Do Aaa Offer Gap Insurance

Wednesday, August 6, 2025

Edit

Do AAA Offer Gap Insurance?

Gap insurance is a type of car insurance coverage that helps to protect drivers in the event they owe more on their car loan than what their car is worth. Gap insurance is important because it provides financial protection if a car is totaled or stolen. In this case, the driver would not be able to cover the difference between the car's actual cash value and the amount that is still owed on the loan. Gap insurance is an important type of coverage for drivers to consider, especially those who are leasing a vehicle or taking out a loan to buy a car.

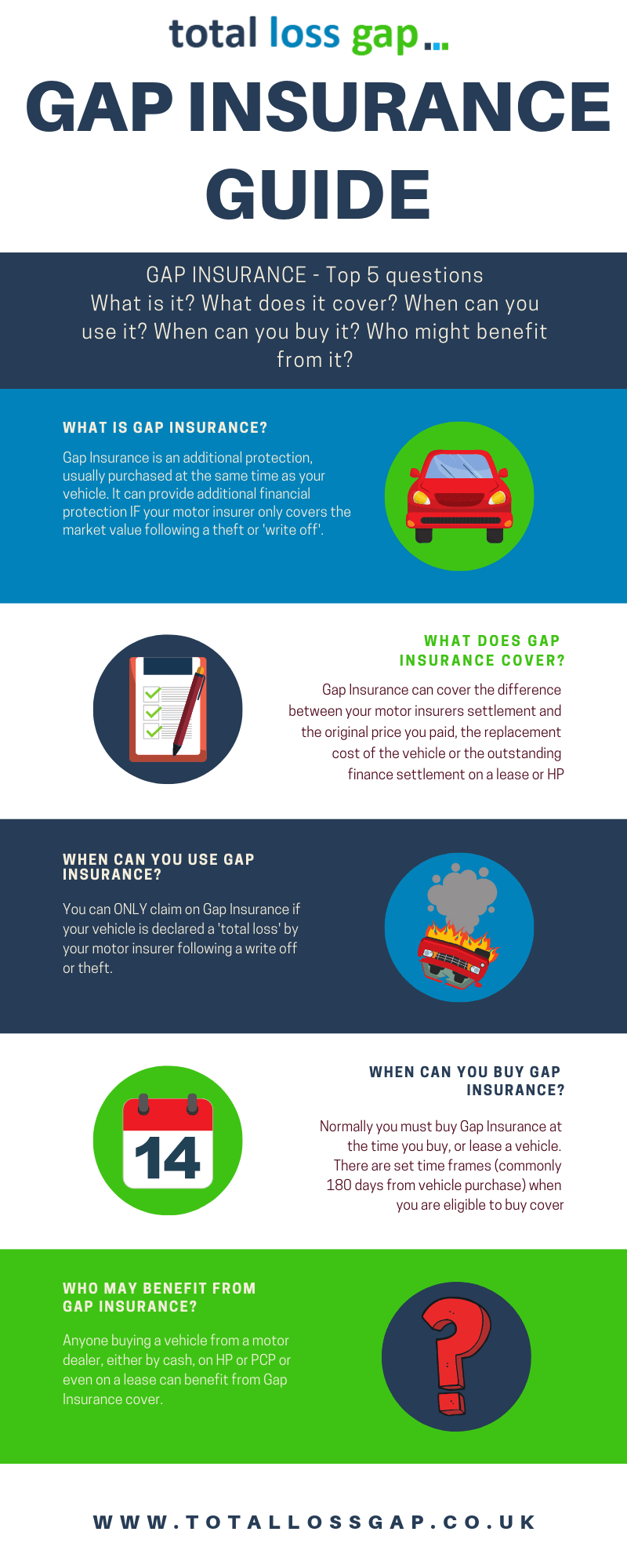

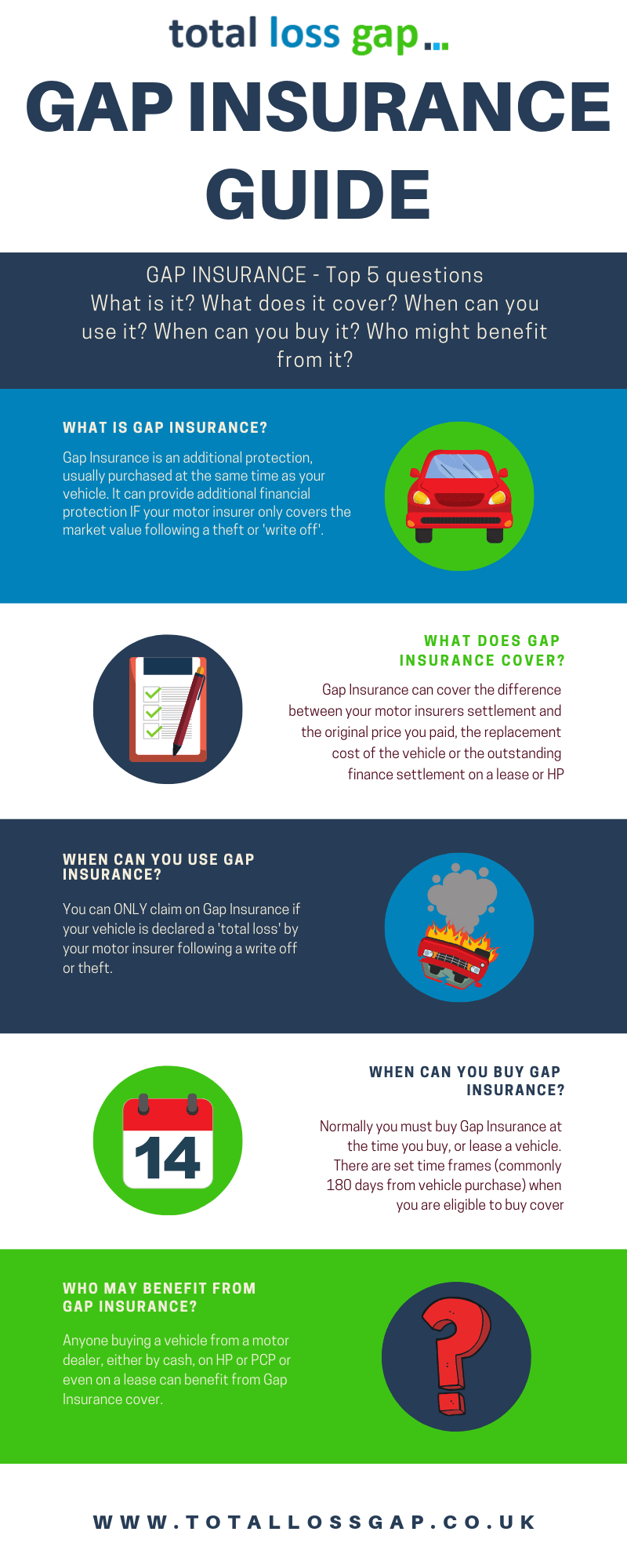

What Is Gap Insurance?

Gap insurance is a type of car insurance coverage that pays the difference between the amount that is still owed on a car loan or lease and the actual cash value of the car if it is totaled or stolen. This coverage is designed to protect drivers in the event that they are unable to make up the difference on their own.

It is important to note that gap insurance does not replace a driver’s primary auto insurance policy. Instead, it is in addition to a driver’s regular insurance coverage. Gap insurance is typically offered by car dealerships and insurance companies, but it is important to read the policy carefully to make sure it meets your needs and that you understand the coverage limits.

Do AAA Offer Gap Insurance?

AAA does not offer gap insurance directly, but it does offer a type of coverage that is similar. AAA offers a coverage called Vehicle Replacement Plus (VRP). This coverage is similar to gap insurance in that it pays the difference between a vehicle’s actual cash value and the amount still owed on the loan or lease.

