Cost Of Long term Care Insurance At Age 77

The Rising Cost of Long Term Care Insurance at Age 77

What is Long Term Care Insurance?

Long term care insurance is a form of insurance that helps cover the costs of long-term care services. These services can include in-home care, assisted living, nursing home care, and other health-related services. Long term care insurance is designed to help cover the costs of these services when they are needed. It is often used to supplement other forms of health insurance and can provide a financial safety net in the event of an unexpected illness or injury.

The Cost of Long Term Care Insurance at Age 77

The cost of long term care insurance increases as you get older. This is because the risk of needing long term care services increases with age. At age 77, the cost of long term care insurance can be quite high. The cost of a policy will depend on a variety of factors, including the type of policy, the amount of coverage, and the age at which the policy is purchased. Generally speaking, the older you are when you purchase a policy, the more expensive it will be.

Factors Affecting the Cost of Long Term Care Insurance at Age 77

The cost of long term care insurance at age 77 will depend on a variety of factors. These can include the type of policy, the amount of coverage, and the age at which the policy is purchased. In addition, your health and lifestyle can also have an impact on the cost of a policy. For example, if you have a pre-existing health condition, such as diabetes or heart disease, you may pay more for a policy than someone who is in good health.

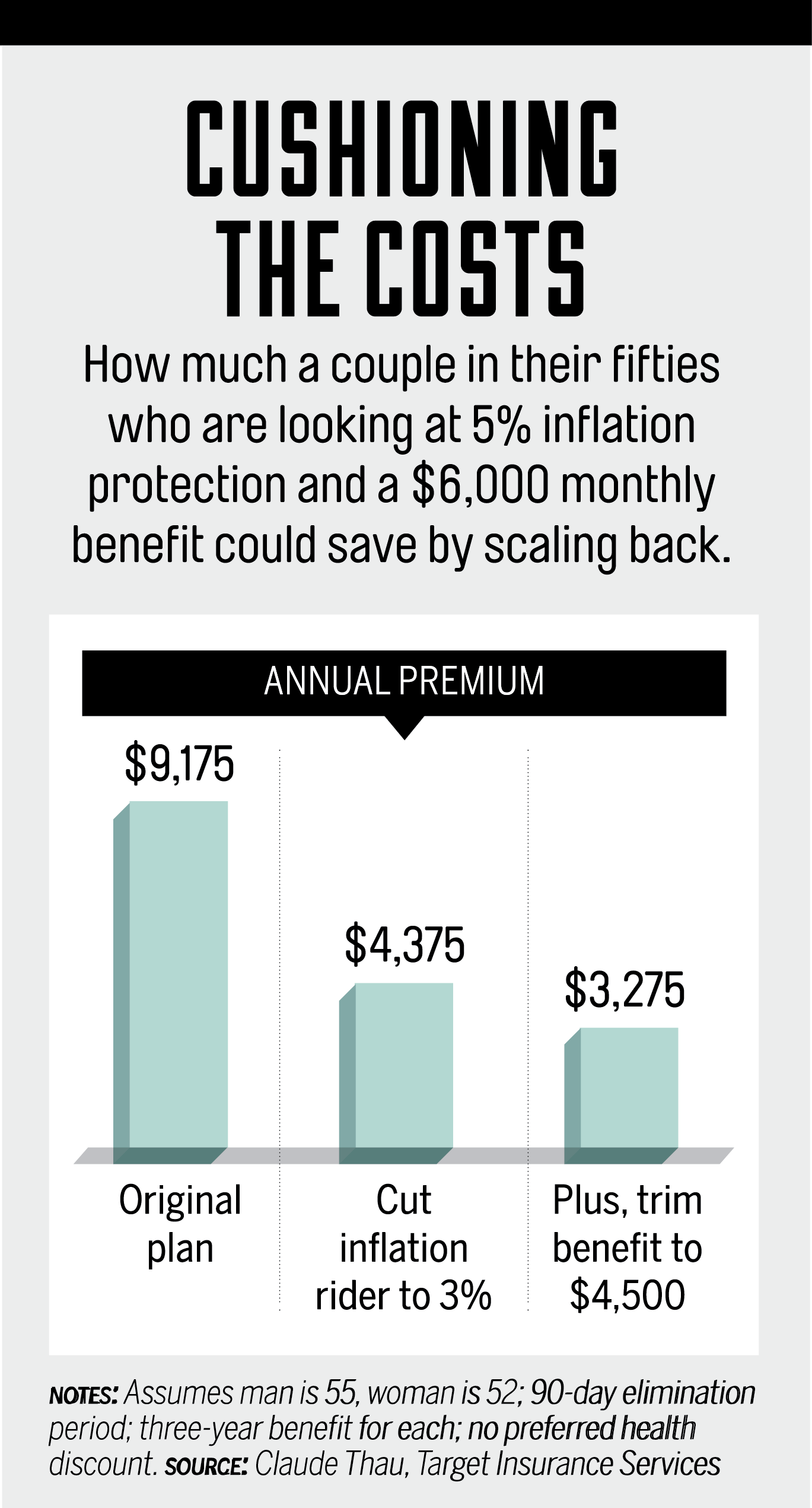

Finding Affordable Long Term Care Insurance at Age 77

