Does My Personal Insurance Cover Turo

Does My Personal Insurance Cover Turo?

What is Turo?

Turo is an online car sharing platform that connects car owners to people who need a rental car. The website allows car owners to list their cars for rent, and potential customers to search for the best rental car for their needs. Once a customer finds the perfect car, they can reserve it through the website and complete the rental process. Turo also offers special discounts and promotions for both car owners and car renters. Turo is an easy and convenient way for both car owners and customers to access rental cars without having to deal with the traditional rental car agencies.

Does My Personal Insurance Cover Turo?

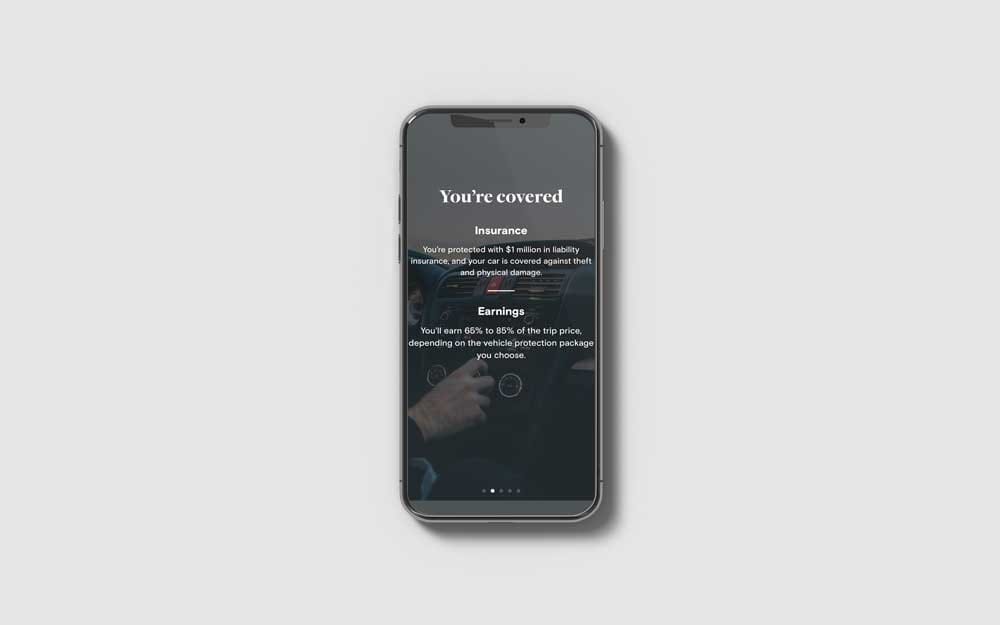

If you are a car owner and you are renting out your car through Turo, then you will need to have insurance to cover your car. Turo offers a variety of insurance policies to cover your car while it is being rented. These policies include liability coverage, property damage coverage, and personal injury protection. You can also purchase additional coverage such as comprehensive and collision coverage. If you are a car renter, then you will need to purchase rental car insurance, which will provide you with coverage for any damages to the car while it is in your possession.

In addition to the insurance policies that Turo offers, you may also need to purchase additional coverage from your own personal insurance provider. This is because your personal car insurance policy may not cover any damages that occur while your car is being rented. It is important to speak with your insurance provider to determine what coverage you will need to purchase in order to cover your car while it is being rented.

Things To Consider

When deciding if you need to purchase additional coverage for your car while it is being rented, there are a few things to consider. First, consider the type of car you are renting out and the area in which it is being rented. If you are renting out a luxury car or an exotic car, then you may need to purchase extra coverage to protect yourself. Additionally, if you are renting out your car in an area that is known for its high crime rate, then you may want to purchase additional coverage to protect yourself from any potential damages that may occur while your car is in the hands of a renter.

It is also important to speak with your insurance provider to determine if your personal insurance policy will cover any damages that occur while your car is being rented. Many insurance providers will offer additional coverage for rental cars, so be sure to inquire about this with your insurance provider. Additionally, some insurance providers may require you to purchase a special type of policy to cover rental cars, so make sure to speak with your provider about this before signing any paperwork.

Conclusion

Whether you are a car owner who is renting out their car through Turo or a car renter who is looking for a rental car, it is important to make sure that your car is properly insured. Turo offers a variety of insurance policies to cover your car while it is being rented, but you may need to purchase additional coverage from your own personal insurance provider. Be sure to speak with your insurance provider to determine what coverage you will need to purchase in order to cover your car while it is being rented.

Turo Third-Party Automobile Liability Insurance - KAASS LAW

How Does Turo Insurance Work : Host Tips How Insurance Works On Turo

Turo, the 'Airbnb for cars,' could upend the car-rental industry

The Ultimate Beginner’s Guide to Turo Car Rental

Does USAA cover Turo Rental? (Hint: Yes, but...)