VRP is typically offered as an add-on to a driver’s existing auto insurance policy. It is important to note that VRP does not cover the same things as gap insurance. For example, it does not cover the difference between the car’s value and the amount still owed on the loan if the car is totaled in an accident. Additionally, VRP does not cover any additional expenses associated with the purchase of a new car, such as sales tax and registration fees.

Is Gap Insurance Necessary?

Gap insurance can be beneficial in some cases, but it is important to consider all of the options before making a decision. For example, if a driver is leasing a car or taking out a loan to buy a car, gap insurance may be beneficial. This is because the driver may not have enough money to cover the difference between the car’s actual cash value and the amount still owed on the loan if the car is totaled or stolen.

Gap insurance can also be beneficial if a driver has a large down payment. In this case, the driver may not have enough money to cover the difference between the car’s actual cash value and the amount still owed on the loan if the car is totaled or stolen.

Conclusion

Gap insurance is an important type of coverage for drivers to consider, especially those who are leasing a vehicle or taking out a loan to buy a car. While AAA does not offer gap insurance directly, it does offer a type of coverage that is similar called Vehicle Replacement Plus (VRP). It is important to read the policy carefully to make sure it meets your needs and that you understand the coverage limits. Gap insurance can be beneficial in some cases, but it is important to consider all of the options before making a decision.

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS

Buying A Car Gap Insurance ~ designologer

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Gap Insurance: Gap Insurance Bank Of America