Even though the cost of long term care insurance at age 77 can be high, there are still ways to find an affordable policy. One way is to shop around and compare policies from different providers. This can help you find the best policy to fit your needs and budget. In addition, you may be able to get discounts on long term care insurance if you have other types of insurance, such as life insurance or health insurance. Additionally, some employers offer discounted long term care insurance as part of their benefits package.

The Benefits of Long Term Care Insurance at Age 77

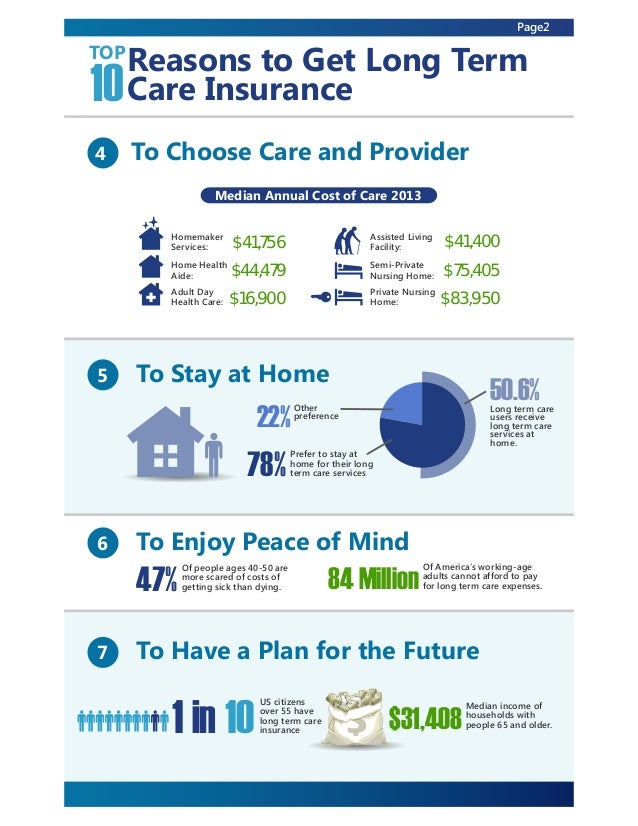

Though the cost of long term care insurance at age 77 can be high, it is important to keep in mind the potential benefits of having a policy. Long term care insurance can help you cover the costs of long term care services, which can be very expensive. In addition, it can provide peace of mind knowing that your future care needs are taken care of. Lastly, having a long term care insurance policy can help protect your assets and ensure that you have the funds available to cover the costs of long term care services.

Conclusion

The cost of long term care insurance at age 77 can be high, but there are still ways to find an affordable policy. Shopping around and comparing policies from different providers is one way to find a policy that fits your needs and budget. Additionally, some employers offer discounted long term care insurance as part of their benefits package. Though the cost of long term care insurance may be high, the potential benefits can be invaluable and can provide peace of mind knowing that your future care needs are taken care of.

Long-Term Care Insurance Information: Policy Features & Benefits

Cost of Care in Arizona – INtouch Senior Services

Nursing Home Insurance Policy Cost - Insurance Reference

Top 10 Reasons to Get Long Term Care Insurance

Long Term Care Insurance Cost For 40 Year Old