How To Lower My Car Insurance

How To Lower My Car Insurance

Do Your Research

Car insurance rates vary drastically from one provider to the next. It’s important to do your research and shop around for the best rate. Start by gathering quotes from multiple providers to compare pricing and coverage. Also, review your policy annually to make sure you’re still getting the best deal. Some insurers may offer discounts for being a loyal customer, so consider staying with the same provider if you’re happy with their service.

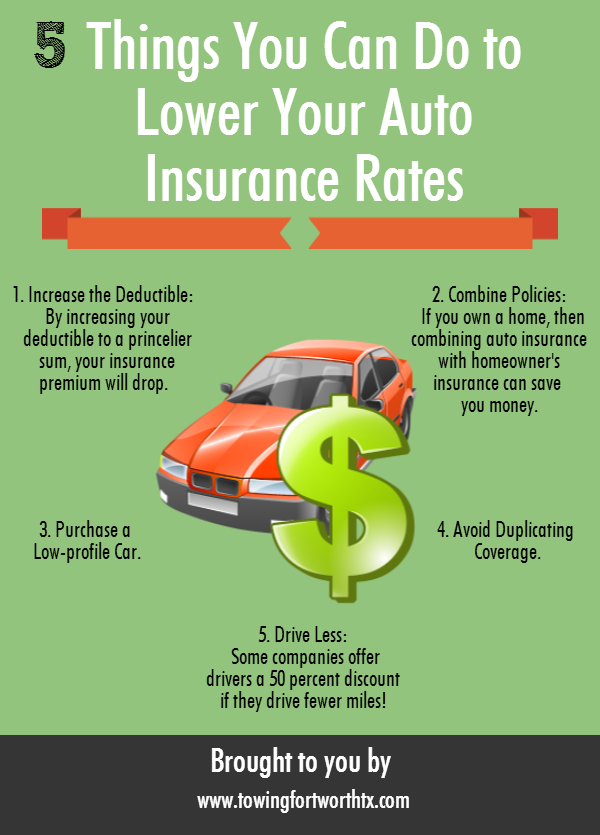

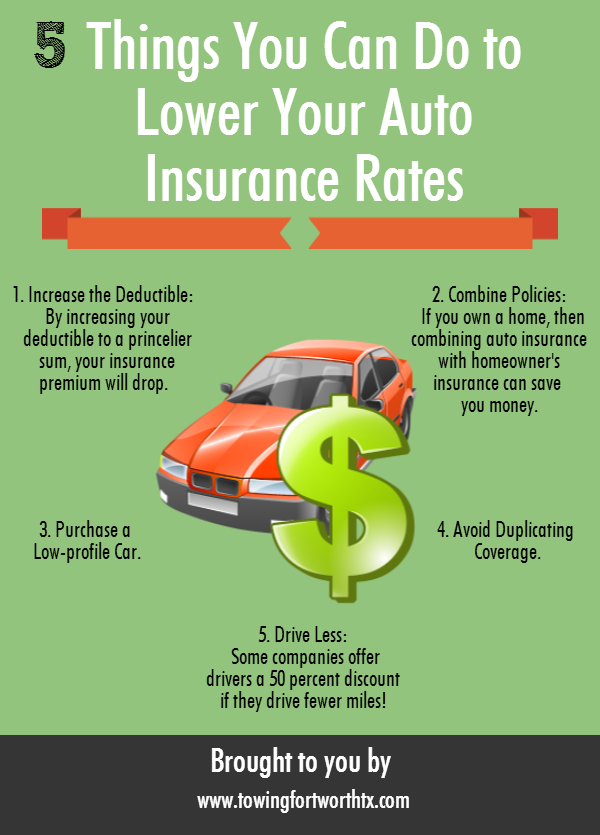

Increase Your Deductible

By raising your deductible, you can significantly lower your car insurance premiums. A deductible is the amount of money you’ll pay out of pocket before your insurance company pays for a claim. A higher deductible could save you hundreds of dollars in premiums each year, but it’s important to understand the tradeoff. You’ll pay more out of pocket if you need to make a claim. Also, be sure to ask about any discounts for having a higher deductible.

Maintain a Clean Driving Record

Drivers with a clean record often get lower car insurance rates. Keep your driving record spotless by following the rules of the road and avoiding accidents and traffic violations. Additionally, consider taking a defensive driving course to help lower your premiums. Many states offer discounts for drivers who complete these courses, so be sure to ask your insurer if they offer any discounts.

Choose the Right Car

The type of car you drive can have a big impact on your insurance rates. Smaller, less expensive cars typically come with lower premiums. Additionally, cars with safety features like airbags and anti-lock brakes can help lower your rates. Consider these factors when choosing a car, as they could save you money in the long run.

Take Advantage of Discounts

Most insurance companies offer discounts to help reduce your premiums. Common discounts include good driver, good student, low mileage, and multi-policy. Be sure to ask your provider about any discounts you may qualify for and take advantage of them.

Review Your Policy Annually

It’s important to review your policy annually to ensure you’re getting the best rate. Your circumstances may have changed since you last purchased a policy, so it’s important to take advantage of any discounts or special offers that may be available. Additionally, be sure to shop around for the best rate and compare coverage from multiple providers.

Lower Your Auto Insurance Rates with 5 steps

5 Tips to Lower your Car Insuarance - One Crazy Mom

lower-car-insurance-quote-lp-011 | Auto Insurance Landing Page Design

How To Lower Your Car Insurance

4 Ways to Lower Your Auto Insurance Premium in 2020 | Car insurance