Gap Insurance For Cars Geico

Tuesday, August 5, 2025

Edit

Gap Insurance For Cars Geico - All You Need To Know

What is Gap Insurance for Cars?

Gap insurance for cars is an additional insurance product that you can purchase to cover the gap between the amount you owe on your car and the amount your car is worth. It is a type of automobile insurance that covers the difference between the actual cash value of your car and the amount of money you owe on it. The amount of money you owe on your car is typically higher than the actual cash value of the car due to the interest on a loan and other factors. This type of insurance is often referred to as a loan/lease payoff product and it is important to understand exactly what it is and how it works.

How Does Gap Insurance Work?

When you purchase gap insurance for cars, it is important to understand how it works. First, when you purchase a car, the amount of money you owe on the car is usually higher than the actual cash value of the car. This is because of the interest you are paying on the loan. If your car is stolen or totaled in an accident, the insurance company will only pay you the actual cash value of the car. This means that you may still owe money on the car even though the car is no longer in your possession. Gap insurance will cover this balance, so you don’t have to worry about paying off the loan.

What Does Gap Insurance Cover?

Gap insurance for cars will typically cover the gap between the actual cash value of the car and the amount you owe on it. It may also cover other expenses such as taxes, fees, and the cost of a rental car if your car is totaled. Some companies may offer additional coverage such as coverage for items that are stolen from the car or coverage for mechanical repairs. It is important to understand exactly what the policy covers and what it does not cover before you purchase it.

What is Geico Gap Insurance?

Geico gap insurance is a type of gap insurance offered by Geico Insurance. It is designed to cover the gap between the actual cash value of your car and the amount you owe on it. It also covers additional expenses such as taxes, fees, and the cost of a rental car if your car is totaled or stolen. Geico gap insurance is typically offered as an additional policy to your existing Geico car insurance policy and can be purchased for an additional premium.

Is Gap Insurance Worth it?

Gap insurance for cars can be beneficial if you are financing a car and have a loan with a high interest rate. Gap insurance will protect you if your car is totaled or stolen and you owe more money on the loan than the actual cash value of the car. It can also provide you with additional protection if you are involved in an accident and need a rental car. It is important to understand the details of the policy before you purchase it and make sure it is right for you.

Where Can I Buy Gap Insurance?

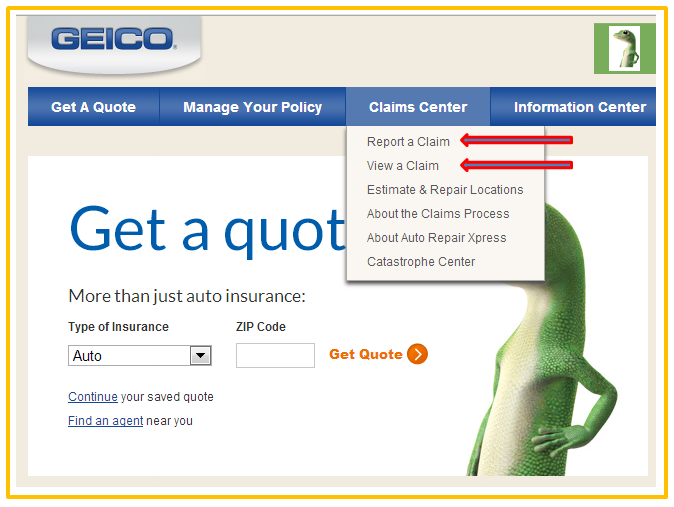

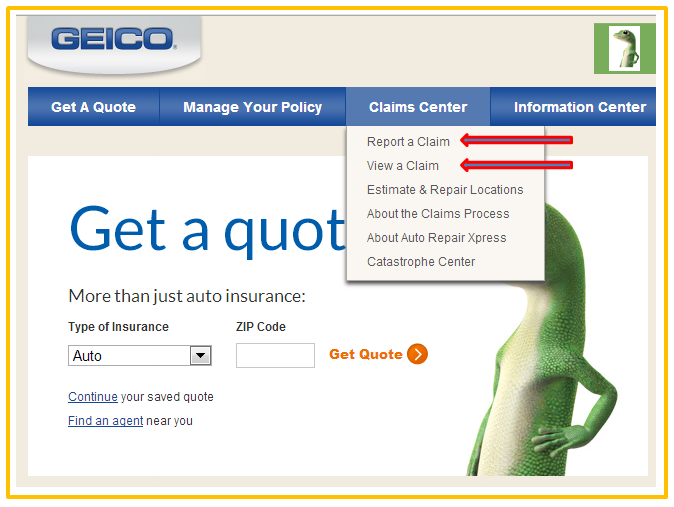

Gap insurance for cars is typically offered by car insurance companies such as Geico. You can find out more information about gap insurance by visiting the website of your car insurance provider or by speaking to an agent. You can also purchase gap insurance from an independent insurance agent who specializes in gap insurance products. It is important to shop around and compare different policies to make sure you are getting the best coverage for the best price.

Gap Insurance Geico See Auto Insurance Options From Geico, Plus

Page for individual images • Quoteinspector.com

Buy GAP insurance at the time of your car mishap or a stolen car with

Do you need gap insurance for your car? How does it work?

The Ultimate Guide To What Is The Difference Between Gap, Liability