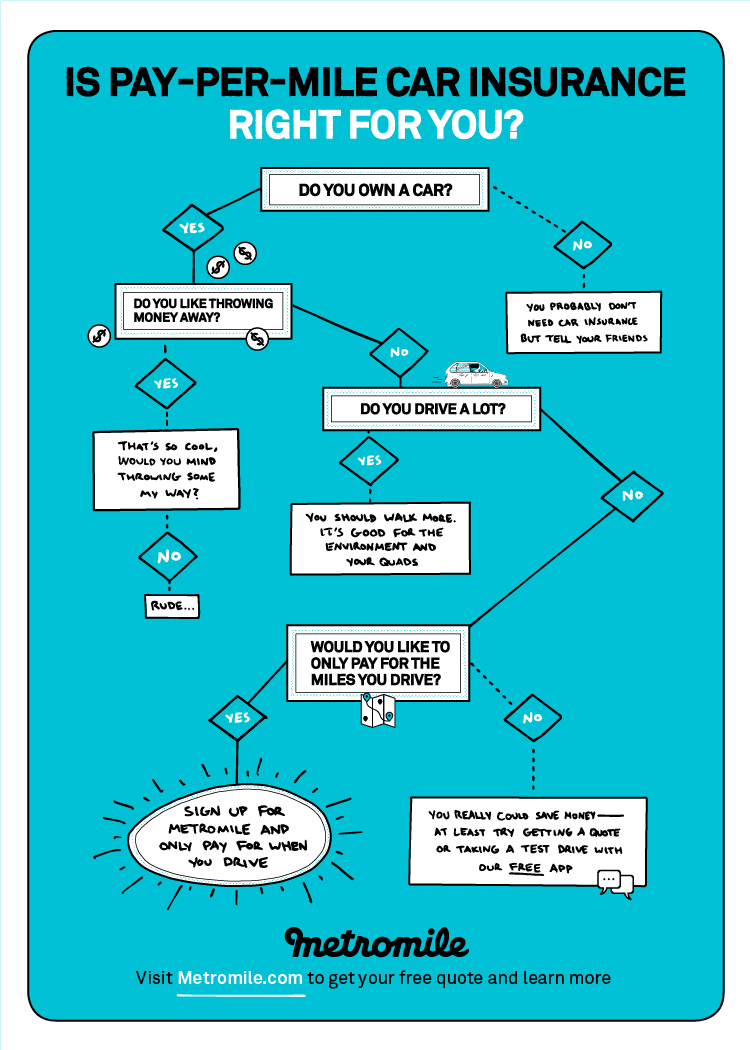

Is Pay Per Mile Auto Insurance Right for You?

Pay Per Mile auto insurance is a great option for those who don’t drive often, or who don’t drive very far. It can help you save money on your car insurance, but it’s important to make sure that you understand how the plan works and what benefits it does and does not provide. Additionally, you need to make sure that you accurately estimate how many miles you’ll be driving each month or year so that you don’t end up paying more than you expected.

Quiz: Is Pay-per-mile Car Insurance Right for You?

Allstate Milewise, Pay-per-mile Insurance Now Available in New Jersey

Is Pay Per Mile Car Insurance Right For You? ( April 2022)

Pay-Per-Mile Car Insurance Could Cut Your Bill in Half - YouTube

Metromile Offers Pay-Per-Mile Car Insurance - Shopping Kim | Car