Long Term Care Insurance Costs By Age

The Rising Costs of Long Term Care Insurance By Age

What is Long-Term Care Insurance?

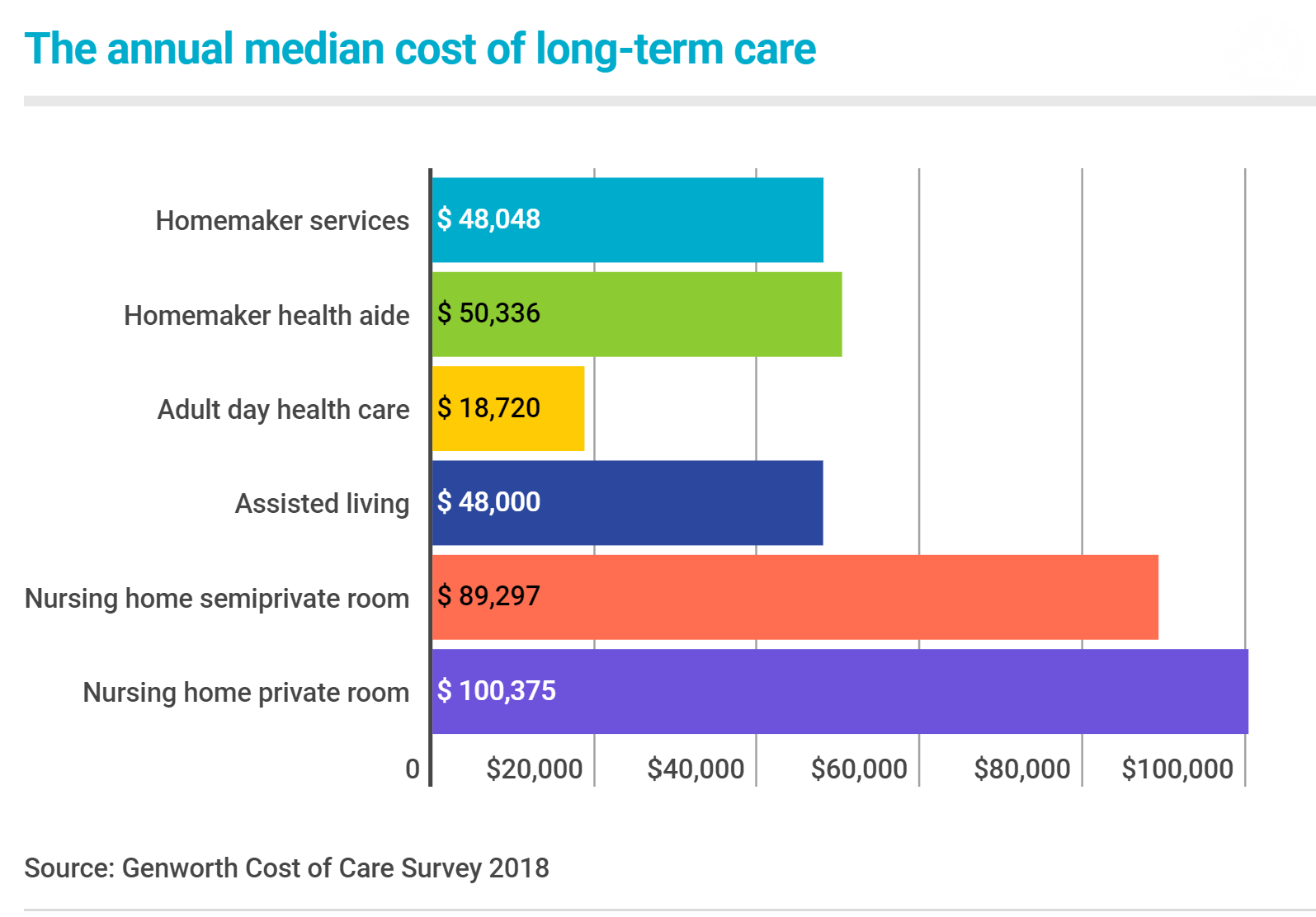

Long-term care insurance is an insurance policy that can help cover the costs associated with long-term medical care. It is designed to help individuals who need extended medical care due to a chronic illness, disability, or aging. Long-term care insurance helps to pay for services such as home health care, assisted living facilities, nursing homes, and other forms of custodial care. It can provide financial support to those who need it most and can help to protect their assets and maintain their independence.

The Cost of Long-Term Care Insurance By Age

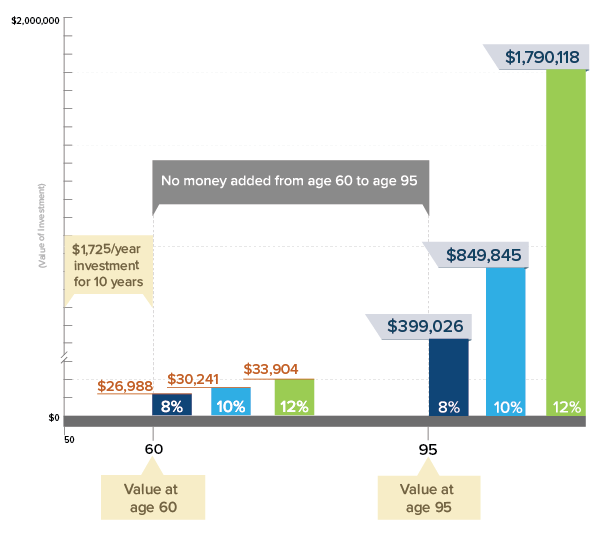

The cost of long-term care insurance varies depending on the age of the individual. Generally, the younger an individual is, the lower their premiums will be. However, as individuals get older, the cost of coverage increases significantly. This is because older individuals are more likely to need long-term medical care, making them a greater risk for insurance companies. Here is a look at the average cost of long-term care insurance by age:

- Age 30 – 40: $100 – $400 per year

- Age 40 – 50: $150 – $500 per year

- Age 50 – 60: $200 – $800 per year

- Age 60 – 70: $250 – $1,200 per year

- Age 70+: $400 – $2,000 per year

Factors That Affect the Cost of Long-Term Care Insurance

The cost of long-term care insurance is affected by a number of factors, including the age of the individual, the type of coverage they are seeking, and the amount of coverage they are looking for. For example, younger individuals may be able to get a more affordable rate if they opt for a lower level of coverage. Additionally, the type of coverage an individual chooses can affect their premiums. For example, those seeking coverage for home health care and assisted living facilities may have higher premiums than those who are only looking for coverage for nursing home care.

The Benefits of Long-Term Care Insurance

Although long-term care insurance is a significant financial investment, it can offer a number of benefits. For example, it can help to protect an individual’s assets and provide them with financial support when they need it most. Additionally, long-term care insurance can provide the peace of mind of knowing that the individual will be able to receive the care they need without having to worry about the cost. Finally, long-term care insurance can help to maintain an individual’s independence and allow them to remain in their home for as long as possible.

Conclusion

Long-term care insurance is an important investment for individuals of all ages. It can help to protect an individual’s assets and provide them with financial support when they need it most. The cost of long-term care insurance varies depending on the age of the individual, the type of coverage they are seeking, and the amount of coverage they are looking for. It is important to consider all of these factors when deciding whether or not to purchase long-term care insurance.

Cost of Care in Arizona – INtouch Senior Services

Long-Term Care Insurance Overview - ESI Money

6 Useful Tips to Avoid Paying $280,000 Health Care Costs in Retirement

Long Term Care Insurance Cost By Age : Edmond Consulting Group Llc

Long Term Care Insurance Cost & Premiums Estimate | ALTCP.org